Raphael Bostic

President and Chief Executive Officer

Federal Reserve Bank of Atlanta

Northwestern University Institute for Policy Research

Distinguished Public Policy Lecture

October 5, 2022, 4 p.m. (ET)

Key Points

- Atlanta Fed president Raphael Bostic shares his thoughts about the mechanics for crafting monetary policy and balancing risks to promote the return of inflation to the Fed's longer-run objective of 2 percent.

- Though recent reports have brought glimmers of hope, the overarching message Bostic is drawing from them is that we are still decidedly in the inflationary woods.

- Bostic explains that changes in the stance of monetary policy typically affect economic growth first. Inflation will be among the last economic indicators to materially shift.

- In his view, the Committee should not overreact if inflation does not quickly fall back into the 2 percent range, even if economic activity slows. Because of the lag dynamics of monetary policy, he believes this would guarantee an overshoot and a deep recession.

- Bostic takes lessons from history and the Great Inflation to heart. He believes the Fed reacted too quickly then to changes in the real economy, such as rising unemployment, and helped fuel the inflation of the late 1960s and 1970s.

- Bostic stresses that he is firmly committed to the fight against inflation and will remain purposeful and resolute until the job is done.

Thank you for inviting me to deliver the Institute for Policy Research's Distinguished Public Policy Lecture. I wish we could be together in person, but I am honored to speak with you this afternoon from our studio here in Atlanta.

IPR makes important contributions across a range of subjects, and I congratulate you for your engagement in such a broad set of issues. It is truly impressive. I hope my remarks today enrich all your continued learning and deepen your understanding of the current, quite complicated, macroeconomy and how I believe we should approach monetary policy in this environment.

Before I dive into the topic of the day, let me clarify that my remarks reflect my views only. I do not speak for my colleagues at the Atlanta Fed nor the Federal Open Market Committee, or FOMC.

As you might have guessed, I'm going to discuss inflation. More specifically, I will describe how I am thinking about the mechanics of crafting monetary policy and balancing risks to promote the return of inflation to the Fed's longer-run objective of 2 percent, as measured by the Personal Consumption Expenditures (PCE) price index. I will explain why it is important that we as monetary policymakers remain purposeful and resolute, and do not waver in this mission. And I will show why history is my guide and foundation for my commitment to steadfastness, and not heedlessness, in calibrating monetary policy in these unsettled economic conditions.

Putting today's inflation in context

First, though, let me set forth the background for why inflation has been elevated. It is worth a reminder that the profound effects of the pandemic and attendant policy responses continue to shape macroeconomic conditions. Consider that in just two-and-a-half years, the US economy suffered its sharpest drop in overall output since World War II, followed by a rapid resurgence in demand, a dramatic imbalance between labor supply and demand, widespread supply and shipping constraints, and an inflation rate that surged from about 1.5 percent to nearly 7 percent over just 17 months.

The pace of regaining jobs from the brief but severe downturn early in the pandemic has been faster than the recoveries from the three previous recessions. More importantly, the labor market since the 2020 recession has been characterized by an excess of labor demand over labor supply. That is in stark contrast to the earlier, so-called "jobless recoveries," when there were far more job seekers than jobs.

That imbalance in the labor market mirrors an imbalance between aggregate demand for and supply of goods and services throughout the economy. Our persistently elevated rate of inflation is a direct result of that imbalance. While the main drivers have been COVID-related, geopolitical, and global economic developments have also played a role in price spikes. Russia's invasion of Ukraine, for example, caused an energy price shock that led to gas prices spiking in the spring and into the summer, though prices have receded over the past few months. As another example, a severe drought in China has adversely impacted demand and aggregate output for a major trading partner.

Price pressures are still widespread, though, reflecting the economic truism that high demand and low supply result in rising prices—exactly what we have seen. Demand for goods and services has been high in part because (1) many American families have larger balances in their savings account than they historically would have, a result of slowed overall consumption, particularly of services, during the pandemic, and (2) the quick and large government response left many families, especially those with lower and moderate incomes, in a stronger financial position than they would have otherwise been in.

Early in the pandemic, homebound Americans pulled back from spending on services such as restaurant meals and entertainment. Instead, consumers as a group shifted their spending to goods such as furniture, electronics, and exercise gear. Intensified demand for those goods coincided with pandemic-driven supply constraints such as factory shutdowns and shortages of shipping containers and workers. Ergo, demand quickly outstripped supply, sending prices upward.

