The rapid unfolding of the COVID-19 pandemic has created grave concerns for the health and welfare of the U.S. population and the economy. The economic worries are very apparent in financial markets. From the closing bell on February 21 through March 20, U.S. equities fell more than 30 percent, and stock market volatility skyrocketed.

At present, we simply don't know the extent of the overall disruption to the economy. We are still months away from confidently gauging COVID-19's impact on output growth. However, the latest wave of results from our Survey of Business Uncertainty (SBU) indicates that firms are bracing for a huge negative impact on their businesses. Our results also say the outlook deteriorated rapidly over the past two weeks.

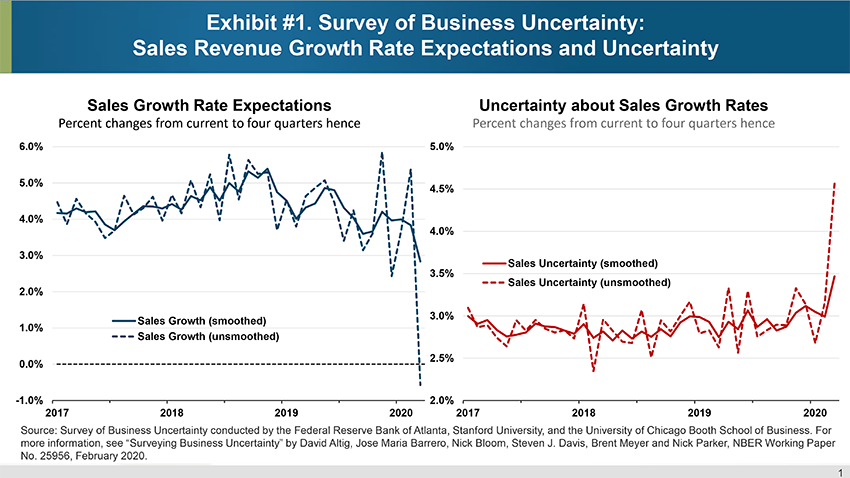

The SBU was in the field from March 9 until last Friday, March 20. Relative to February, firms' four-quarter-ahead sales growth expectations fell sharply, from above 5 percent to below zero. This fall is, by far, the starkest one-month swing we've recorded since the inception of the SBU in October 2014. In addition, firms' uncertainty about their own sales growth rates rose 44 percent from February to March (see exhibit 1).

Interestingly, SBU respondents did not report a material softening in the outlook for employment growth during the next 12 months, or in the capital investment rate four quarters hence. However, given the latest signals from the labor market—most notably, last Thursday's initial unemployment claims report—employment is set to contract sharply for at least a few weeks. Perhaps respondent firms see the coronavirus impact as sharp but short-lived, with little impact on longer-term employment and plans for capital expenditure.

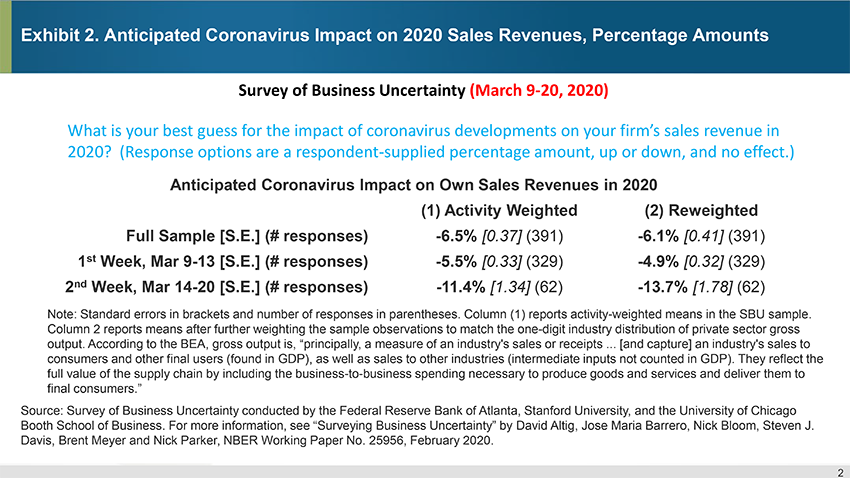

To better gauge how firms see the direct impact of COVID-19 on their sales outlook, the March SBU included the following special question: “What is your best guess for the impact of coronavirus developments on your firm's sales revenue in 2020?” Exhibit 2 summarizes the results.

Pooling responses over the survey's full two weeks in the field, firms anticipate revenue losses of more than 6 percent in 2020 as a result of coronavirus-related disruptions. Perhaps even more telling is how the responses evolved over the two-week period. As the virus spread—and as companies, households, and governments reacted—the collective judgment of responding firms about the severity of the negative hit to sales more than doubled.

In the first week, roughly two thirds of firms said coronavirus-related developments would harm their sales in 2020. Among those affected, the average expected decline was 9 percent. In the second week, nearly 85 percent said coronavirus-related developments would negatively affect their sales, with an average decline of 16 percent among affected firms—making it clear that from one week to the next, both the reach and severity of the anticipated impact rose sharply.

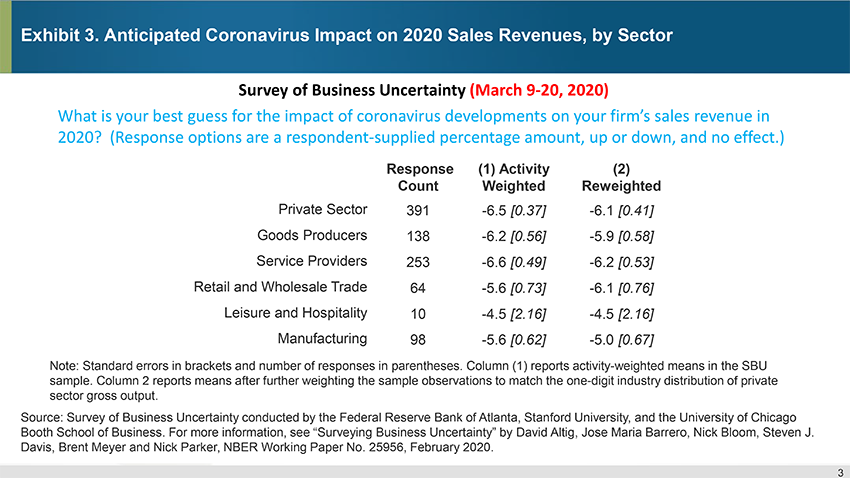

Exhibit 3 breaks down anticipated effects by major industry sector and shows that no sector is immune to the disruptive effects surrounding the virus and efforts to restrain its spread.

In sum, our March survey results show a very large and very negative impact on sales. Our direct question about coronavirus's anticipated impact on the sales outlook (exhibit 2) and the deterioration in the outlook from February to March (exhibit 1) suggest that recent events will lower sales by 6 percent or more. At this point, though, anticipating a sales decline of 6 percent might be too optimistic, for two reasons. First, the anticipated coronavirus impact intensified greatly from the first week to the second week of our March survey. Second, the virus continues a rapid spread domestically and abroad, prompting governments to respond with tighter travel restrictions and stricter social distancing policies.

By

By  Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School,

Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys