Economic activity across the Southeast was largely unchanged during late May and June compared to the previous six-week period, according to the Federal Reserve Bank of Atlanta's new Beige Book of anecdotal reports from business contacts.

Patterns at work for the past couple of months continued: Labor markets and wage pressures eased further, and worker availability and turnover improved. Cost growth moderated overall, the Beige Book reported.

Workers still scarce in some industries

Even as broad labor market conditions continued to ease, worker shortages persisted in certain industries including construction, maintenance, retail, nursing, and tourism. Extending another trend, employers in south Florida and Nashville said a lack of affordable housing complicated their efforts to attract and keep workers.

Companies also continued turning to automation and outsourcing to save money or compensate for actual or expected labor shortages.

Firms' ability to increase prices without repelling customers weakened as demand softened, according to the Beige Book. While food and commodities costs were mostly unchanged, prices rose for freighting and some construction materials.

The Atlanta Fed's Business Inflation Expectations survey showed year-over-year unit cost growth in June relatively unchanged at 2.8 percent, on average, up from 2.7 percent in May. Firms' year-ahead inflation expectations for unit cost growth has remained at 2.3 percent, on average, since April.

In other sectors:

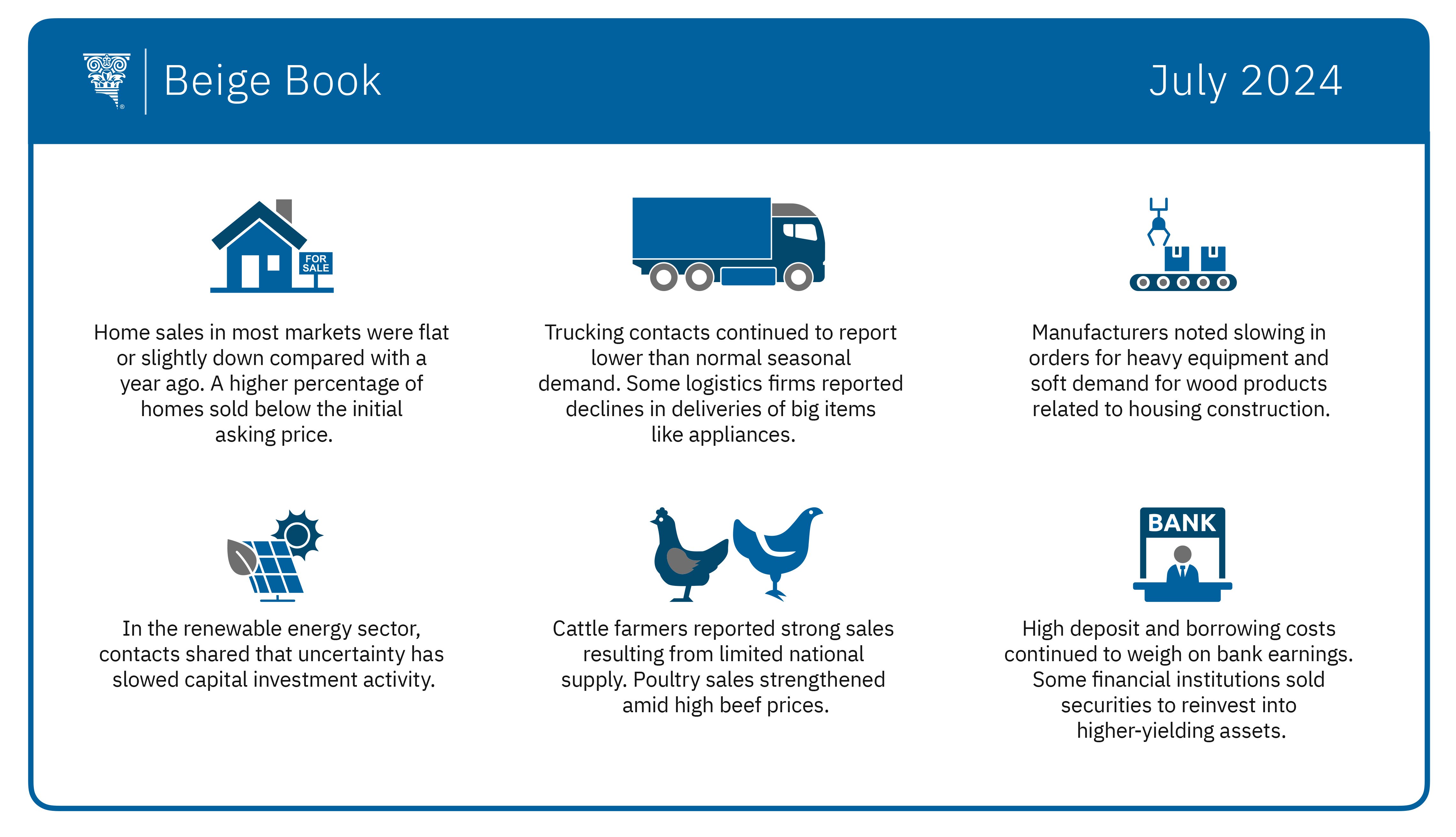

- With home prices near peak levels and interest rates still elevated, home sales in most markets were flat or slightly down compared with a year ago. A higher percentage of homes sold below the initial asking price, suggesting a market shift in favor of buyers.

- Commercial real estate activity was mixed. Slowing activity in the office and apartment sectors resulted in rising vacancy rates, flat-to-declining rent growth, and an increase in foreclosures in those segments. In an interesting twist, contacts involved in retail real estate noted an increase in "clicks-to-bricks" investments, where a brick-and-mortar presence supplements online sales.

- In transportation, trucking contacts continued to report lower-than-normal seasonal demand. Some logistics firms reported declines in wholesale, retail, and direct-to-consumer deliveries of big items such as appliances. Warehousing contacts reported slowing demand for distribution and warehouse space.

- Manufacturing activity decreased slightly since the previous Beige Book. Some contacts reported slowing orders for new heavy equipment. Manufacturers also noted soft demand for wood products, especially related to housing construction.

- At Southeast financial institutions, loan growth was flat as underwriting remained tight and interest rates stayed elevated. High deposit and borrowing costs continued to weigh on bank earnings with some financial institutions selling securities to reinvest proceeds into higher-yielding assets.

- Utility contacts reported increasing power demand in commercial and industrial segments, largely attributed to new and expanding data center projects focused on the growing use of artificial intelligence technology. Contacts in the renewable energy sector shared that election uncertainty had slowed capital investment activity.

- Agriculture conditions improved slightly in recent weeks. Cattle farmers reported strong sales resulting from limited national supply. Poultry sales strengthened amid high beef prices, and poultry farmers expressed increased optimism about the remainder of the year.

The Federal Reserve publishes the Beige Book before each meeting of the policymaking Federal Open Market Committee. The Committee's next meeting is scheduled for July 30 and 31.