An easing of supply constraints could help bring supply and demand into better balance and thus chip away at elevated inflation. Unfortunately, supply chains are still not functioning nearly as well as they did before the pandemic. Our surveys of business leaders reflect this. The latest release of the CFO Survey that we conduct with the Richmond Fed and Duke University shows that the fraction of firms experiencing abnormally high pressure on most of their input costs rose to 53 percent in the third quarter of 2022, doubling from 26 percent in the second quarter of last year.

Anecdotes from my contacts and other evidence indicate these price pressures result primarily from materials and goods scarcity—supply chain issues. But the same sources are increasingly citing labor supply constraints as a significant impediment, especially in the services sector.

Price pressures in the services sector bear close watching because consumers' expenditures have shifted to a more normal, service-dominated mix. Through the April–June period of 2022, data from the Bureau of Economic Analysis show that while services spending has climbed in eight straight quarters from the preceding quarter, goods spending has declined in three of the past four quarters from very elevated levels.

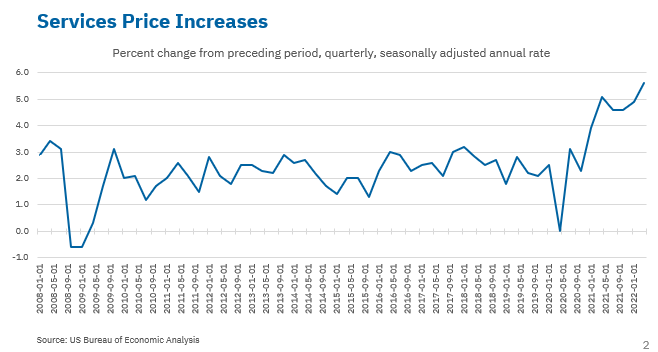

As a result, even as increases in the prices of goods slow, services prices are rising swiftly. The Personal Consumption Expenditures price index shows that services price increases have exceeded 4 percent on a year-over-year basis in five straight quarters, after lingering below 3 percent for over a decade before the pandemic (see the image below). I watch this very closely because services price increases tend to be more persistent than increases in the prices of goods. Our staff and others have noted this pattern, and it is why the Atlanta Fed's Sticky-Price CPI tool includes many service-based categories. Moreover, services account for roughly two-thirds of the consumption basket, so it carries a big weight when we consider the underlying determinants of overall inflation.

Importantly, services prices may continue to rise at a fast clip. I continue to hear of very strong demand for in-person services like restaurant meals. Leaders of medical service providers are paying much higher wages for health care workers. Prices for housing services like rent are still climbing. On this last point, you've very likely heard that home price increases have moderated recently. Despite this, they are still climbing in most markets at relatively high rates.

So, we must remain vigilant because this inflation battle is likely still in early days if the projections of my FOMC colleagues are correct. At every other meeting, each FOMC member submits their projections for the federal funds rate—which is the Fed's main policy instrument—and various economic indicators for the end of the current year, next year, and beyond. The compilation of these projections is known as the Summary of Economic Projections, or SEP. At the September meeting, the median committee projection of PCE inflation for all of 2022 was 5.4 percent, and 2.8 percent in 2023, and finally 2.3 in 2024. To be clear, the Committee projections are not forecasts, per se, but rather projections of where we think inflation is likely to be under each member's assumption of appropriate monetary policy.

What are we seeing ahead?

These are particularly uncertain times, and the view beyond the next few quarters is unusually murky. So I would encourage you to avoid anchoring to any specific number; precision isn't the point here. Rather, focus on the trajectory of these projections. Looking at those, the point is that it will likely take some time to bring inflation all the way back to 2 percent, which is the FOMC's target level for inflation in the economy.

Though recent reports have brought glimmers of hope, the overarching message I'm drawing from them is that we are still decidedly in the inflationary woods, not out of them. The past couple of monthly inflation prints produced a mixed bag, with some evidence that the pace of month-to-month price increases has slowed. But the August inflation reports were a sobering reminder that price pressures remain broad and stubborn.

