Economic activity in the Southeast grew modestly over the past several weeks as labor market and pricing conditions broadly continued on their paths of recent months, according to the new Beige Book anecdotal report from the Federal Reserve Bank of Atlanta.

Most Atlanta Fed contacts said it continued to get easier to fill open jobs. Even so, business leaders across the region reported pockets of labor shortages that varied widely by location and industry. Where shortages prevailed, companies focused on training and crafting pipelines to ensure future talent supplies. That pattern was notable among firms facing a wave of retirements.

Meanwhile, most firms indicated that pressures to increase wages continued to ease, and growth in pay was closer to historical averages.

Regarding prices, increases in nonlabor costs stabilized for most but not all items. For example, prices for transportation and commodities including lumber and steel held steady or fell. At the same, construction delays boosted the final cost of building projects, food prices continued to climb, and contacts reported ongoing increases in insurance premiums.

In other sectors:

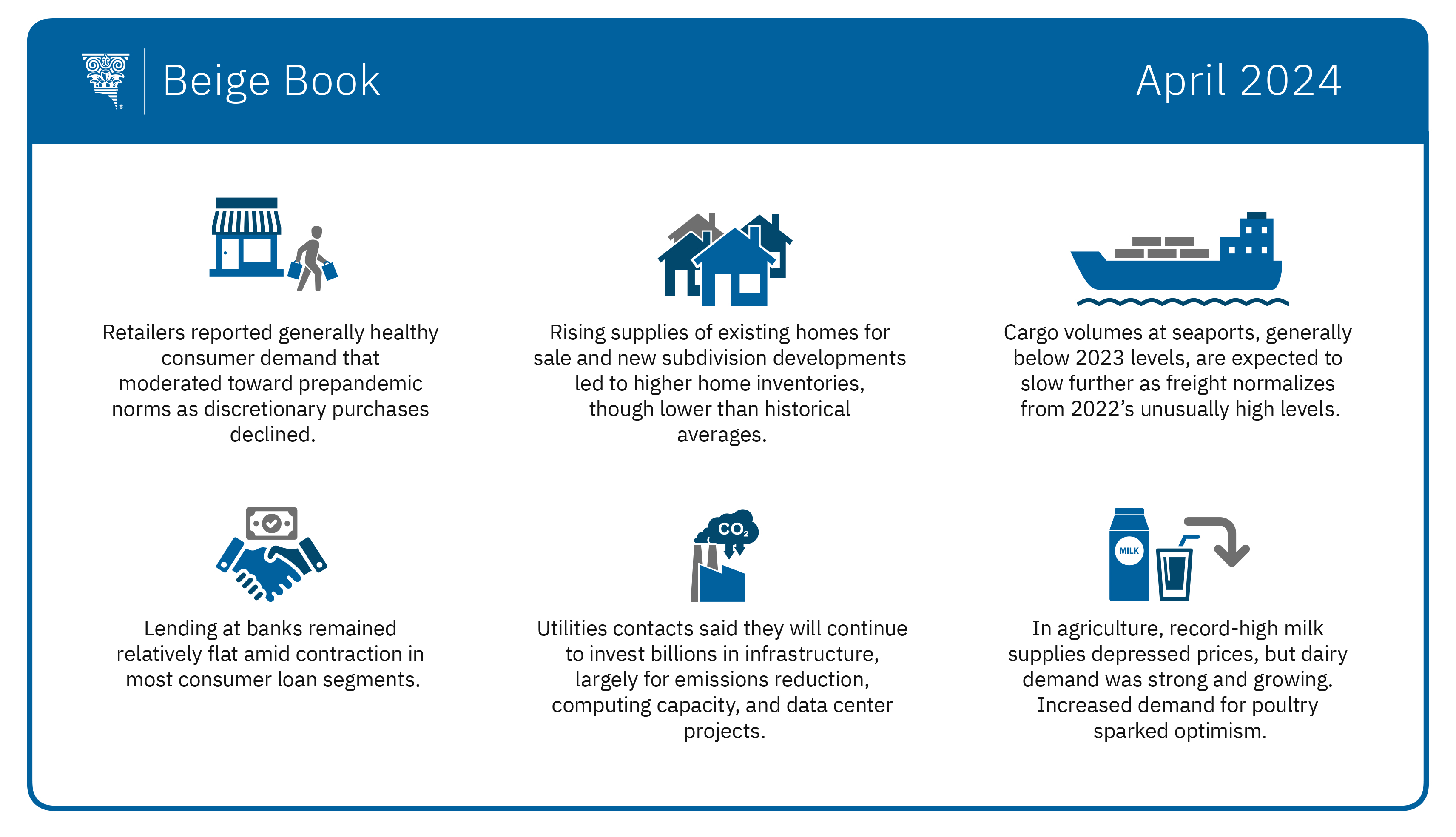

- Retailers continued to report generally healthy consumer demand that moderated toward prepandemic norms as discretionary purchases declined. Auto dealers said business was stabilizing. Inventories were sufficient to meet demand and vehicle manufacturers offered incentives to boost sales.

- Tourism and hospitality contacts reported that strong spring break travel met expectations. Meanwhile, several Florida cruise ports reported strong passenger counts, and business travel continued to improve.

- Rising supplies of existing homes for sale and new subdivision developments led to higher home inventories, though they remain lower than historical averages.

- Cargo volumes at seaports were generally below 2023 levels. They are expected to slow further as freight normalizes down from 2022's unusually high levels.

- Manufacturers of products tied to government and infrastructure projects reported higher demand, while a few consumer goods makers reported some softening.

- Lending at banks remained relatively flat amid continued contraction in most consumer loan segments. One notable exception was home equity lines of credit.

- Utilities contacts said they will continue to invest billions in infrastructure in the next several years, largely for emissions reduction, computing capacity, and data center projects.

- In agriculture, record-high supplies of milk depressed prices, but demand for dairy was strong and growing. Some increase in demand for poultry sparked optimism in the market, but many producers struggled because of export restrictions.

The Federal Reserve publishes the Beige Book before each meeting of the policymaking Federal Open Market Committee. The Committee's next meeting is scheduled for April 30 and May 1.