The new Beige Book largely describes economic trends holding steady in the Southeast with slow overall growth as price pressures generally continue to ease and employers have a slightly easier time finding labor.

This edition of the anecdotal report included a "community perspectives" section on conditions in low- and moderate-income communities that appears in every other Atlanta Fed section of the Beige Book. It noted that several workforce service providers said employers were becoming more selective and using extended tryout periods for prospective employees.

Nevertheless, many workers expressed optimism about their prospects for finding jobs along with apprehensions about the quality of available jobs in terms of wages, flexible hours, and paid time off. Broadly speaking, concerns about household finances remained widespread among nonprofits serving low- and middle-income households.

Meanwhile, contacts at several companies in Florida said high housing prices hindered their ability to attract talent. In fact, one nonprofit contact said more employers were considering building housing for their workers.

The pricing picture was mixed. Some firms reported keeping prices unchanged in response to increasingly price-sensitive consumers, while some looked to cutting costs to preserve profit margins. Others said they could still raise prices to cover rising costs.

The Atlanta Fed's Business Inflation Expectations survey showed that year-over-year unit cost growth decreased in April to 2.6 percent, on average, from 2.8 percent in March. Firms' year-ahead inflation expectations for unit cost growth ticked down in April to 2.3 percent, on average, from 2.4 percent in March.

In other sectors:

- Retailers reported consumer demand was generally healthy, but most expect flat year-over-year sales growth. Shoppers continued to be cautious with discretionary spending.

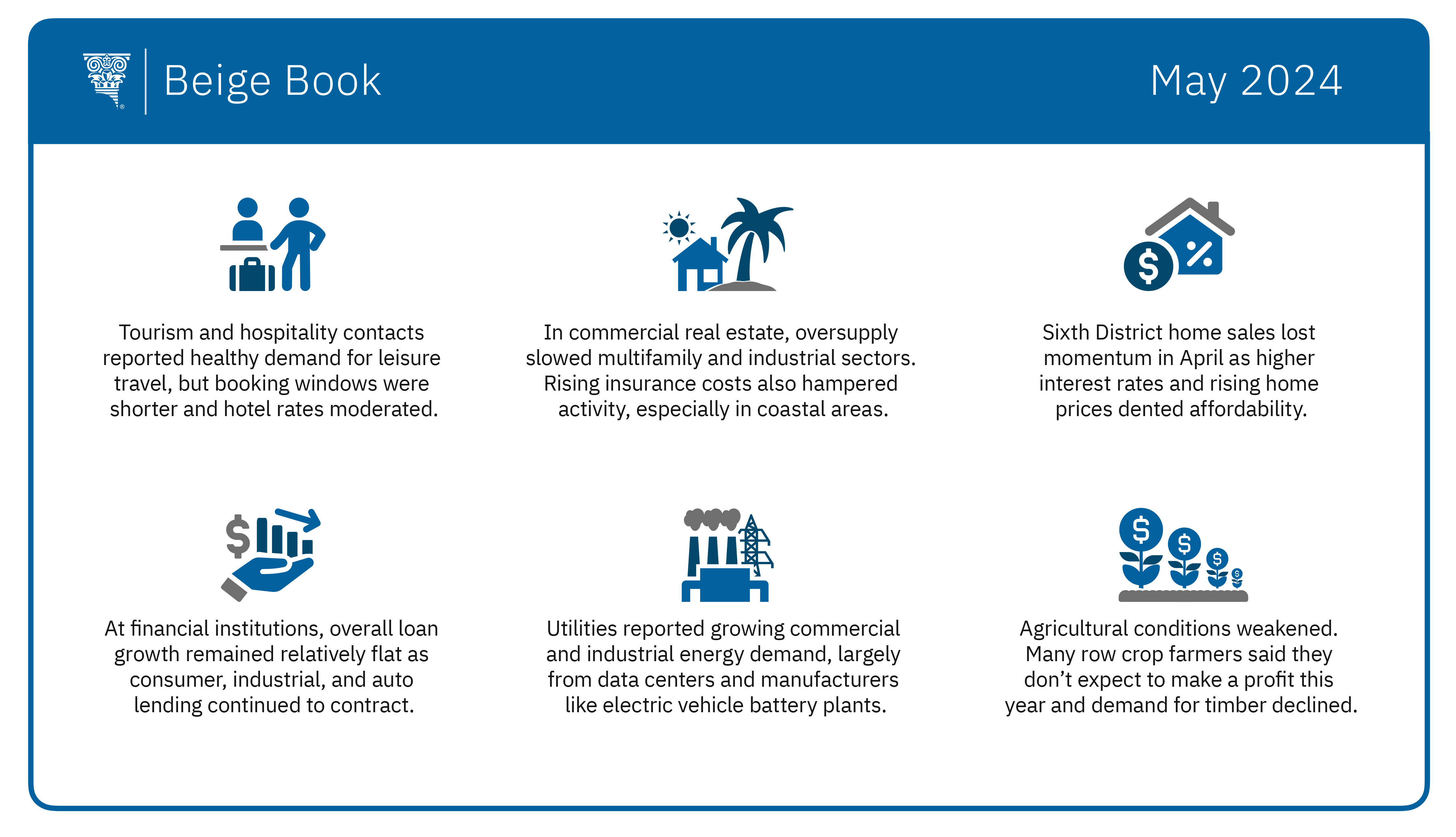

- Tourism and hospitality contacts reported healthy demand for leisure travel, but booking windows were shorter and hotel rates moderated. Group, international, and business travel continued to improve but was still not back to prepandemic levels.

- Sixth District home sales lost momentum in April as higher interest rates and rising home prices dented affordability. Despite the “mortgage rate lock-in effect”—homeowners not willing to sell because they have favorable mortgage rates—existing home inventory levels rose overall.

- In commercial real estate, the office and apartment sectors continued to slow. Oversupply in the multifamily and industrial segments weighed on market conditions as new buildings came online. Meanwhile, rising insurance costs hampered activity, especially in coastal areas.

- Demand for transportation services varied. Trucking firms reported volumes were at or just below seasonal norms. Officials at eastern seaboard ports listed catastrophic weather and a potential fall labor strike as serious risks to their outlook.

- At financial institutions, overall loan growth remained relatively flat, as consumer, industrial, and auto lending continued to contract. Credit conditions continued to normalize to pre-COVID levels with a minor uptick in the allowance for loan and lease losses as a percentage of total loans.

- In the energy sector, utility companies reported growing electricity demand in commercial and industrial segments, largely from new and expanded data centers and manufacturing such as electric vehicle battery plants, a trend expected to continue across the Southeast.

- Agricultural conditions weakened. Many row crop farmers said they don't expect to make a profit this year amid low demand and excess supply. Demand for timber declined, leading some growers to pause production. Demand for beef was strong as the supply of cattle remained limited.

The Federal Reserve publishes the Beige Book before each meeting of the policymaking Federal Open Market Committee. The Committee's next meeting is scheduled for June 11 and 12.