The Southeast economy grew slowly from mid-August through September as labor markets continued to loosen and price pressures mostly stabilized, according to the new Beige Book report from the Federal Reserve Bank of Atlanta.

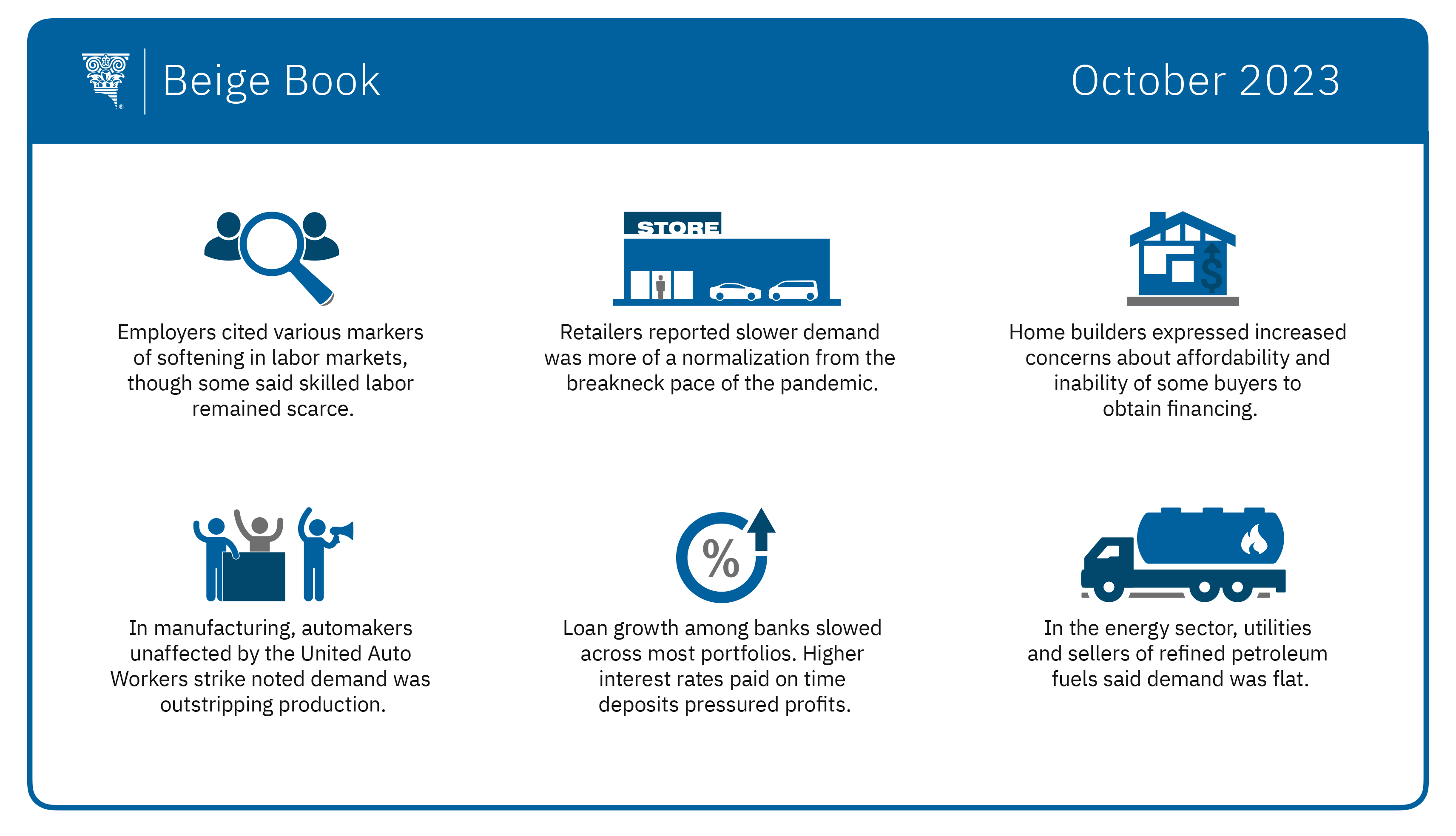

Employers in the Atlanta Fed's district cited various markers of softening in labor markets. They said it was easier to find and keep employees and that the quality of job candidates improved. The Sixth District encompasses Alabama, Florida, Georgia, and parts of Louisiana, Mississippi, and Tennessee.

At the same time, contacts in certain industries, especially construction, said skilled labor remained scarce. Worker shortages in building trades and agriculture led to delayed construction projects and a longer planting season, contacts said.

Florida was a bit of an outlier. Contacts in several markets in the state said high living costs complicated retention and recruiting of talent.

Consumer spending normalized

Robust consumer spending is often cited as a sturdy underpinning of a macroeconomy that's been resilient in the face of tighter monetary policy. In that sector, retailers reported some slowing in demand but characterized it as more of a normalization from the breakneck pace of the COVID-19 pandemic than an alarming slowdown. Many contacts also expect meaningful but not worrisome weakening of demand growth through the rest of the year.

For retailers and others, nonlabor costs generally appear to be stabilizing. Nevertheless, housing prices continued to climb. Rising home prices and interest rates sent home ownership affordability to record lows in the District in recent weeks, according to contacts. Home builders expressed increased concerns about affordability and an inability of some buyers to obtain financing. In that environment, some builders offer to pay a portion of customers' mortgage interest for two or three years, an arrangement known as a "rate buy down," to lure buyers.

In other economic sectors:

- Commercial real estate contacts said newer office buildings continued to fill up while older properties reported declining occupancy.

- Transportation activity remained sluggish. Lower import volumes affected rail carriers, and container shippers have reduced capacity as they expect weaker consumer demand for imported goods.

- In manufacturing, auto makers unaffected by the United Auto Workers strike noted that demand was outstripping production, and some noted strong demand for lower-priced autos.

- Loan growth among banks slowed across most portfolios. Banking contacts noted that higher interest rates paid on time deposits were pressuring profits.

- From the energy sector, utilities and sellers of refined petroleum fuels said demand was flat. Meanwhile, rising input and maintenance costs squeezed profit margins in all energy sectors.

- Agriculture conditions were mixed, as usual. In Louisiana and Mississippi, droughts led to the thinning of cattle herds, which resulted in an oversupply of beef. Strong yields also produced surpluses of soybeans and corn. In Florida's "timber basket" region, growers were forced to give away downed trees or pay to have them hauled away after Hurricane Idalia.

The Federal Reserve publishes the Beige Book before each meeting of the Federal Open Market Committee. The Committee is scheduled to meet October 31 and November 1.