Over the next several months, as monetary policy takes hold, we will see aggregate demand slacken as we seek to bring demand in alignment with supply. The strength of labor markets will wane, and economic activity will weaken, which is fundamentally necessary to reduce inflation.

We should not let the emergence of this weakness deter our push to lower inflation, though. We must reduce the existing demand-supply imbalance and thereby bring down inflation. We need to remain focused on the core mission of putting underlying inflation on a sustained path toward 2 percent.

The longer inflation remains top of mind for consumers and price setters, the likelier they are to make spending and investment decisions based on an assumption that prices will keep rising. That makes it more likely that inflation will take deep root in the economy, and in that case, it would become more difficult and painful to uproot it. We are determined to avoid that.

We must. Without price stability, the other half of our dual mandate—achieving sustained maximum employment—would become exceedingly difficult and American families would continue to suffer. Elevated inflation is already inflicting hardship and is affecting families and businesses in numerous ways. In these circumstances, monetary policy assumes enormous importance because it is our bulwark against inflation.

Differing inflation experiences

When we discuss inflation, we generally cite numbers that reflect aggregates across tens of millions of consumers and hundreds of prices, from infants' apparel to funeral expenses. Yet no single individual or household represents the aggregate. We each experience our own reality, so in a real sense those realities combine to form different economies.

We have much to learn about the varying intensity of inflation among different groups. But those least able to weather price increases suffer the most for various reasons.

For starters, numerous studies have shown that the market baskets of lower-income consumers—the items they routinely purchase—have experienced higher-than-average inflation over time. Economists at the Bureau of Labor Statistics, which publishes the Consumer Price Index (CPI), examined price data spanning 2003 through 2018. The economists found that a price index reflecting the consumption basket for households in the lowest-income quartile rose faster than the broad CPI did, while a price index for households in the highest-income quartile rose more slowly than did the overall CPI.

One reason inflation batters lower-wage earners is that they spend comparatively bigger portions of their income on necessities, whose prices have risen greatly. The Census Bureau's Consumer Expenditure Surveys show, according to my staff's calculations, that households earning $50,000 or less spend more than 70 percent of their after-tax income on food, housing, transportation, and health care. By contrast, households with annual incomes of $150,000 or more on average spend less than 45 percent of their take-home pay on those essentials. Even as some prices have climbed more slowly of late, those for necessities have kept rising briskly. Prices for food at home spiked 13.5 percent in August over August 2021, well above the overall inflation rate of 8.3 percent as measured by the CPI.

Rents have also continued rising swiftly. In the August CPI report, rent of primary residence rose at an annualized rate of 9.2 percent, near its all-time high. In other words, there is still upward momentum in rents. That is especially bad news for low- to moderate-income households because they are far more likely to rent than are higher-income households. Census Bureau data and calculations by our Bank's analysts show that as of August, 55 percent of households earning under $35,000 a year rent, compared to only 11 percent of households making more than $150,000 a year.

Renters are inherently more vulnerable to rising costs, as homeowners with fixed-rate mortgages generally do not face increases in their monthly payments even in severe inflationary episodes. Renters, on the other hand, typically face higher monthly payments at least annually.

Along with wealth and income levels, inflation manifests differently along other dimensions, too, including geography. We see pronounced disparities in inflation across metropolitan areas. In June and July, New York, San Francisco, and Honolulu all experienced inflation rates under 7 percent, while Anchorage, Phoenix, Atlanta, and Tampa were above 11 percent. Three metro areas in the Atlanta Fed's six-state district—Atlanta, Miami, and Tampa—were among six with the highest local inflation readings, according to the CPI. (The BLS reports inflation for Chicago, Los Angeles, and New York monthly and every other month for 20 other metros.)

Housing costs explain much of the geographic disparity. Net migration into areas such as Phoenix, Tampa, Atlanta, and Miami is forcing up housing demand and thus housing prices faster than in other markets. Those four metros posted the highest price rises for shelter in June and July.

All that said, some evidence suggests that the Committee's policy tightening may have already sapped momentum from soaring housing prices. This could help bring supply and demand more in alignment in an important sector of the economy.

In a broader sense, suffice it to say that bringing underlying inflation closer to our 2 percent objective will benefit Americans everywhere, of all incomes. The way I think about this is that achieving the Fed's long-run maximum employment mandate is necessary for an economy that works for everyone, a pursuit that is among my Bank's strategic priorities. Price stability—represented by low inflation—is necessary for us to achieve sustained maximum employment.

