The Southeast economy continued to grow and employment held steady, while consumer spending dipped slightly, according to the new Beige Book. The Atlanta Fed's latest report on economic conditions includes anecdotal feedback from January through mid-February.

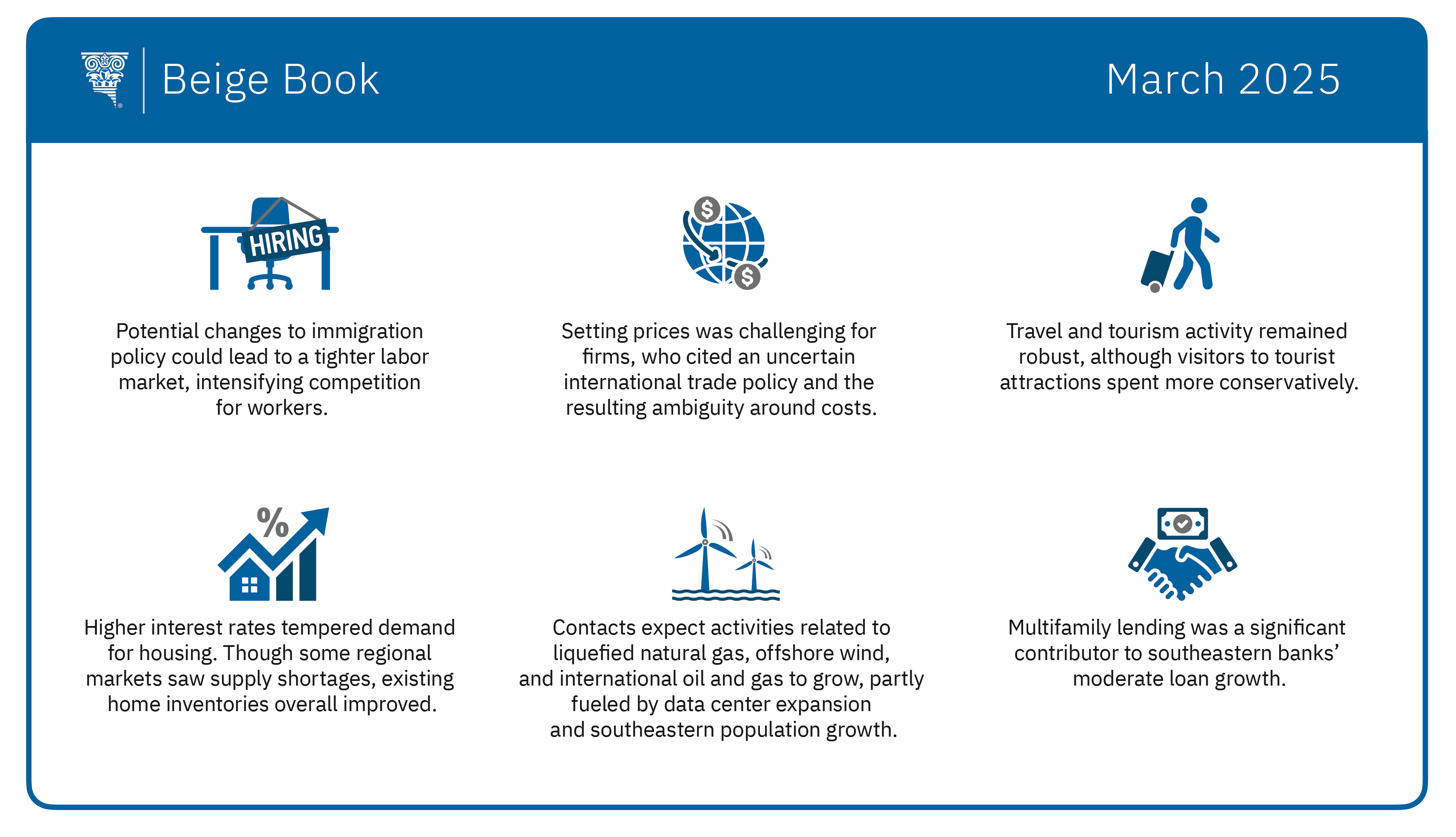

On the labor market front, little changed since the last report: headcounts remained mostly flat and firms' abilities to hire and retain workers continued to improve. Contacts did observe some emerging risks that center on potential changes to immigration policy, such as increased competition for workers if the labor market tightens.

Many firms reported challenges setting prices, pointing to uncertain international trade policy and the resulting ambiguity around costs. Most of these contacts say they plan to pass the majority of any additional costs on to consumers, though some firms said they're revising contract structures to mitigate cost risk.

The cost of living—and particularly the lack of affordable housing—remains a top concern among the Atlanta Fed's community contacts. Additionally, job seekers in lower-wage occupations reported a more challenging job search experience.

In other sectors:

- Travel and tourism activity held steady as many contacts reported healthy demand. Still, tourist attractions drew fewer visitors, who in turn also spent less.

- Across the Southeast, higher interest rates curtailed demand for housing a bit since the last report. While supply shortages linger in some markets, existing home inventories generally improved.

- The transportation sector saw modest growth. Container volumes for ocean carriers and southeast ports remained especially strong. On the downside, warehousing contacts said economic concerns and an overbuilt supply are stifling demand for space. Winter weather events hindered truck load volumes, and uncertainty around trade policy has made forecasting for 2025 a challenge for some contacts.

- Manufacturing activity grew slightly, boosted primarily by strong demand for chemicals, transportation equipment, and machinery.

- Financial institutions across the Sixth District saw moderate loan growth, paced notably by multifamily lending.

- Energy contacts said they're expecting a spike in activities related to liquefied natural gas, offshore wind, and international oil and gas. The expansion of data centers and the region's growing population has kept power demand high.

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve districts. The Fed System and regional reserve banks publish the Beige Book eight times a year, before each meeting of the Federal Open Market Committee. The reports from each District characterize regional economic conditions based on a variety of mostly qualitative information, gathered directly from District sources, including interviews and online questionnaires completed by businesses, community organizations, economists, market experts, and other sources. The Committee next meets March 18 and 19.

By Jason Taylor, the Atlanta Fed's editorial director