Raphael Bostic

President and Chief Executive Officer

Federal Reserve Bank of Atlanta

The Economic Club of New York

March 25, 2021

Key points

- Atlanta Fed president Raphael Bostic speaks on the need to take a broader view of inflation and employment.

- Bostic also emphasizes that we must cement the notion that an inclusive economy is not a zero-sum proposition. Greater opportunity for historically disadvantaged Americans produces not less opportunity and prosperity for everyone else, but more.

- Bostic warns that an exclusive focus on a single measure of inflation could lead one to miss important context and draw inaccurate inferences.

- He notes that while aggregate readings of the labor market have in some respects been better than many expected, these readings don't tell the whole story because almost nobody lives the story implied by the aggregate.

- Bostic says he does not think the Fed will need to remove monetary policy accommodation soon. He adds that he is data dependent, so his view can change if conditions warrant. But he does not think that will happen in the next few months.

Thank you for inviting me. It's a pleasure to be here, and a bit daunting, too. I took a look at your program roster, and you've hosted many luminaries. I'm flattered to be among them. I hope I don't disappoint you.

Today I'll explore a couple of ideas I trust you'll find timely. First, I'll explain why I believe we should broaden our gauges of inflation and full employment, the components of the Federal Reserve's dual mandate.

Then I will discuss racial equity in the economy. Specifically, I want to say a bit about the essential task of convincing the public and policymakers that inclusive economic growth is not a zero-sum proposition. Greater opportunity for historically disadvantaged Americans produces not less opportunity and prosperity for everyone else, but more.

Before I get to the substance of my remarks, though, let me remind you that these thoughts are mine alone. They do not necessarily reflect the views of my colleagues on the Federal Open Market Committee or at the Atlanta Fed.

Taking a broader view of inflation

So let's start with inflation.

I know you're all familiar with the prepandemic narrative: inflation was stuck below our 2 percent objective as measured by the committee's preferred metric, the personal consumption expenditures, or PCE, price index.

That narrative is correct as far as it goes. But in my view, it reflects an overly narrow view of inflation by relying largely on a single reading as fully representing the de facto underlying inflation trend.

Divining the real inflation signal is difficult enough in any circumstance, and more so since the pandemic upended consumer behavior and sent relative prices careening every which way. So, we should take note of a range of measures to gain the broadest possible understanding of underlying inflation.

Traditionally, the core PCE price index has been used to cut through some of the noise in the headline index to clarify the underlying inflation trend. But I think one of the central flaws of the core concept is that dramatic price swings outside of food and energy—the items excluded from the core measure—often lead to large and sometimes lasting changes in core PCE inflation that are unconnected to our price stability mandate.

In recent years, we've seen several relative price declines that did not provide meaningful signals regarding inflation that could be used to guide thinking about the stance of policy. Instead, these declines flowed from technicalities like changes in the methodology used to calculate inflation.

Recall the cell phone carriers offering unlimited data packages in 2017. That torpedoed year-over-year core PCE inflation, though it revealed little about where monetary policy should be.

