Recession, Real Estate Crash, S&L Crisis Challenge Atlanta Fed

The late eighties and early nineties were challenging times for the U.S. economy and financial system.

Nearly a third of America's 3,234 savings and loan associations (S&Ls) had failed by the time the crisis ended, prompting a federal government intervention in 1989. Federal actions included forming the multi-agency Thrift Intervention Program to exercise joint regulatory authority over the troubled S&L industry. This program, which included the Federal Reserve, sent teams to problem thrifts to try to stabilize them. As part of this effort, Atlanta Fed bank examiners oversaw seven S&Ls.

The federal crisis response granted the Fed additional regulatory authority. In particular, the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) expanded the scope of the Fed's responsibilities over commercial banks' acquisitions of thrifts. Subsequently, the Atlanta Fed bank supervision and regulation staff devoted more time to analyzing proposals of bank holding companies to acquire S&Ls.

Meanwhile, the Atlanta Fed played a role in the speedy resolution of a large Florida bank. The resolution proved to be something of a test case for the Fed's lending role in the prompt resolution of troubled financial institutions, in part because the institution failed to repay a loan it took from the Atlanta Fed. The Federal Deposit Insurance Corporation later repaid the loan.

Recession follows S&L, banking problems

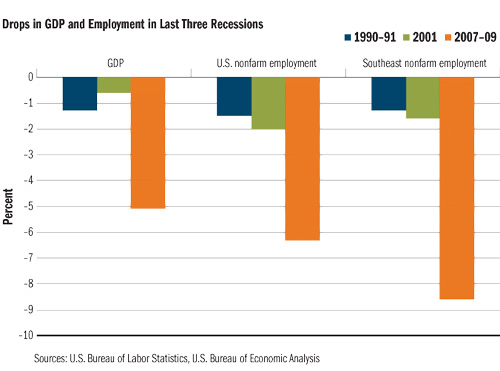

In July 1990, the U.S. economy entered an eight-month recession. As measured by gross domestic product (GDP), the economy contracted about 1.3 percent (roughly a third as much as it shrank during the Great Recession; see the chart for a comparison across three recessions). Along with the S&L crisis, the weak economy encouraged banking industry consolidation. This trend of consolidation meant more merger applications to review, straining Atlanta Fed resources. The number of troubled banks in the Southeast rose, mainly because of continued deterioration in real estate markets.

In that environment, the Atlanta Fed's supervision and regulation (S&R) unit sought to ease the orderly resolution of problem institutions in various ways. The S&R staff also supported several federal criminal investigations of fraudulent banking activities. Some of these had the makings of a spy novel. In one case, Atlanta Fed bank examiners helped unravel a scheme in which the manager of an Italian bank's Atlanta office engineered illegal loans to the Iraqi regime of Saddam Hussein.

During the same period, Atlanta Fed economists began exploring the growing use of complicated financial instruments known as derivatives. The Bank started recruiting economists and regulatory professionals with knowledge of derivatives and complex derivatives transactions. This work was part of a broader move to study how the nation might ensure a safe and stable financial system amid rapid advances in financial products and services. The work gave rise to what remains the Atlanta Fed's signature annual research and policy event, the Financial Markets Conference. The first conference in 1992 assembled economists and policymakers to discuss derivatives and related public policy issues.

The 2007–09 recession hits especially hard

The financial crisis that began in 2007 and ended in 2008 led to the worst recession in U.S. history since the Great Depression. Turmoil in the financial system created significant economic pressures, leading to sharp declines in business investment and consumer spending. With mounting job losses, rising foreclosures, and frozen credit markets, the Federal Reserve was forced to act swiftly.

At the outset, the Fed used its lender-of-last-resort role to provide liquidity and stabilize vital financial institutions and markets. It worked with the Treasury and other regulatory agencies—both domestic and abroad—to strengthen the global financial system. The Fed also extended discount window loan maturities, reduced the federal funds rate, and created special liquidity and credit facilities to enhance the stability of the financial system and promote the availability of credit. Institutions covered by these lender-of-last-resort actions included banks, broker-dealers, issuers of commercial paper, money market funds, and asset-backed securities markets.

The Federal Open Market Committee (FOMC), the Federal Reserve's monetary policymaking body, slashed the federal funds rate from 5.25 percent in September 2007 to nearly zero in December 2008. With that move, the scope of conventional monetary policy was exhausted. In a still-weak economy, the Fed had to look outside its traditional toolbox. In 2009, the FOMC announced plans to purchase large amounts of U.S. Treasury securities, as well as debt and mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae to support the housing market. The aim of these large-scale asset purchases was to influence longer-term rates. Enhanced communication about current and future policy actions further supported monetary policy. As an example of this increased transparency, the chair of the FOMC began in 2011 to hold news conferences four times a year after FOMC meetings to discuss policy decisions.

Throughout this challenging time, the Atlanta Fed continued to help contribute to the monetary policymaking process. The Sixth Federal Reserve District, with more than 46 million people representing a diverse economy, was a good barometer of the national economy. In 2008, the Atlanta Fed created its Regional Economic Information Network (REIN) to better monitor the southeastern economy. REIN systematically gathers data on regional economic activity, both qualitative and quantitative.

The crisis revealed many weaknesses in the financial system. The failure of Lehman Brothers and the rescue of AIG, or American International Group, revealed how some firms were interconnected with each other and with many other parts of the global financial system. Policymakers began to recognize this interconnectedness as a serious risk, so began to implement better tools for regulating and supervising systemically important financial institutions.

Stress tests, designed to help restore investor confidence and assess bank capital, were one such tool. In spring 2009, the Atlanta Fed supervisory staff participated in the initial Supervisory Capital Assessment Program of the nation's 19 largest banks.

The next year, the Dodd-Frank Wall Street Reform and Consumer Protection Act instituted numerous, wide-ranging reforms of the U.S. financial system. Among other things, Dodd-Frank increased the supervisory responsibilities of the Federal Reserve and other regulatory agencies. With these additional responsibilities, the Atlanta Fed restructured its supervision and regulation division to be more flexible, clearer in communication, and more forward looking. Other changes the Dodd-Frank Act effected include the establishment of an Office of Minority and Women Inclusion at each Federal Reserve Bank and the creation of the Consumer Financial Protection Bureau (CFPB). The CFPB became responsible for many of the consumer financial protection and education responsibilities that had been with the Fed.