Economic activity in the Southeast expanded "slightly" from the middle of August through September, as a shortage of available workers eased somewhat, according to the Federal Reserve Bank of Atlanta's Beige Book compilation of reports from business contacts.

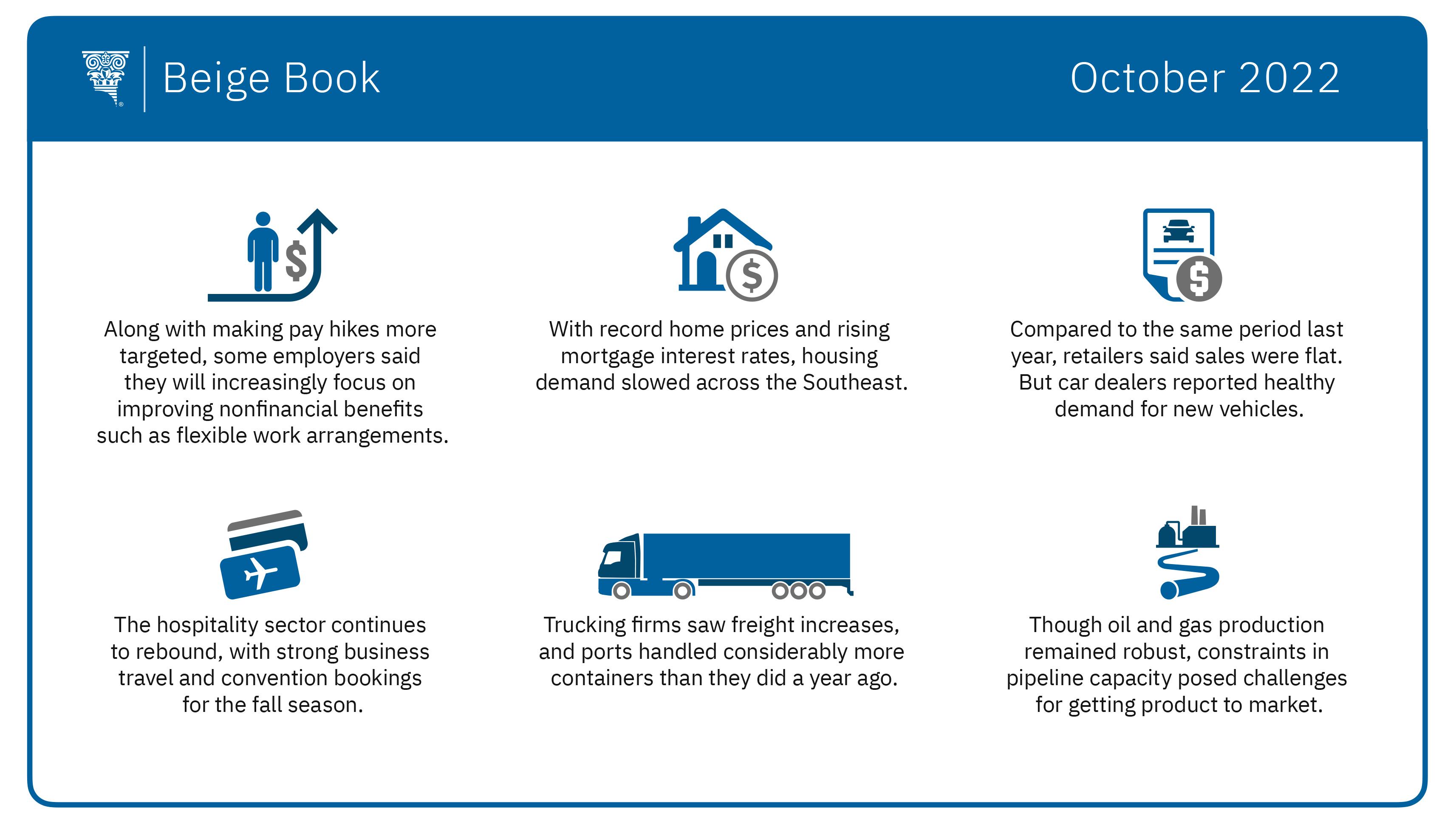

Most employers said pressure to increase wages remained but had lessened in recent months. Although most Atlanta Fed contacts said they continued to raise pay to attract and retain workers, several contacts plan to make future pay hikes more targeted. And many indicated they will focus more on improving benefits, such as flexible work arrangements, expanded healthcare coverage, and more time off.

Because labor costs make up a large portion of many businesses' expenses, wages are an important ingredient in inflation. As a result, Federal Reserve policymakers closely monitor wage growth as they pursue the central bank's twin mandate of stable prices and maximum employment.

In an important economic segment for both prices and employment, housing contacts reported continued slowing demand across the region as record prices and rising interest rates discouraged more potential buyers. Consequently, home sales declined sharply compared to the same time a year ago in most of the Atlanta Fed's district, which encompasses Alabama, Florida, Georgia, the southern halves of Louisiana and Mississippi, and the eastern two-thirds of Tennessee. Meanwhile, the supply of homes for sale rose but remained low in many markets, nevertheless still leading to record year-over-year price increases in growing markets including Tampa, Nashville, and Orlando.

In other economic sectors:

- Even as some input costs eased, a few contacts mentioned rising costs for labor, fuel, and freight, after the previous two reports found that freight costs had fallen. Two Atlanta Fed surveys showed signs that the pace of price increases could be slowing. The Business Inflation Expectations survey showed that year-over-year unit cost increases fell to 4.1 percent, on average, from 4.3 percent in August, while firms' expectations for inflation one year out decreased to 3.3 percent from 3.5 percent in August.

- Retailers reported flat unit sales, as opposed to sales in dollar terms, compared to this time last year. On the other hand, auto dealers said demand for new vehicles is healthy and inventories have improved.

- Hospitality contacts noted strong business travel and convention bookings for the fall season.

- Commercial real estate activity was mixed. Contacts in the apartment and industrial segments said conditions were stable. But demand ebbed for lower-tier office space and some retail space.

- Overall, manufacturers reported solid activity, though makers of some discretionary consumer products noted softening demand. That development aligns with reports that some consumers, especially low- and moderate-income shoppers, are forgoing nonessential purchases.

- Reports from transportation contacts were varied. Ports continued to handle far more containers than they did a year ago, and trucking firms saw increases in freight. But rail and air cargo contacts said volumes fell.

- In banking, loan growth was generally positive, though consumer loan demand softened, especially for vehicle loans.

- Energy contacts said oil and gas production was strong, but limited pipeline capacity made getting product to market challenging. Power companies reported rising demand from commercial, residential, and industrial customers.

- On the agriculture front, poultry producers said demand was strong amid reports of consumers electing to buy chicken instead of pricier meats. Crop production was solid, but growers hesitated to buy equipment because of concerns about future demand.

The Federal Reserve publishes the Beige Book before each meeting of the Federal Open Market Committee. The committee is scheduled to meet November 1 and 2.