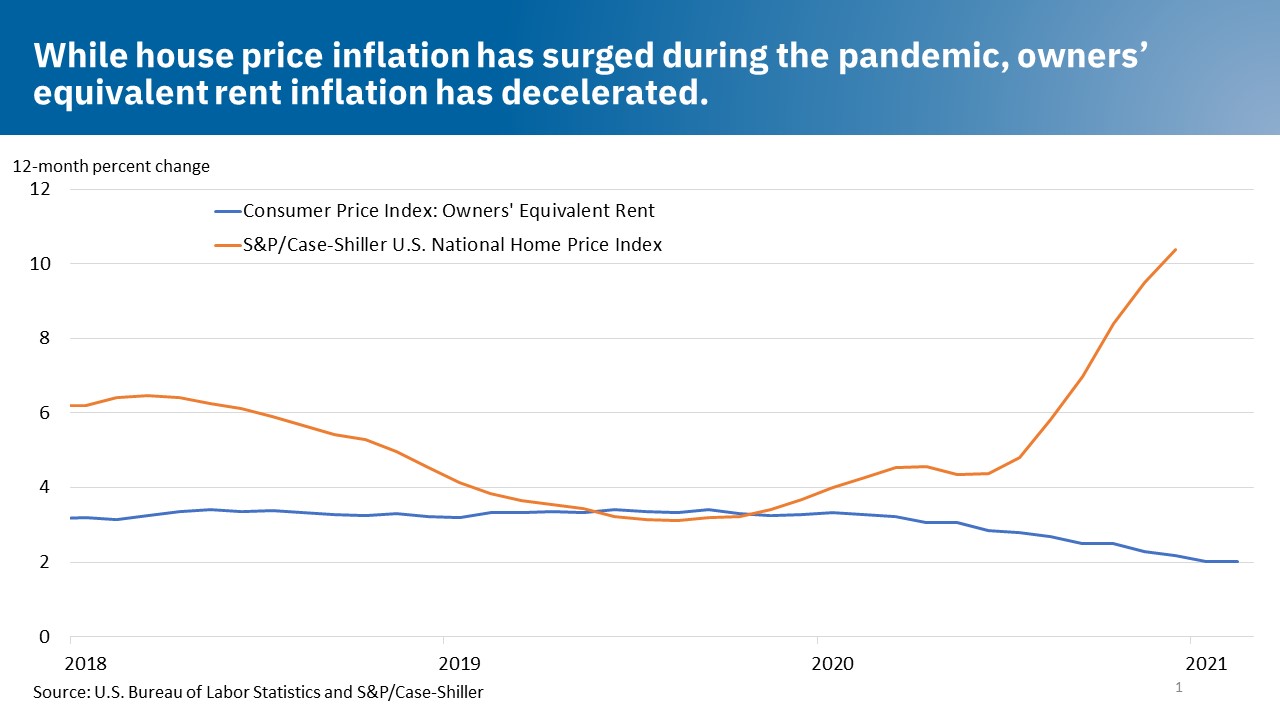

I'm a housing guy, so let me dive into that topic for a moment as a way to further illustrate why measuring broad inflation is so complicated and, particularly to laypeople, serves up often unsatisfying conclusions.

Consider the Consumer Price Index (CPI), one of the familiar measures I follow to help identify inflation trends. One of the most important components of the Bureau of Labor Statistics' (BLS) inflation basket is owners' equivalent rent (OER) of primary residence. OER accounts for nearly a quarter of the overall CPI index. And as you can see in this slide, housing prices have soared, while OER has stayed pretty flat or even declined.

The rub here is that the BLS treats home purchases as investments not consumption. To measure prices of goods and services intended for consumption, OER attempts to abstract from the asset value of a house and focus on the value of living in a house by approximating what homeowners would pay were they renting. That value, or service flow, of living in a house changes only gradually from year to year.

Further contributing to the disconnect between house price inflation and OER inflation during the pandemic are the extraordinary housing policy actions that have been taken. While they protect households that have disproportionately lost jobs and income, eviction moratoriums and rent freezes are weighing on prevailing rental prices. This in turns puts downward pressure on OER because it is imputed from observed rental rates.

In both of these cases, an exclusive focus on a single measure of inflation could lead one to miss important context and potentially draw inaccurate inferences. Though less dramatic because the housing share in the consumer expenditure bundle is lower, these problems carry over to the PCE price index measure of inflation as well.

