Beige Book Reports Slowing Activity

The new Beige Book from the Federal Reserve Bank of Atlanta reports that economic activity slowed a bit in the Southeast during July and the first half of August compared to the previous six weeks.

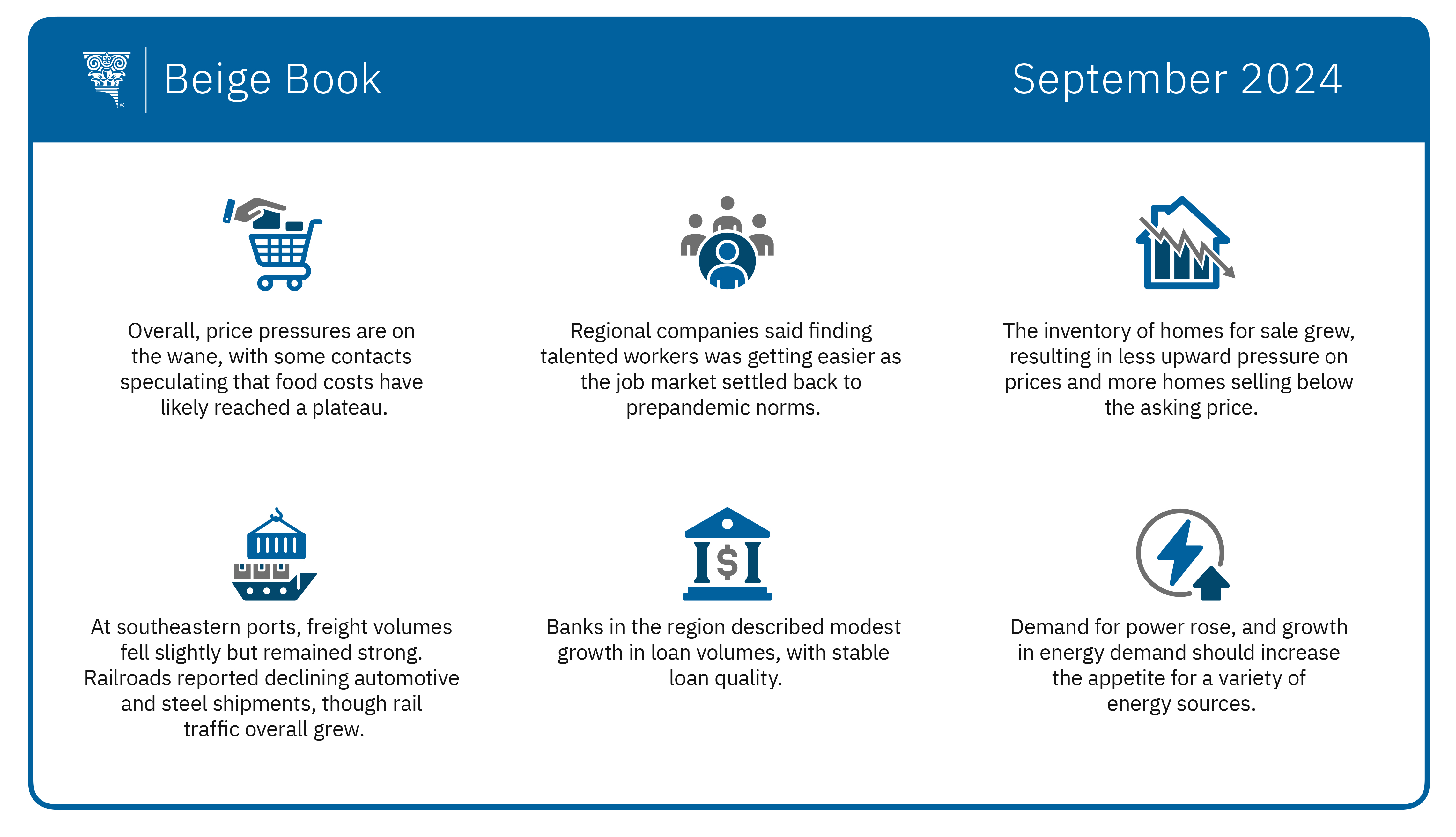

Still, employment in the district edged higher, even as some contacts said they were curtailing hiring for the rest of 2024. Most firms told the Atlanta Fed that it became easier to find talented workers, as the labor market settled back to a more normal state after three years of unusually rapid job growth following the pandemic.

A few contacts said their companies were trimming payroll, mainly by reducing workers' hours. A minority of the firms that were cutting back reported layoffs. However, several firms said further weakening in demand could lead to layoffs.

Turning to the other side of the Fed's dual mandate of fostering stable prices and maximum employment, price pressures continued to wane. Several contacts speculated that food costs have likely plateaued, and although labor and insurance costs remained most firms' biggest expense, increases in those areas also slowed.

Overall, firms reported diminished pricing power, which is the ability to pass along rising costs via higher prices without losing customers. The Atlanta Fed's Business Inflation Expectations survey showed year-over-year unit cost growth ticked down to 2.7 percent, on average, in July from 2.8 percent in June, and firms' year-ahead inflation expectations for unit cost growth remained relatively unchanged at 2.4 percent, on average.

In other sectors:

- Consumer spending declined slightly from the previous Beige Book reporting period. Retailers said they observed more trade-downs, bulk purchases, and a shift to shopping at outlets. Auto dealers noted a modest decline in demand, as consumers delayed big-ticket purchases.

- Housing activity continued to slow. Inventories of homes for sale increased sharply, especially in Florida, resulting in less upward pressure on prices and more homes selling below the asking price. Homebuilder sentiment deteriorated as demand for new homes declined moderately.

- Most transportation said activity was below expectations. Trucking demand was mostly down. Freight volumes at Sixth District ports declined slightly but remained strong. Railroads reported a decline in automotive and steel shipments, though total rail traffic increased.

- Manufacturing activity slowed a little in recent weeks. Some retail goods producers said wholesalers were reacting to slackening consumer demand by reverting to just-in-time inventories, as opposed to stockpiling products. Some manufacturers, however, continued to flourish, particularly makers of pharmaceuticals and materials for infrastructure projects.

- In banking and finance, contacts reported that loan volumes grew modestly, and the quality of loans remained stable. Yet certain categories of credit, including commercial real estate as well as commercial, industrial, and consumer lending, continued to soften.

- In the energy sector, economic development continued to create demand for power. One utility reported data centers used 17 percent more electricity in recent months, and rapid growth in power demand figures to heighten the need for various forms of supply, including natural gas turbines, solar, wind, and battery energy storage systems.

The Beige Book is a compendium of anecdotal reports from business contacts that the Federal Reserve publishes before each meeting of the policymaking Federal Open Market Committee. The committee gathers next on September 17 and 18.