Where we stand in the monetary policy cycle

In that quest for price stability, the Committee launched a tightening cycle roughly seven months ago. We have increased the target range for the federal funds rate from 0 to 1/4 percent up to 3 to 3 1/4 percent, and we are reducing the size of the Federal Reserve's balance sheet.

These significant policy moves come against the backdrop of an unsettled economic environment. We've lived through a lot, and economic signals are still scrambled.

One set of indicators suggests the economy is slowing. Reports on inflation show that increases may have slowed somewhat. Economic activity as measured by gross domestic product (GDP) was soft in the first half of the year. As I've noted, the housing market has shown signs of cooling, as demand has ebbed. House prices have continued to rise, but the rate of increase has diminished.

Anecdotally, our Bank's contacts in the retail industry tell us that low- and moderate-income consumers in particular are buying less expensive products and forgoing discretionary purchases in the face of higher prices. Meanwhile, trucking firms, an important bellwether, are reporting slackening demand.

Then there is a flip side. Even as the GDP signals that the economy is slowing, an alternative measure of broad economic performance—gross domestic income—climbed through the first half of 2022. And the labor market is chugging along and remains tight. Employment growth this year averaged a robust 438,000 jobs a month through August. Total nonfarm employment returned to its prepandemic peak in July. The broad U-6 measure of unemployment—which includes people marginally attached to the labor force and those working part-time for economic reasons in addition to the unemployed—was at all-time lows in the summer. And the nation's job openings rate, a gauge of vacant positions compared to total employment, has dipped a smidge from its March peak but remains near record highs.

At the grassroots, even our business contacts who voice concern about the direction of the economy are, nearly to a person, quick to add that their own business is healthy. Business leaders tell me they are not worried so much about whether they can sell products in the short term. Their bigger concerns involve supply-side issues like labor availability and the sustainability of demand months out. Based on our surveys, data, and conversations with business leaders, I think those concerns are grounded more in uncertainty than in actual signs that the economy is taking a step back.

So, altogether, I think the economy still has reasonable momentum. Business leaders and consumers are experiencing a degree of gloom, to be sure. But I do not see that gloom inevitably leading to doom. Two significant reasons for my belief are that many households and businesses still are in a better financial position than they were before the pandemic, and the labor market remains robust.

Where I see appropriate monetary policy headed

That's where we are. Where might the economy be headed, and what are the implications for the path of monetary policy?

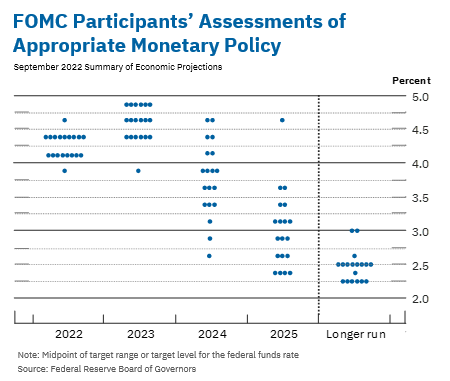

The Summary of Economic Projections I discussed earlier is known as the "dot plot" because the projections of the federal funds rate are depicted as, yes, dots on a plot, as you see in the image below. Trying to decipher which dot belongs to which committee member is something of a parlor game among Fed watchers.

I will basically tell you where my dots are. My baseline outlook is for GDP to grow about 1 1/4 percent in the second half of 2022, and about 1 percent in 2023. I think we will end 2022 with an unemployment rate in the neighborhood of 3.7 percent, which is about where we are now and still low by historical standards.

As I noted earlier, the global economy is fraught with uncertainty on numerous fronts, so I suggest you view my projections as rough estimates rather than precise predictions. To that end, my Bank's models describe a band of possible scenarios, where unemployment remains mostly flat even as tighter policy takes hold, but also outcomes where it climbs a bit above 4 percent.

By some estimates, an unemployment rate of slightly above 4 percent represents about the level of full employment, so we may well be overshooting the maximum employment side of our dual mandate now, particularly given the current wide gap between labor demand and labor supply. If that's true, we may have a bit of maneuvering room so that we can continue to tighten policy—if we deem that appropriate—without inflicting undue damage on labor markets.