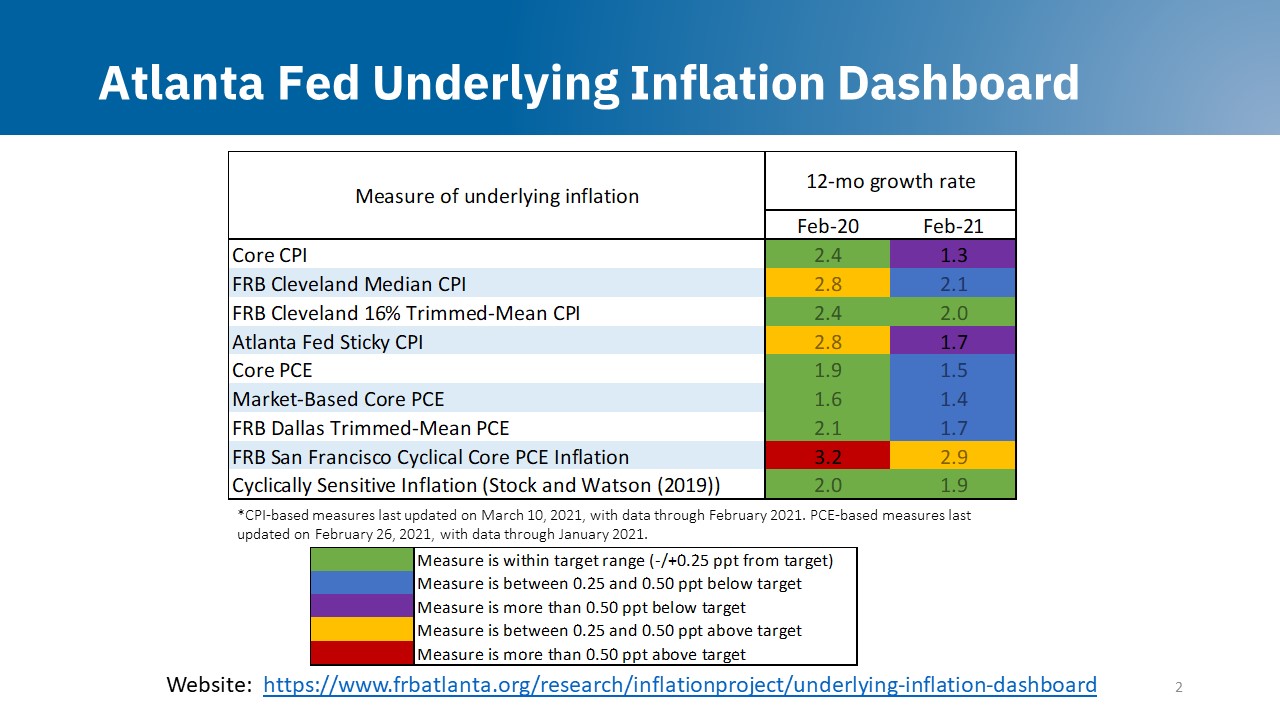

To try and drill through the muck to the true inflation signal, then, we at the Atlanta Fed have increasingly turned to an underlying inflation dashboard that incorporates multiple measurements. (Permit me a shout-out to economists across the Fed system who built these alternative gauges.)

By helping my staff and me better identify the underlying inflation signal, the dashboard in turn helps us determine whether monetary policy is properly calibrated to economic fundamentals.

If you'll notice in the slide, the green shading indicates readings within range of the committee's 2 percent target—that is, 0.25 percentage points above or below. As you see, entering the pandemic, six of the nine measures had inflation within the target range. So maybe we were not undershooting quite as badly as conventional wisdom suggested.

Of course, in recent weeks, the specter of troublesome inflation has garnered profuse commentary. Certainly, there are forces in play that merit watching. Some commodity prices and 10-year Treasury yields have climbed, and our surveys tell us firms' short- and longer-run inflation expectations have likewise ticked up in recent weeks. Moreover, many hold a view that a large infusion of fiscal relief could overheat an already recovering economy.

I'd like to make a couple of points on why I'm not sure we are staring down a fearsome inflation outbreak. First, it's unlikely that we'll get a clear reading on underlying inflation for a few months yet. As I noted, the pandemic-induced swings in spending, generally toward goods and away from services, have played havoc with prices. For instance, as travel nearly ceased last year, so few people leased cars that the Bureau of Labor Statistics lacked sufficient data to even publish a price index for that service for several months as part of the Consumer Price Index.

Meanwhile, prices soared for goods like used cars, appliances, and home furnishings. In short, price volatility exploded in the underlying market basket from which inflation is calculated.

Coming off very low measures a year ago, this is likely to produce a big, but not especially meaningful, spike in inflation readings over the next few months.

On balance, I don't think it is clear that a surge in underlying inflation is imminent. The latest official readings substantiate that. For February, only one of the nine readings in our dashboard came in above the Fed's target range. I watch for the trajectory of inflation, and I'm not sure the path bothers me.

I would also note that given the shortfall in inflation during the pandemic, appropriate monetary policy will aim to achieve inflation moderately above 2 percent for some time, per the policy framework the Committee adopted last year. Furthermore, we also must reach maximum employment, and that goal is at least many months away.

So, let me say unambiguously that I am not at the moment thinking we will need to remove policy accommodation soon.

Of course, the Committee and I are data dependent, so my view can change if conditions warrant. But I don't think that'll happen in the next few months.

