The Southeast’s economy grew slowly from mid-November through December as most companies generally held consumer prices steady, according to the new Beige Book report from the Federal Reserve Bank of Atlanta.

The holiday shopping season yielded mixed results for retailers, the Beige Book shows. Instead of an alarming pullback, contacts said consumer spending continued to normalize from the COVID-19 pandemic-era surge.

In line with trends before the pandemic, retail contacts reported managing inventories more closely, and many offered customary holiday-season promotions and discounts. Broadly, retailers’ outlook remains positive for the first half of 2024.

Inflation, the Fed’s primary focus for the past two-plus years, declined sharply over the past year. Feedback captured in the latest Beige Book reflects that trend.

Contacts told Atlanta Fed staff that pricing power, their ability to increase prices without chasing away customers, continued to diminish, as did nonlabor cost increases. Firms noted supply chains became more predictable, leading to lower freight and shipping costs.

The Atlanta Fed’s Business Inflation Expectations survey showed year-over-year unit cost growth decreased significantly in December, to 2.9 percent on average, from 3.2 percent in November. For the year ahead, respondent firms expect unit costs to rise 2.4 percent on average, about the same number as in November.

Contacts reported similar cooling in labor markets. Some employers slowed hiring, while most continued to report that finding and keeping workers were easier compared to earlier in 2023. The leisure and hospitality sector, where hiring remained challenging, was an exception. Additionally, some contacts cited a lack of affordable housing as a barrier to attracting workers in certain areas.

In other sectors:

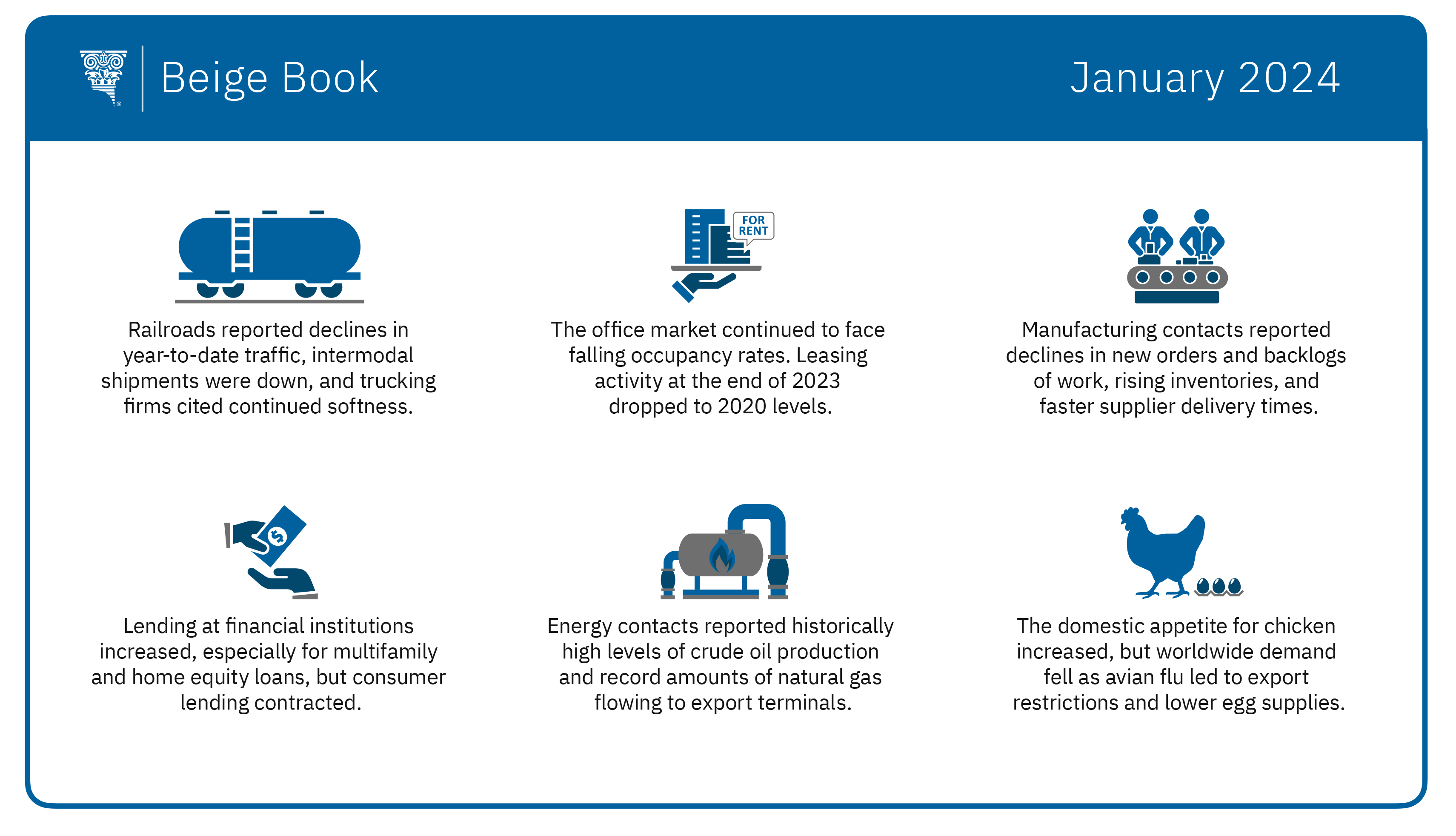

- Transportation activity remained muted. Railroads reported declines in year-to-date total traffic, intermodal (ship, rail, and truck) shipments were down significantly, and trucking firms cited continued softness in freight volumes. Some logistics contacts hinted at reemerging supply chain constraints because drought conditions in the Panama Canal forced shippers to reroute to the Suez Canal, extending lead times for products from China and southeast Asia.

- The Sixth District’s office market continued to face falling occupancy rates as more space came onto the market than tenants filled. Leasing activity at the end of 2023 dropped to 2020 levels.

- Manufacturing activity slowed slightly. Some contacts reported declines in new orders and backlogs of work, along with rising finished goods inventories and faster supplier delivery times.

- Lending at Sixth District financial institutions increased since the previous Beige Book report, especially for multifamily and home equity loans. However, consumer lending contracted, alongside a rise in delinquencies in credit cards, auto loans, and unsecured personal loans.

- Energy contacts reported historically high levels of crude oil production and record amounts of natural gas flowing to export terminals. Contacts also continued to report planning and development of industrial decarbonization and renewable energy projects.

- In agriculture, while the domestic appetite for chicken increased, worldwide demand fell as avian flu led to additional export restrictions and lower egg supplies.

The Beige Book is a compilation of anecdotal reports from business contacts that the Federal Reserve publishes before each meeting of its policymaking Federal Open Market Committee. The Committee is scheduled to meet January 30 and 31.