The Southeast economy grew modestly in the six weeks through the end of March, and banks in the region reported strong loan growth despite concerns about liquidity following the failure of two banks in the West and Northeast, according to the Federal Reserve Bank of Atlanta’s Beige Book report of economic conditions in the Southeast.

Banking contacts also reported they did not experience significant deposit outflows and heard only limited concerns from customers about the recent failures and uninsured deposits. On the other hand, there remain considerable unrealized losses on securities on banks' books, which limits their ability to sell those securities for liquidity, should they need to, without reducing capital.

The Federal Reserve System publishes the Beige Book before each meeting of the policy-setting Federal Open Market Committee. The committee is scheduled to meet May 2 and 3. Each of the 12 regional Reserve Banks publishes a report on its district.

The Atlanta Fed's Beige Book describes labor market and pricing conditions that continue to evolve. Concerning labor, contacts reported it became easier to fill many positions and to keep employees. At the same time, some firms said certain positions were still hard to fill—in hospitality, accounting, and transportation, for example. Most employers hired to fill open positions, while a few hired to expand their operations.

Meanwhile, transportation pricing pressures eased as supply chain snarls continued to clear and shipping capacity opened up. Also, companies reported winning more concessions on their input prices compared to the past two years of "take-it-or-leave-it" price negotiations. Even as some wholesale price pressures eased, however, other nonlabor costs, including food inputs and construction materials, were still volatile. That circumstance, along with still-high labor costs, kept many firms from passing lower costs to customers.

In other sectors:

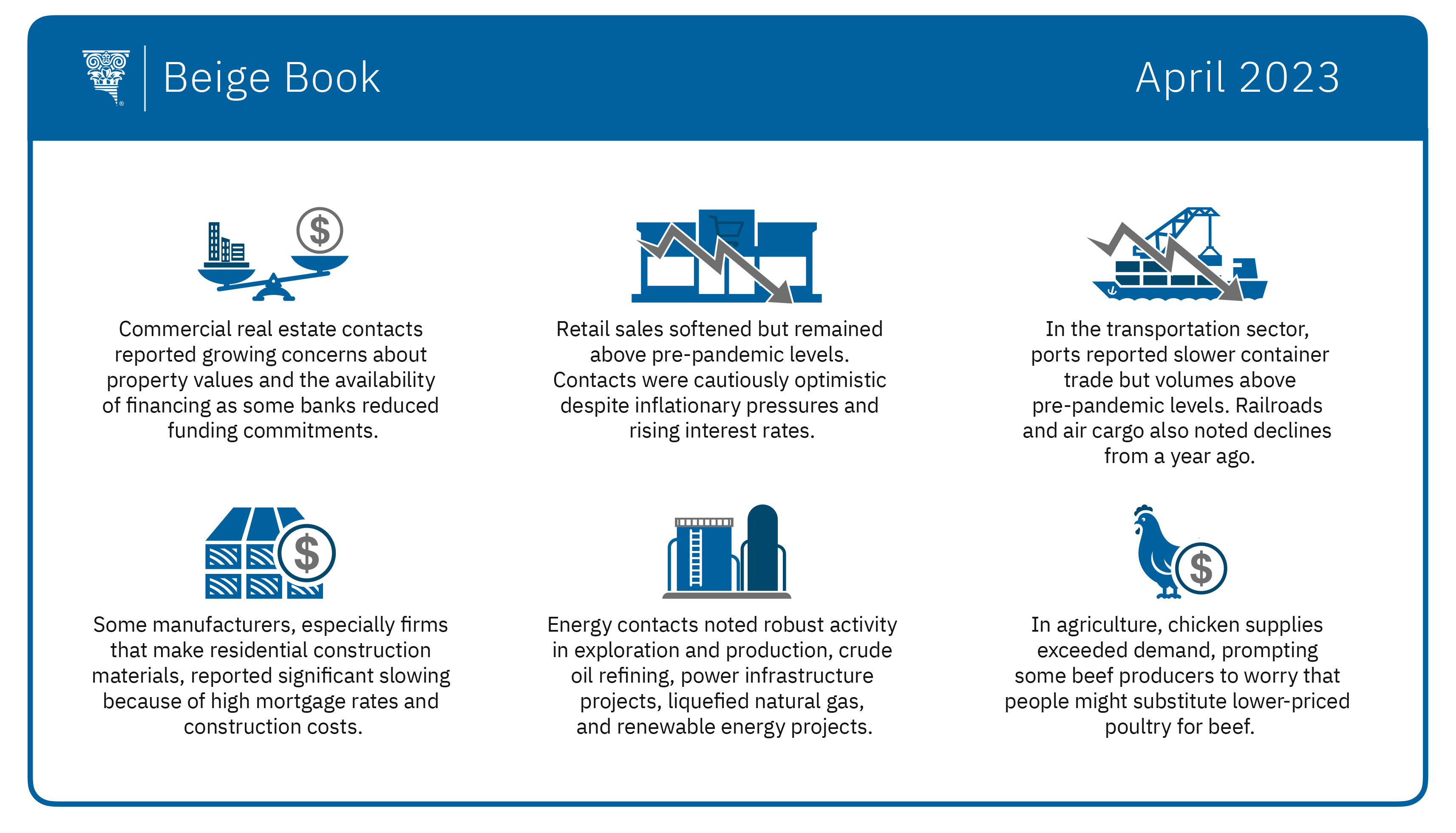

- Commercial real estate contacts reported growing concerns about property values and financing availability as some banks reduced funding commitments amid weaker lending from larger financial institutions. However, the industrial sector stayed strong while activity slowed in the office, multifamily, and retail categories.

- Retail sales softened but remained above prepandemic levels. Despite inflationary pressures and rising interest rates, retail contacts were cautiously optimistic about the remainder of the year. Tourism was healthy through the spring break season, and contacts described leisure travel as returning to normal from last year’s unsustainable levels.

- In the transportation sector, ports reported slower container trade, though volumes remained above prepandemic levels. Railroads and air cargo contacts also noted declines from the corresponding period a year ago.

- Some manufacturers, especially firms that make residential construction materials, reported significant slowing because of high mortgage rates and construction costs.

- Energy contacts noted robust activity in exploration and production, crude oil refining, power infrastructure projects, liquefied natural gas, and renewable energy projects.

- In agriculture, chicken supplies exceeded demand, prompting some beef producers to worry that people might substitute lower-priced poultry for beef. Contacts expect to plant less cotton this year as discretionary spending across the economy softens.