Taking a similarly holistic view of the labor market

Just as I believe the committee is best served by a holistic view of inflation measures, I believe the same holds true for employment.

After several months of weak job growth on the heels of a spike in virus cases last fall, aggregate readings of the labor market have in some respects been better than many expected. The unemployment rate is down from nearly 15 percent to 6.2 percent. February's employment report was solid, with nearly 400,000 new jobs even as much of the country remained under social distancing measures.

But these positive aggregates do not tell the whole story. I like to say that almost nobody lives the story implied by the aggregate, and this is certainly the case today.

When one looks at a broader set of employment measures, what emerges is the contour of an uneven economic recovery. I would argue that the unevenness of the COVID-19 impact is THE signature characteristic of our pandemic-driven economic crisis. The disparities manifest along multiple dimensions but let me home in on four: industry sector, wage levels, gender, and race and ethnicity foremost.

It is widely recognized that people who work in restaurants, museums, theaters, hotels, and other places that depend on large gatherings have suffered the brunt of job losses. There are at least three reasons for this. First, for the most part, people working in these sectors can't work at home. Second, many of their workplaces closed or all but closed because of restrictions. And third, many people have been understandably uncomfortable going out even when establishments have reopened.

Indeed, employment in leisure and hospitality is still 3.5 million jobs below where it was in February 2020. Given that this represents 35 percent of the nation's current job shortfall relative to our pre-COVID employment level, recovery for this industry will be central for the overall economic recovery.

The second dimension of uneven impact is wage level. The impacts of the COVID-driven economic contraction have hit low-wage workers much harder than high-wage workers. Among the top quarter of wage earners, employment declined about 4 percent since February 2020. For the bottom quarter of earners, the decline is more than quadruple that, at 17 percent. This is due in part to a correlation between sector and wage level, but only in part. We see this more broadly, in sectors beyond leisure and hospitality.

