Economic activity across the Sixth Federal Reserve District expanded slightly in the last month and a half of 2025, but no sectors reported more than a modest uptick in the new Beige Book report from the Federal Reserve Bank of Atlanta.

The Federal Reserve is charged by Congress with pursuing a dual mandate: sustainable maximum employment and price stability.

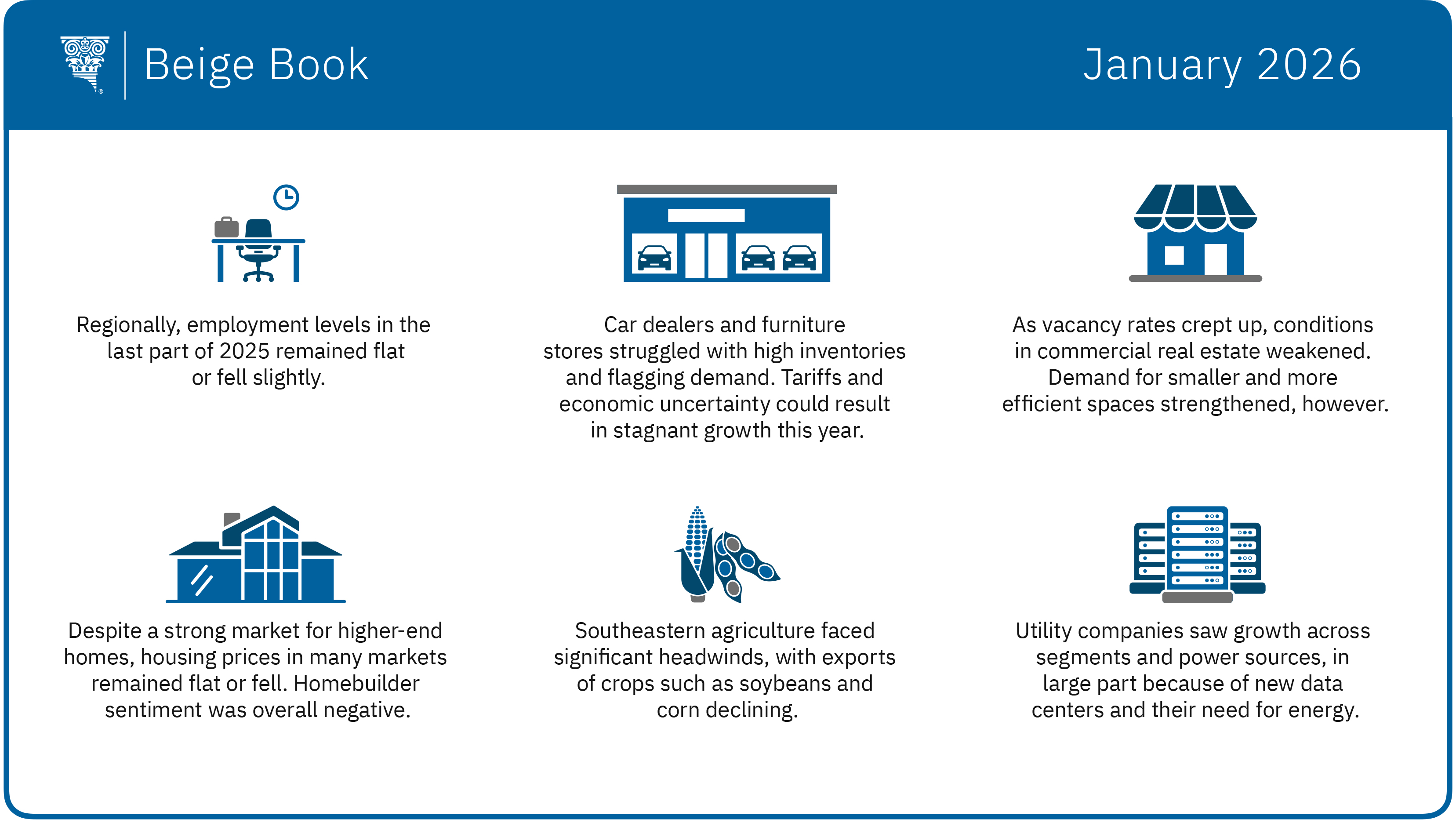

Employment levels across the six-state district were flat to lower in the period from mid-November through December. More employers than in the previous weeks said they had trimmed staff. Several Atlanta Fed business contacts also described more intense use of artificial intelligence (AI) to boost productivity and manage head count, though some contacts said it would be years before AI significantly affects employment levels.

Meanwhile, cost pressures associated with tariffs persisted as prices overall rose slightly. Labor, technology, and insurance remained the most frequently cited cost concerns. Many contacts said they expect to increase prices in the first half of 2026 to preserve profit margins, especially contacts that held prices steady in 2025.

In other economic sectors:

- Black Friday was a bright spot for some retailers, although others described sales as ordinary. Auto dealerships and furniture stores continued to face challenges amid high inventories and subdued demand. Contacts expect tariffs and economic uncertainty to keep sales growth stagnant in 2026.

- Housing prices in many markets plateaued or declined, as demand for higher-end homes was strongest. Sentiment among homebuilders was broadly negative, as more of them cut prices and offered other incentives.

- Commercial real estate conditions weakened a bit, as vacancy rates inched up across sectors. Office and retail contacts reported more demand for smaller, more efficient spaces. Demand and supply grew in the industrial real estate market.

- Transportation activity was stable to down overall, as logistics contacts said home appliance shipments were way off as housing starts slowed.

- Manufacturing was flat to slightly up, and forecasts for 2026 were mixed but generally upbeat.

- In the banking sector, overall loan growth was modest, with the largest increases in credit cards. Volumes of auto and other consumer loans declined, which was described as a reflection of uncertainty on the part of consumers.

- Energy demand was generally flat since the previous Beige Book. While petrochemical industry contacts reported slackening demand, utility companies cheered robust business across segments and power sources, including liquefied natural gas, wind, solar, and nuclear, largely because of data center development.

- Agricultural conditions were difficult. Soybean and corn exports weakened, higher overseas milk production reduced domestic demand, and demand flagged for timber used in building products, pulp, and paper.

The Beige Book is a Federal Reserve System publication about current economic conditions across the 12 Federal Reserve districts. The Fed System and regional reserve banks publish the Beige Book eight times a year, before each meeting

of the Federal Open Market Committee. The reports from each District characterize regional economic conditions based on a variety of mostly qualitative information, gathered directly from District sources, including interviews and online questionnaires completed by businesses, community organizations, economists, market experts, and other sources. The Committee next meets January 27 and 28.