The Federal Reserve Bank of Atlanta's new Beige Book compilation of on-the-ground reports shows that economic activity kept growing modestly from April through mid-May, with ongoing tightness in labor markets and rising costs. By and large, business contacts continued to report record profit margins, though several noted a "slight dampening of demand" and customers trading down to less expensive products.

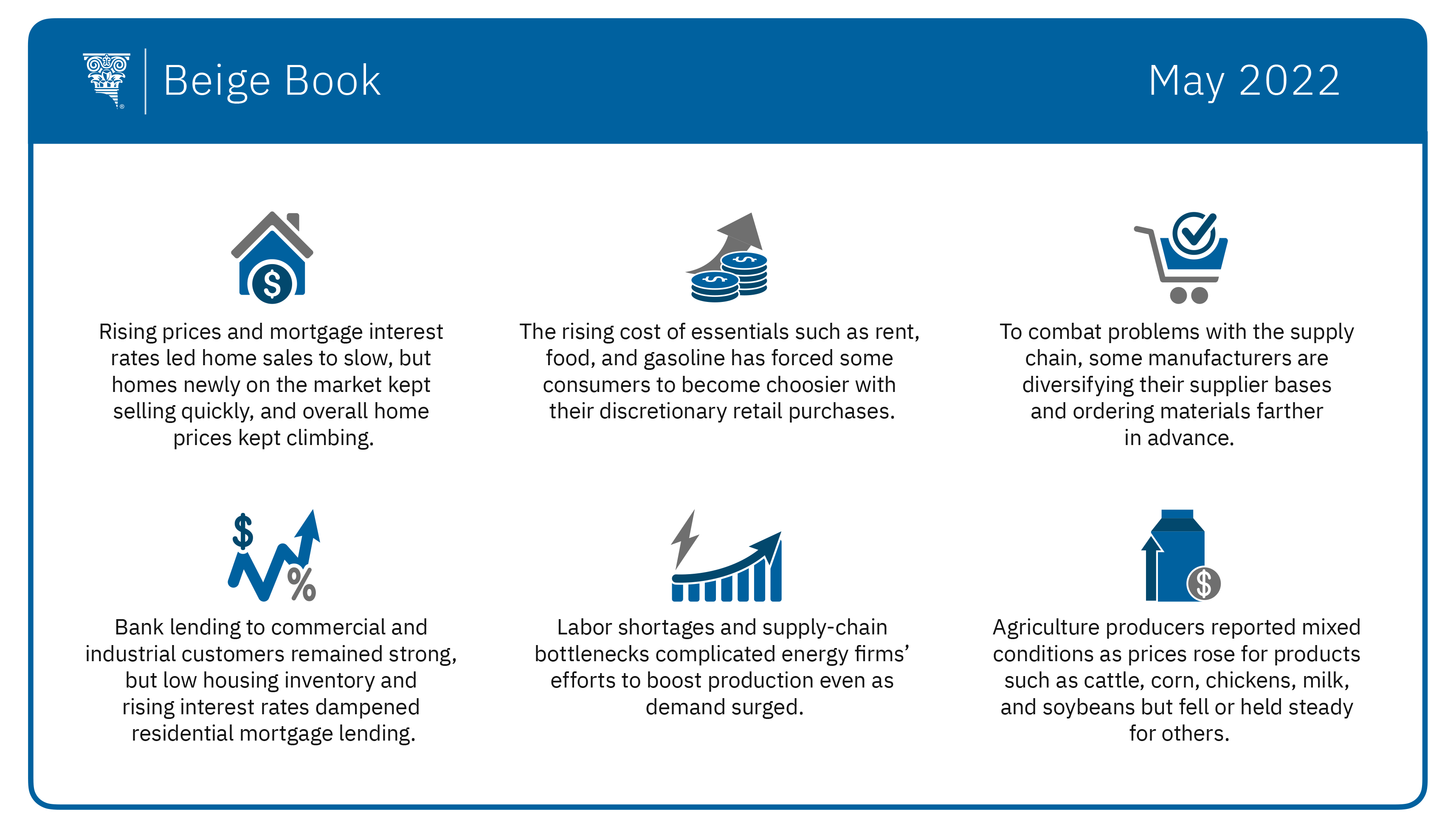

The Beige Book, which is published before each of eight annual meetings of the Fed's policy-setting Federal Open Market Committee, reflects scattered signs that inflation and the policy response from the Fed are starting to influence consumers' buying patterns. For example, home sales "slowed somewhat" in the face of rising prices and mortgage interest rates. Nevertheless, homes newly on the market kept selling quickly, and on the whole prices continued to climb.

Retailers across the Atlanta Fed's district reported some softening in unit sales and a shift in discretionary spending since the previous Beige Book report. Contacts noted that some customers began forgoing discretionary purchases to cover the costs of necessities such as rent, food, and gasoline. Though demand for luxury goods held up, lower- and middle-income customers tightened their belts in areas such as home decor. Also, vehicle sales remained well below 2021 levels while low inventories on dealer lots persisted.

In other economic sectors, the Beige Book reported:

- Commercial real estate conditions remained mixed. Demand was still brisk for apartments and industrial space but cooled for lower-tier office space.

- Demand for housing remained strong. But sales continued to be suppressed by forces including limited inventory and rising costs related to the low quantity of homes for sale, ongoing supply chain issues, and construction labor shortages. As mortgage interest rates climbed, declining affordability was another concern in an otherwise robust housing market. In the Southeast, affordability fell most in Nashville, Atlanta, Tampa, and Orlando, where home prices reached record levels, according to the Beige Book.

- Manufacturing stayed strong. Several contacts said they are broadening their supplier bases and ordering materials farther in advance to defuse supply-chain problems and avoid depleting inventories. Half of manufacturing respondents in the Atlanta Fed's Business Inflation Expectations survey reported increasing capacity by adding staff or shifts to meet demand, but some manufacturers simply turned away customers.

- Though most transportation contacts indicated they expect steady activity during the next six months to a year, some voiced concerns that general inflation and higher fuel prices could hurt business.

- In the banking industry, consumer, commercial, and industrial lending strengthened, but construction loans fell. Residential mortgage lending moderated because of low housing inventory and higher interest rates.

- Oil production increased, helping global crude markets withstand the loss of Russian supplies. Still, many producers said it was difficult to boost production as labor shortages and supply-chain bottlenecks complicated access to equipment and raw materials for drilling.

- In the agricultural sector, prices on a month-over-month basis were up slightly for cattle, corn, chickens, milk, and soybeans but down for eggs and unchanged for rice.

The Federal Reserve publishes the Beige Book before each meeting of the Federal Open Market Committee. The next meeting is scheduled for June 14 and 15.