The Federal Reserve Bank of Atlanta's new Beige Book shows the Southeast's economy grew slightly from mid-April through May, although signs of economic uncertainty are evident across several sectors.

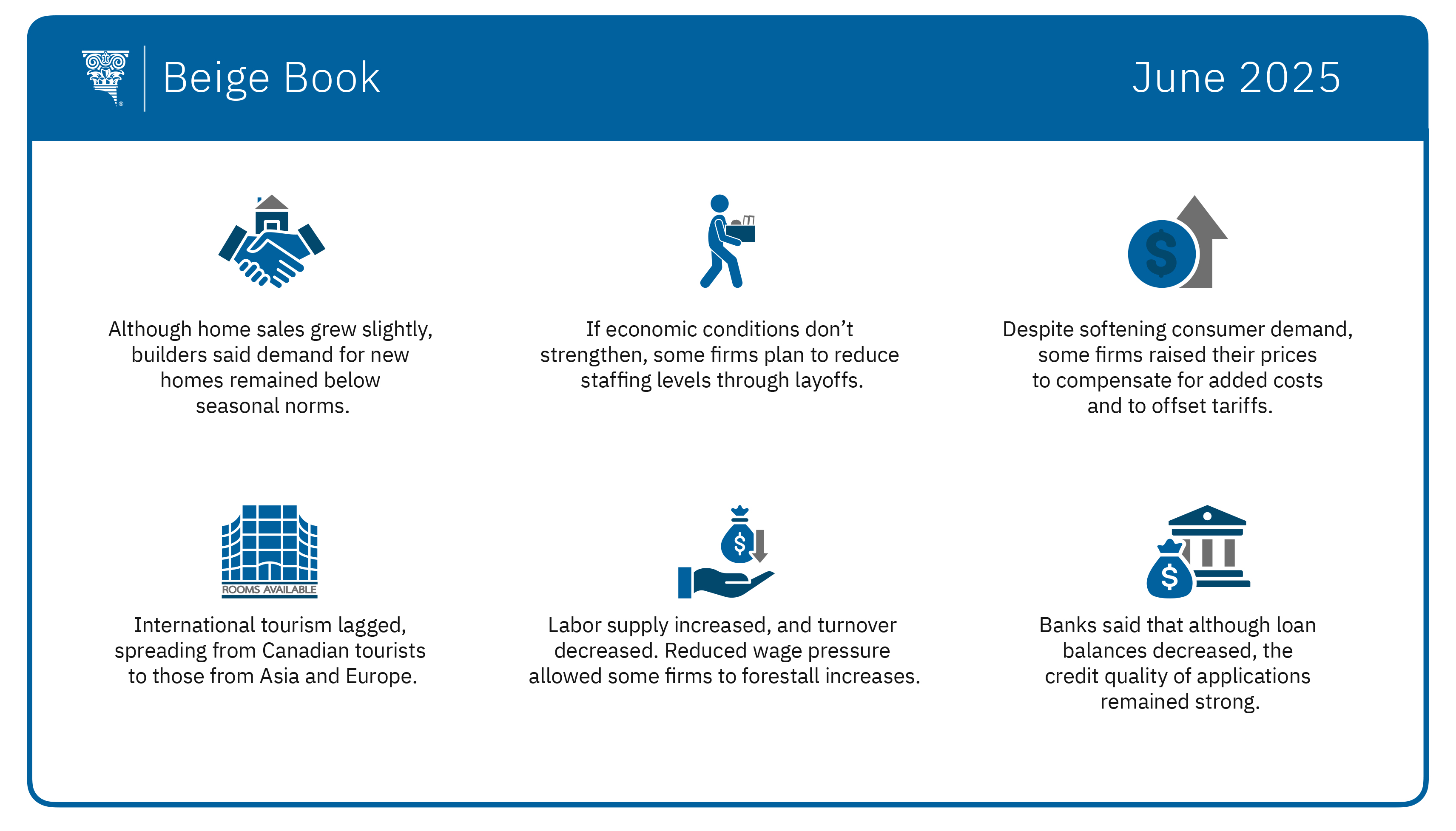

In the bellwether housing sector, for example, home sales grew slightly, attributed to stabilizing mortgage rates. However, demand for new homes remained below seasonal norms. Some homebuilders reported pulling back on lot purchases, and some lenders reported a decline in loans for residential construction.

Employment levels remained flat during the reporting period. Many firms expected relatively stable staffing levels in the near term. Conversely, some firms reported devising contingency plans to reduce headcount through layoffs, if conditions do not improve. Some nonprofit and philanthropic organizations have reduced staffing because of current and potential cuts in federal funding.

Firms across sectors, geographies, firm sizes voiced inflationary concerns related to trade policy. The Atlanta Fed's April Business Inflation Expectations survey showed the manufacturers that were concerned about a possible US recession listed trade policy as the top worry, along with inflation, consumer demand, geopolitical risks, interest rates, and the equity markets.

In other economic sectors:

- Prices rose moderately from the previous report. Although consumer demand was softening, some firms raised prices to consumers as part of a multipronged approach to manage added costs and tariffs.

- A decline in international tourism, previously confined mainly to Canadian travelers, broadened to include visitors from Asia and Europe. Room rates were flat or slightly higher, and some hotels offered incentives such as an additional free night.

- Commercial real estate remained stable, on balance. Multifamily development slowed overall. Delinquencies on office loans rose, as did the vacancy rate in industrial space.

- Utility companies reported moderate growth across sectors. Offshore wind contacts reported a significant decline in demand that had led to downsizing.

- Financial institutions reported that loan balances had decreased across all sectors. However, the applications that were submitted showed continued strength in credit quality.

- Demand for transportation services rose modestly. Railroads and seaports reported increased traffic. Some trucking firms reported their volumes were lower than normal for this reporting period.

- Firms reported an increase in labor supply and decreased turnover. Wage pressure has decreased sufficiently for some firms to hold wages flat or delay wage increases.

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve districts. The Fed System and regional reserve banks publish the Beige Book eight times a year, before each meeting of the Federal Open Market Committee. The reports from each District characterize regional economic conditions based on a variety of mostly qualitative information, gathered directly from District sources, including interviews and online questionnaires completed by businesses, community organizations, economists, market experts, and other sources. The Committee next meets June 17 and June 18.