One of the main points I want to leave you with is that we must look to signals in addition to inflation readings to guide our policy. That's because inflation will be among the last economic indicators to materially shift. Simply waiting for inflation to decline all the way to 2 percent before backing off on tightening may not be the best approach.

Be assured that I am not advocating a quick turn toward accommodation. On the contrary. You no doubt are aware of considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall.

I would say: not so fast.

I am going to remain purposeful and resolute in my approach to monetary policy. Over the past two-and-a-half years, the unexpected has happened repeatedly. Nothing should be carved in stone. And while I do not speak for my colleagues on the FOMC, I think we agree that we do not want to stir even more questions into an economy already roiled by uncertainty. We want the public and markets to clearly understand our reaction function—how policy will respond to economic events—our aims, and the fact that we are going to be unwavering in the pursuit to bring underlying inflation back toward our 2 percent objective.

In that spirit, then, let me detail what I mean by purposeful and resolute. My staff has analyzed past tightening cycles. This work is instructive, especially in highlighting what not to do. Two of our economists, Federico Mandelman and Brent Meyer, examined monetary policy before and during "the Great Inflation," which lasted from the late 1960s through the early 1980s.

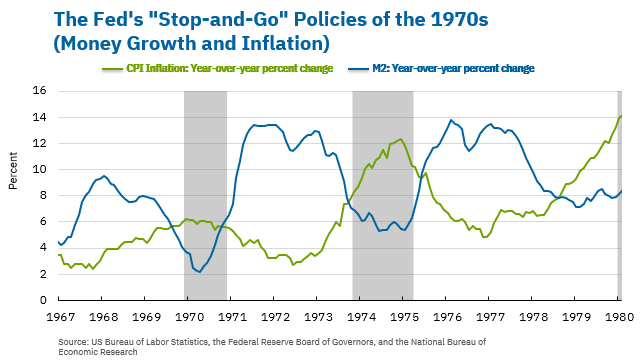

The main takeaway from their research is that history shows we must be resolute if we are to completely uproot inflation. What economists have come to call stop-and-go monetary policy—tightening in the face of rising inflation only to reverse course abruptly when unemployment rises—likely helped fuel inflation during the late 1960s and 1970s (see the following image).

Moving too aggressively could introduce the temptation to abruptly shift course. Most notably, the risk there is that monetary policy could slam the brakes on economic activity, and then the Committee might conclude it should reverse course and ease policy. Therein lies the risk of repeating the stop-and-go approach that arguably contributed to economic instability in the late 1960s and '70s.

Indeed, a recession during 1969 and 1970 was viewed by many economists at the time as caused at least partially by policy. To briefly recap, that downturn followed a period of fiscal tightening intended to make up for large government outlays to finance the Vietnam War, and a sizable slowing in money growth as the Fed attempted to quell rising inflation. Controlling the money supply was the key monetary policy tool in that day.

In the lead-up to the 1969–70 recession, the Fed tightened the money supply—by selling government securities through open market operations—and the federal funds rate climbed roughly 4 1/2 percentage points, to 9 percent. Growth in the money supply slowed from 8 percent on a year-over-year basis to just 2 percent. But as soon as inflation began falling, the Fed quickly reversed course with an aggressive expansion in the money supply that overshadowed the one originating the previous cycle, citing as justification spikes in unemployment along with a lagged decline in inflation. By late 1971, the money supply was again surging, up 13 percent on a year-over-year basis.

To sum up the policy reversals, as the FOMC repeatedly shrank and then grew the money supply, the federal funds rate climbed from about 4 to over 9 percent in two years then dropped back to less than 4 percent over about a year-and-a-half, and then scaled up again to above 10 percent three years later, in the middle of 1974. The funds rate declined yet again to around 4 percent in late 1976 before beginning a steady climb and holding at over 8 percent for most of the 1980s.

In hindsight, the Fed reacted too quickly to changes in the real economy, such as rising unemployment. Policy reversals never allowed inflation to fully recede to the 1 to 3 percent range that was the norm after the Korean War. Hence, instead of fading from the American psyche, inflation remained an ever-present danger to vigilantly guard against. That meant business leaders and workers anticipated higher future inflation rates as they set prices and bargained for wages. That is, inflation expectations became, in monetary policy parlance, unanchored.