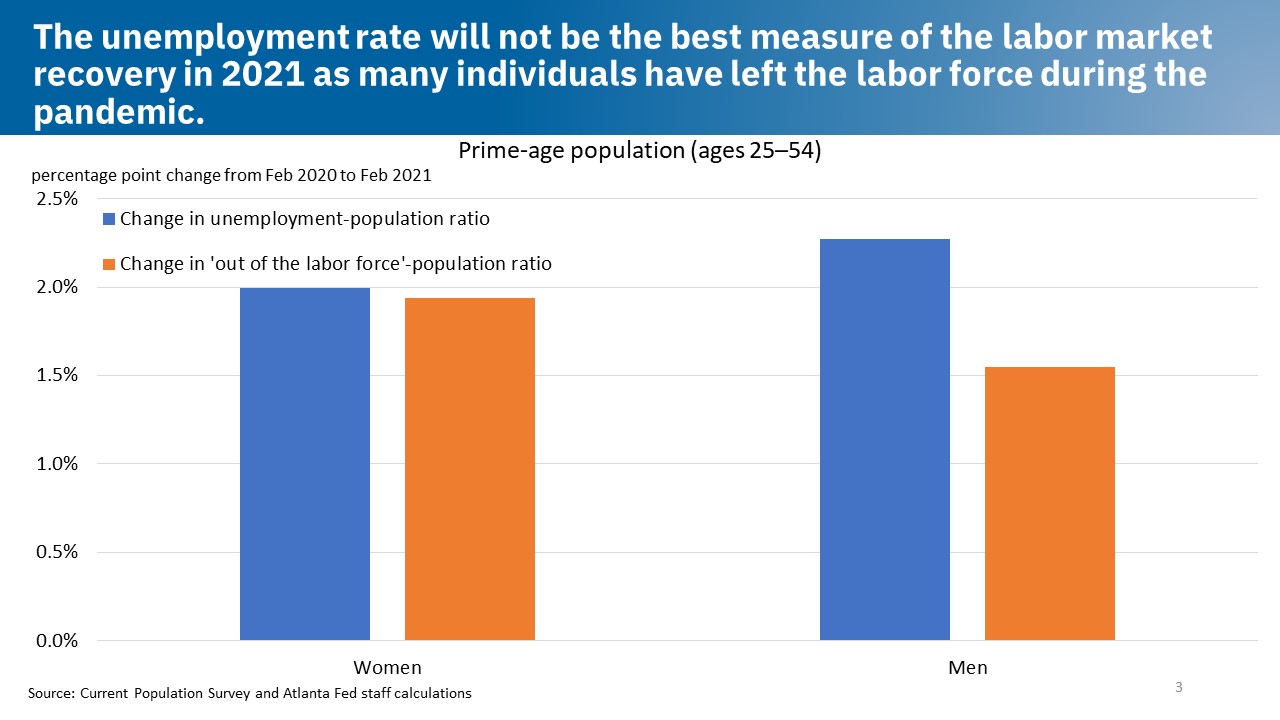

Thirdly, women have absorbed a sharper labor market hit. One reason for this is that women disproportionately work in low-wage jobs. But it is also true that women have quit the labor force at much higher rates than men. Looking strictly at unemployment, it appears men have fared worse in the pandemic recession. However, notice the taller orange bar on the left. That describes the disproportionate rate at which women have left the labor force.

Sociology has undoubtedly played a role here. The crisis led to school and day care center closures and also made home healthcare services less viable given the risks of infection, meaning that a family member would need to devote time to tend to children and elders. In many families, women have made the choice to do this, in an echo of their historical caretaking role.

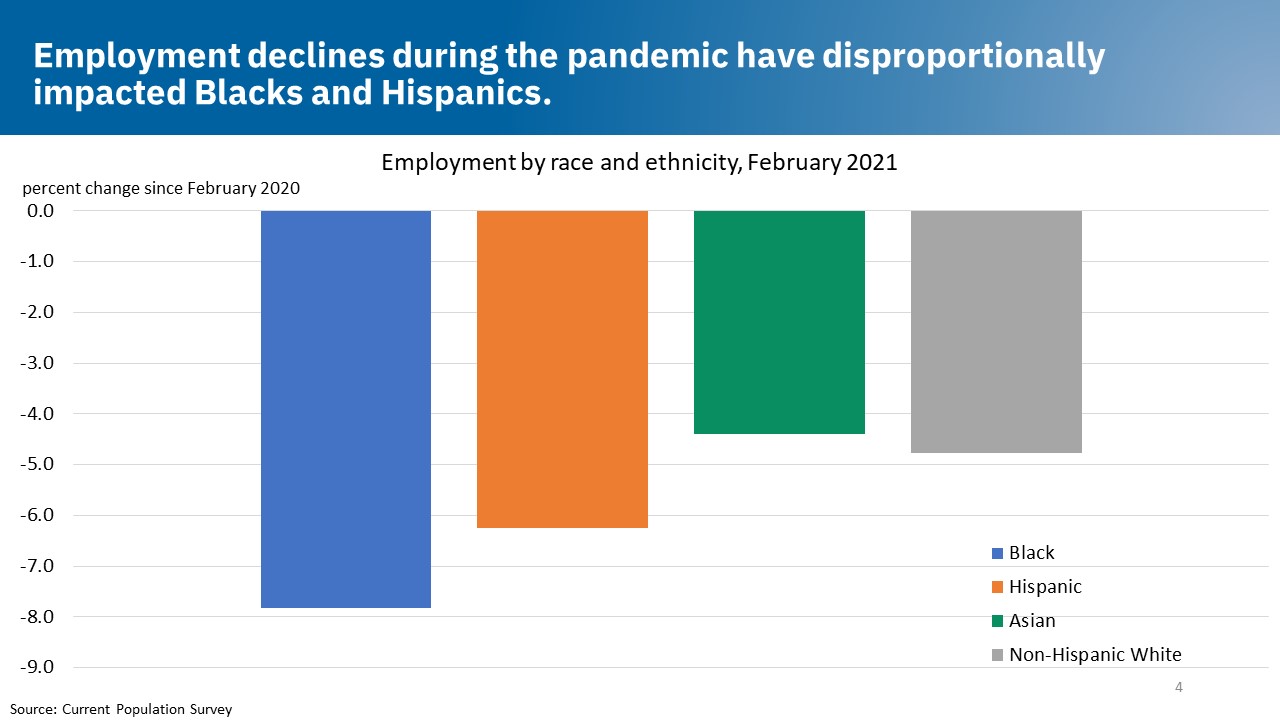

The fourth and final dimension of labor market unevenness that I'd like to comment on is race and ethnicity. Employment among non-Hispanic whites is down about 4.5 percent since the onset of the pandemic, substantially less than among African Americans and Hispanics. Some of that disparity is because Blacks and Hispanics are overrepresented in the occupations where the most jobs disappeared.

