Turbulent global energy markets are affecting oil producers and refiners across the Southeast, according to the Federal Reserve Bank of Atlanta’s latest Beige Book survey of business contacts across the Reserve Bank’s six-state region in the Southeast.

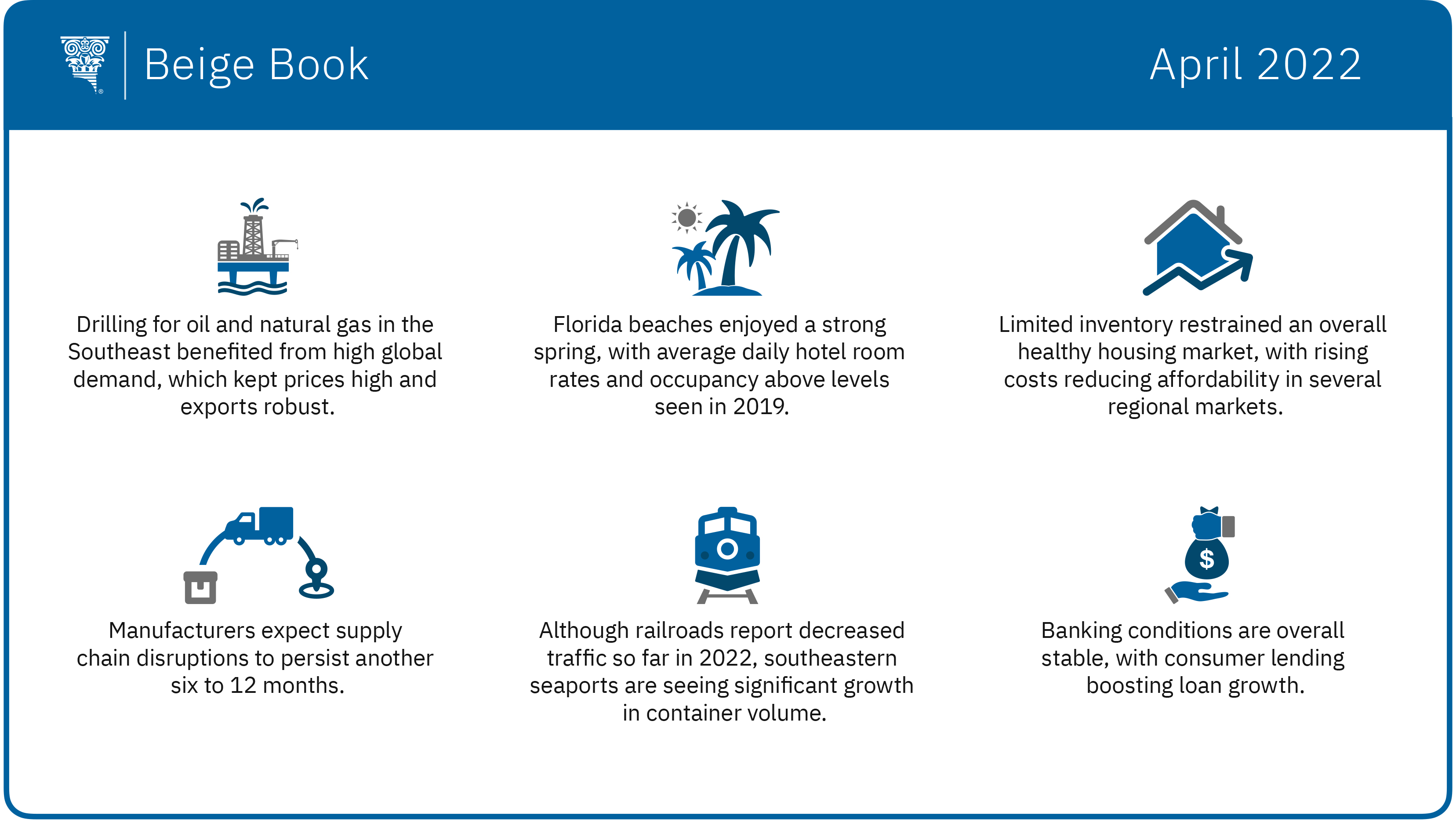

Generally, business activity across all industries including energy expanded from mid-February through March. Drilling for oil and natural gas increased as global demand kept prices high and boosted exports. In fact, contacts noted that some oil that would typically be sent to domestic storage hubs was instead routed to the Gulf Coast for export. However, some contacts reported that shortages of labor and equipment crimped oil and gas production. Not surprisingly, refineries were mostly operating at full capacity.

Utility contacts reported that the tight natural gas market buoyed electricity prices. Nevertheless, demand for power remained stable across residential, commercial, and industrial customer segments. Meanwhile, investment in renewable energy projects continued to grow, particularly solar power projects and planned offshore wind farms in the Gulf of Mexico.

Like fossil fuel producers, renewable energy contacts said scarce machine parts resulting from reduced imports could disrupt domestic solar power production.

In other economic sectors:

- Spring break was busy for the Atlanta Fed’s tourism contacts, but they remained cautious about labor shortages and inflation. Contacts said Florida beaches were a leading destination for families and students vacationing in March. Average daily hotel room rates and occupancy topped 2019’s prepandemic levels. Reports from contacts in the business travel and convention industry described improvement, though that business and group activity continues to lag leisure travel.

- Demand for housing remained strong. But sales continued to be suppressed by forces including limited inventory and rising costs related to the low quantity of homes for sale, ongoing supply chain issues, and construction labor shortages. As mortgage interest rates climbed, declining affordability was another concern in an otherwise robust housing market. In the Southeast, affordability fell most in Nashville, Atlanta, Tampa, and Orlando, where home prices reached record levels, according to the Beige Book.

- Commercial real estate conditions remained mixed. Activity in the multifamily, industrial, and tech-related sectors remained vibrant. Meanwhile, amid the spread of remote and hybrid working arrangements, the office market improved modestly as more employers reopened. At the same time, contacts indicated that office rents might not rise significantly until tenants absorb large amounts of sublease space.

- In the Atlanta Fed’s Business Inflation Expectations survey, most manufacturers reported continuing supply chain disruptions that they expect will persist another six to 12 months. The disruptions included trouble finding alternate suppliers, production delays, and slow delivery of finished products.

- Retailers said they expect solid consumer demand to diminish somewhat during the next few months because of high gas prices and smaller tax refunds, which will be reduced by last year’s advance child tax credit payments.

- Transportation activity was mixed. Railroads saw a significant decrease in traffic so far this year compared with 2021, led by declines in petroleum and petroleum products, motor vehicles and parts, metallic ores, and coal. Some District seaports reported continued sizeable growth in container volumes as shipping lines divert some cargo from the West Coast.

- Conditions at financial institutions remained stable. Loan growth improved, led by consumer lending.

The Federal Reserve System publishes the Beige Book before each meeting of the Federal Open Market Committee. The next meeting is scheduled for May 3 and 4.