The new Beige Book compilation of anecdotes from business contacts in the Southeast highlights the ongoing phenomenon of rising costs fueled by labor shortages and supply chain difficulties during January and the first half of February.

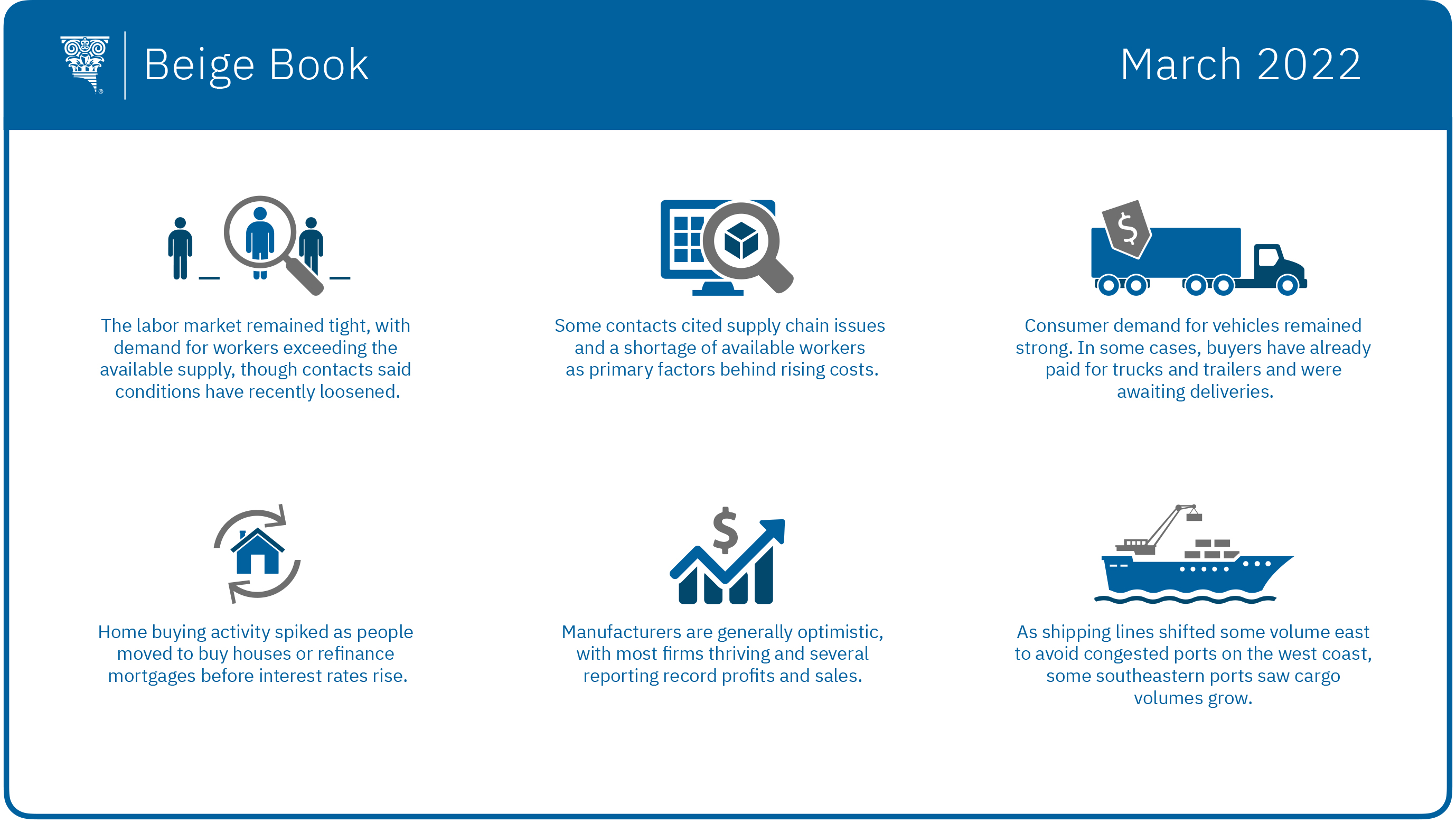

Although tightness in the labor market continued as demand for workers exceeded the available supply, many contacts indicated that those conditions have eased a bit since the start of the year. One result of the ongoing imbalance of labor demand and supply, however, is upward pressure on wages. And even as many firms use bonuses and try to minimize base pay increases, Atlanta Fed contacts expect wages to continue to rise this year. Yet just how quickly wages might rise remains uncertain, the Beige Book notes.

When the omicron variant of COVID-19 surged, several firms reported a spike in absenteeism by sick employees. However, contacts said omicron came and went faster than earlier variants.

As labor costs continued to climb, so did other costs for businesses, particularly the prices of freight services and raw materials. Many contacts continued to describe supply chain issues and a dearth of available labor as the driving factors behind rising costs. At the same time, most firms enjoyed higher profit margins because of price increases, with little to no impact on demand.

The Atlanta Fed's Business Inflation Expectations survey showed year-over-year unit cost growth increased slightly to 3.7 percent, on average, in January. Looking ahead, firms’ inflation expectations for the coming year remained unchanged at 3.4 percent, on average.

In other sectors:

- Retailers expect some dip in business during the next few months, with the expiration of the advance on child tax credits and anticipation of smaller tax refunds. Demand for vehicles remained strong, limited only by availability. Some contacts, in fact, reported that trucks and trailers were presold, with customers just awaiting deliveries.

- Advance bookings for leisure travel were reported to be strong through the second quarter. Meanwhile, the business travel and conventions industry still reported bookings well below prepandemic levels, though conditions are expected to improve in the first half of 2022.

- In residential real estate, many people hurried to buy houses or refinance mortgages before interest rates rise, according to contacts. This surge in activity led to increased mortgage originations. Home prices continued to climb, and a scarcity of available houses caused housing affordability to suffer. Homebuilder contacts indicated steady demand from investors and second-home buyers.

- On the commercial real estate front, the office sector improved modestly as more employers reopened.

- Manufacturers were generally thriving, with several reporting record profits and sales. Demand forecasts were optimistic, yet growing geopolitical risks, continued supply chain constraints, and inflation cast a shadow over the broader manufacturing outlook.

- Sea ports, most notably in Florida, experienced growing cargo volumes as shipping lines shifted some volume eastward to avoid congestion on the West Coast.

- Conditions at financial institutions were stable. Credit cards and other consumer loans saw strong growth.

- In response to stronger demand, oil and gas production strengthened, and contacts indicated that liquefied natural gas export projects resumed after pandemic-driven delays.

- Agricultural conditions across the Southeast were mixed. Some contacts reported that recent cold snaps in Florida could reduce citrus crop yields.

The Federal Reserve System publishes the Beige Book before each meeting of the Federal Open Market Committee. The next meeting is scheduled for March 15 and 16.