One of our economists, Julie Hotchkiss, has published research that suggests the COVID recession will significantly dent the labor market progress Black Americans finally began enjoying late in the recovery from the Great Recession. So, the pandemic recession has been especially painful for the African American workforce, and that's something policymakers must keep front-of-mind.

Economic inclusion is not a zero-sum proposition

This provides a nice segue for me to talk about racial equity. Racial equity in our economy is not some nicety. Rebuilding an economy that works for everyone is critical for, yes, everyone. The status quo is simply leaving too many people behind and too much of our nation's economic potential untapped.

One way to think of it might be the difference between "full employment" and "maximum employment." We can have full employment, as defined by a low unemployment rate, and still leave millions unattached or tenuously attached to the labor force, if we assume institutions and systems are unchangeable. On the other hand, maximum employment contemplates drawing those unattached or tenuously attached back into the labor force.

Ultimately, for all our sake, the nation must reach a place where opportunity is not so tightly linked to race, a place where kids are not consigned to a life of struggle mainly because of the color of their skin.

Clearly this quest is daunting. To get there, we must cement the notion that an inclusive economy is not a zero-sum proposition. If traditionally disadvantaged people get a better shot at a decent job or a small-business loan, that does not rob someone else of opportunity. An expanding body of research is building a powerful, pragmatic argument for economic inclusion.

Eliminating racial inequities in income could boost the U.S. economy by $2.3 trillion a year, according to a study funded by JPMorgan Chase & Co. Our colleagues at the San Francisco Fed produced a paper for the Fed System's Racism and the Economy webinar series. They found that racial and gender disparities in economic opportunity have ripped enormous chunks out of potential GDP: $2.9 trillion in 2019 alone, and roughly $71 trillion over the past 30 years. (Both those figures are in 2019 dollars.) Numerous other studies have reached similar conclusions.

Research from Raj Chetty and coauthors also suggests the country is missing out on potential innovations. We could produce many more inventors if women, people of color, and children from low-income families were exposed to innovation at a young age.

To take a different angle, we can ponder an example in our own country of public policy organized around restricting opportunity to a large group of citizens. Historians including C. Vann Woodward have concluded that the Jim Crow system of segregation was underpinned largely by cynical machinations using the zero-sum proposition to pit working-class whites against Blacks.

No clear-eyed observer could call the Jim Crow-era South a paradise for working-class and low-income white Americans. Poverty and disease were rampant. So, if barring African Americans from economic opportunity was supposed to preserve more opportunity for the masses of white workers, it was woefully unsuccessful.

Thankfully, there are few contemporary structures designed to disadvantage certain groups. Yet institutions and systems have been in place for decades. They are not inherently benign; they need attention and refinement to prevent harmful, if unintended, consequences.

The time to act is now. Our current moment in history shines a bright light on these issues. The disproportionate impact of COVID-19 on the labor market outcomes of people of color and women, as well as the increasing racial diversity of the U.S. population, will only increase these costs.

Therefore, eliminating disparities in access to labor market opportunities and how labor markets treat workers is essential if we are to generate stronger economic growth and maintain global competitiveness.

There are reasons for optimism. Pandemic stresses clarified inequality in our society in ways that opened conversations about historical barriers to opportunity, certainly within the Federal Reserve System. Our Racism and the Economy webinar series is exploring the roots of disparities in housing, the labor market, education, and more. I encourage you to check out those sessions.

At the Atlanta Fed, we've made boosting economic mobility and resilience an animating theme in our work. Through our Advancing Careers for Low-Income Families initiative, we conduct research on benefits cliffs and develop tools to support community and state efforts to improve economic security for families while also meeting the talent needs of businesses. We've also joined with the Markle Foundation to form the Rework America Alliance to help workers emerge from the COVID-19 pandemic crisis stronger and better positioned to move into well-paying jobs regardless of formal education.

In closing, let me say that pursuing economic inclusion in no way conflicts with the Federal Reserve's dual mandate. On the contrary, it enhances and enriches our conception of full employment, as we employ a similarly nuanced approach to better understand inflation. I hope I have helped to make that case today.