Consequently, elevated inflation itself took root, and policymakers successfully ripped it out of the economy only after a pair of painful recessions in the early 1980s. In fact, during the second downturn, in 1981–82, the unemployment rate peaked at 10.9 percent, which has, except for three months early in the pandemic, been the highest rate since World War II.

I take those lessons from the Great Inflation to heart. I am firmly committed to the fight against inflation and will remain purposeful and resolute until the job is done. So what does all of this imply for the policy path in the coming months?

History and a large body of research teach us that tighter policy materially moves inflation with a lag, and only after it affects other economic indicators.

Changes in the stance of monetary policy typically affect economic growth first, particularly in interest-rate-sensitive sectors. For instance, the average rate on a 30-year fixed rate home loan began climbing even before the committee started increasing the federal funds rate, nearly doubling from December of last year to about 6 percent now. Our GDPNow prediction tool projects that residential investment will have declined by 20 percent in the third quarter of this year. And the GDPNow estimate of the current quarter's GDP growth and consumer spending have until recently steadily fallen. Meanwhile, rates on auto loans have climbed, and we anticipate some slowing in the trend rate of employment growth.

These are impacts on what economists call the "real economy" that typically occur well before any slowing in the underlying rate of inflation. How long does this take to play out? A large body of research has tried to answer this question. To cite a few prominent works, former Fed chair Ben Bernanke and coauthors (1999) as well as Christiano, Eichenbaum, and Evans (2005) point to a two-year lag between monetary policy actions and their main effect on inflation. Svensson and Gerlach (2001) report an approximately 18-month lag in the euro area, while Batini and Nelson (2003) estimate that changes in the money supply have their peak impact on inflation in the United Kingdom after a year.

Given unusual and swift changes brought about the by global pandemic, it is possible that the lag in policy affecting inflation may have shortened. Through the pandemic, we have seen companies change prices more rapidly and frequently than has historically been the case.

That noted, I do not think we've effectively overturned history, primarily because even as interest-rate-sensitive sectors and financial markets reacted quickly to tighter policy, financial markets are not the real economy where people live and where inflation does its worst. And the real economy has remained generally robust.

Purposeful, resolute, and analytical

In my view, the Committee should not overreact if, as appears likely, inflation does not fairly quickly fall back into the 2 percent range, even if we see some slowing in economic activity.

Chair Powell said in his August Jackson Hole speech that reducing inflation will probably induce softening of labor market conditions and could well bring some pain to households and businesses. The labor market is still strong but out of balance, as the number of job openings far exceeds the supply of job seekers. We have already seen some reduction in monthly employment growth. But with millions of unfilled openings and a smaller number of unemployed workers, slowing need not mean that job growth dries up completely.

If supply throughout the macroeconomy climbs closer to alignment with demand, then we would require less slowing of demand to bring them into balance. That would mean inflation could more likely fall without severe economic disruption. That is my hope, and the hope of many of my FOMC colleagues.

As the chair noted, there could be short-term pain. That may be the unfortunate cost of reducing inflation. Yet failing to restore price stability now would only lead to worse suffering later, as the work of our staff on the Great Inflation makes clear.

We're seven months into the tightening cycle. We likely still have some ways to go. Ideally, I would like to reach a point where policy is moderately restrictive—between 4 and 4 1/2 percent by the end of this year—and then hold at that level and see how the economy and prices react. I do not think we should continue raising rates until the inflation level has gotten down to 2 percent. Because of the lag dynamics of our policy that I discussed earlier, this would guarantee an overshoot and a deep recession. My baseline outlook is that the macroeconomy will be strong enough that we can tighten policy to that point—4 to 4 1/2 percent—without causing undue dislocation in output and employment.

Once policy reaches what I judge an appropriately restrictive level, I'm going to analyze and assess how the Committee's policies are flowing through the economy. If economic conditions weaken appreciably—for example, if unemployment rises uncomfortably—it will be important to resist the temptation to react by reversing our policy course prematurely.

I hope I've made it clear that I will be purposeful and resolute in the quest to bring down inflation. We cannot waver because price stability is necessary for us to achieve sustained maximum employment and to pursue an economy that works for everyone. Thank you.