Economic activity in the Southeast was little changed from mid-August through September as compared to the previous couple of months, according to the new Beige Book report from the Federal Reserve Bank of Atlanta.

Business contacts reported that employment levels were flat, while wages and prices rose moderately. But some of the six-state region's key economic sectors reported a degree of slowing. For instance, consumer spending and leisure travel softened.

The Federal Reserve pursues a dual mandate from Congress—to strive for sustainable maximum employment and price stability.

In the Atlanta Fed's Sixth District—comprising Alabama, Florida, Georgia, and parts of Louisiana, Mississippi, and Tennessee—numerous executives described what one contact dubbed a "hiring chill." The contacts said they welcomed a degree of attrition and scaled back hiring even in growing business areas. Many employers said employee turnover was as low as they'd ever seen it.

At the same time, a growing but still small number of firms reported laying off staff. Impacts from changing immigration policies were more significant than previously reported but were concentrated in particular places like south Georgia and certain sectors such as agriculture and hospitality. Uncertainty surrounding labor supply and consumer demand continued to weigh on firms' hiring plans.

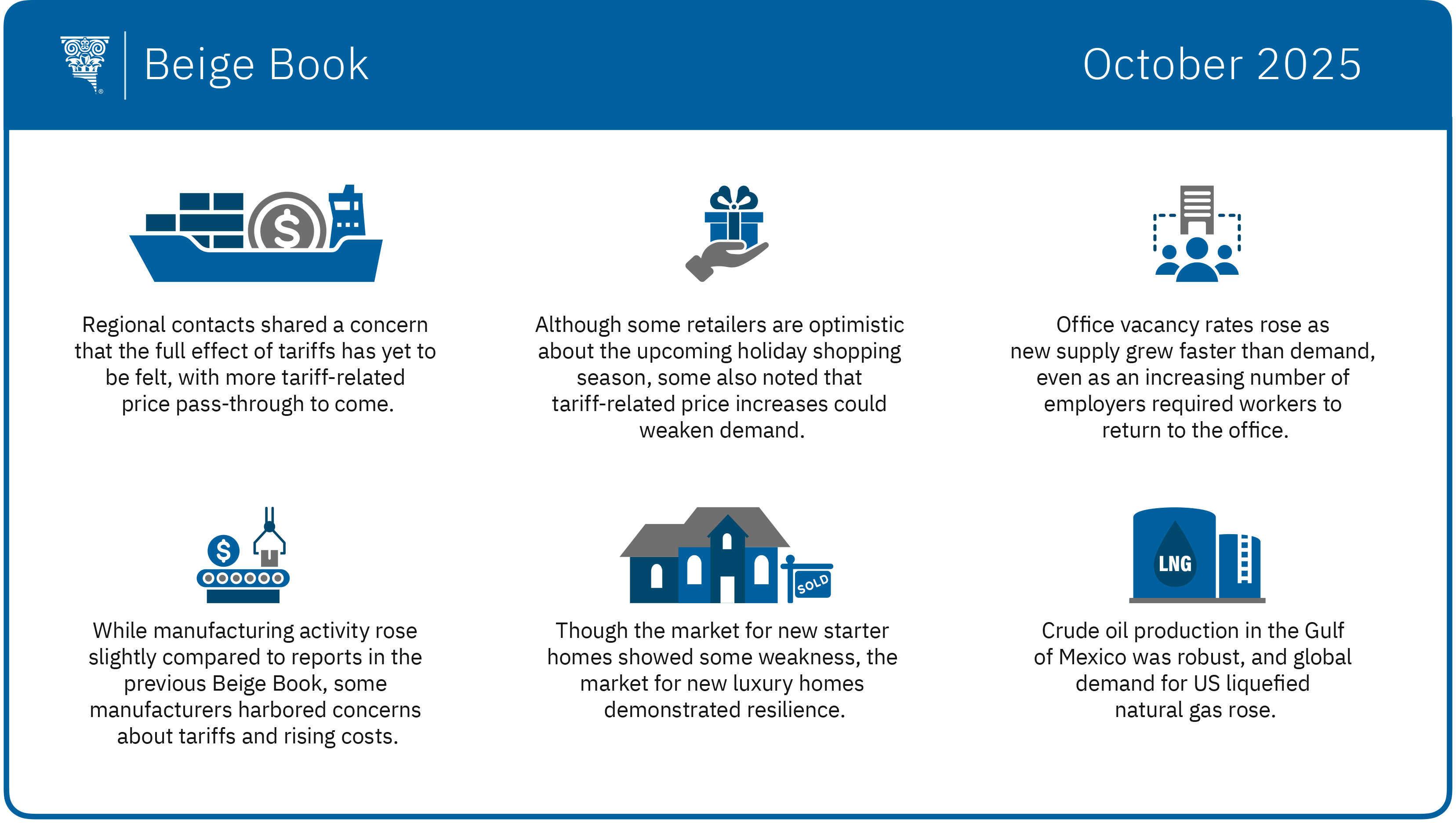

On the inflation front, contacts warned that price pass-through resulting from tariffs has just begun, and many expect to see price increases to continue into 2026. In the most recent period, prices climbed moderately. Firms noted a range of tariff impacts on operating costs and pricing, as well as varying approaches to managing those impacts such as absorbing cost increases, negotiating with suppliers, and passing through higher costs to customers via price hikes.

In other economic sectors:

- Retail sales declined slightly over the reporting period. Some retailers were cautiously optimistic about the upcoming holiday season, but a few noted that tariffs could soon cause prices to rise, causing demand to weaken further. Restaurateurs reported that diners cut costs by forgoing desserts and alcohol.

- In the tourism business, hotel occupancy rates continued to trend downward as both leisure and business travel were lackluster. Cruising remained the strongest segment of the industry, as district ports reported solid passenger volumes. Despite the mixed picture, hospitality contacts remained guardedly optimistic about the upcoming holiday travel season.

- Home sales declined moderately, and real estate agents reported increased buyer hesitation because of economic uncertainty. Demand for new starter homes remained weak, while the luxury new home market was resilient.

- In the commercial real estate market, despite spreading return-to-office requirements from employers, office vacancy rates increased as new supply outpaced demand.

- Transportation activity declined modestly. Some trucking firms reported that ongoing weakness in consumer goods shipments intensified.

- Manufacturing activity rose slightly compared to the previous Beige Book. Yet concerns over tariffs and rising costs remained prevalent among manufacturers.

- Overall loan growth among financial institutions in the Sixth District was flat since the previous report. Loan demand from businesses and consumers was tepid amid persistent economic uncertainty.

- The energy sector remained robust, and crude oil production in the Gulf of Mexico remained strong, despite reports of continued softening demand for various refined products. Liquefied natural gas demand rose globally, and US exports remained robust.

- Broadly speaking, demand for agricultural products was healthy, though volatile trade policy weighed on exports. Overseas sales of US rice fell because buyers sought lower-priced sources, and exports of soybeans, wheat, and corn remained depressed as China turned to Brazil for those commodities.

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve districts. The Fed System and regional reserve banks publish the Beige Book eight times a year, before each meeting of the Federal Open Market Committee. The reports from each District characterize regional economic conditions based on a variety of mostly qualitative information, gathered directly from District sources, including interviews and online questionnaires completed by businesses, community organizations, economists, market experts, and other sources. The Committee next meets October 28 and 29.