The recent economic data paint a picture of recovery. Our in-house gross domestic product growth tracker, GDPNow, has pegged third quarter 2020 growth at an astonishing 32 percent annualized pace. The unemployment rate has fallen from a high of 14.7 percent in the depths of the pandemic to 8.4 percent alongside the addition of nearly 11 million payroll jobs.

Yet, despite that dramatic initial bounceback, the unemployment rate is more than double its February level of 3.5 percent and nonfarm payrolls still sit 11.5 million below their prepandemic levels. Moody's Analytics and CNN Business's "Back-to-Normal Index" suggests that the economy is operating at about three-quarters of its prepandemic levels. However, progress toward "normal" appears to have stalled out in recent weeks.

The question of how quickly the United States is going to return to prepandemic levels of economic activity looms large. Data from the Survey of Business Uncertainty (SBU) suggest that the road forward is going to be a tough slog. Businesses hold tepid expectations for year-ahead employment and sales growth. Expectations are, in fact, so tepid that, based on the latest average projection, it will take firms more than four-and-a-half years to recover their pre-COVID employment levels and about three-and-a-half years to recover their lost sales revenue. In short, the coronavirus pandemic has knocked the economy off its previous robust path and firms don't see us returning to that path anytime in the foreseeable future.

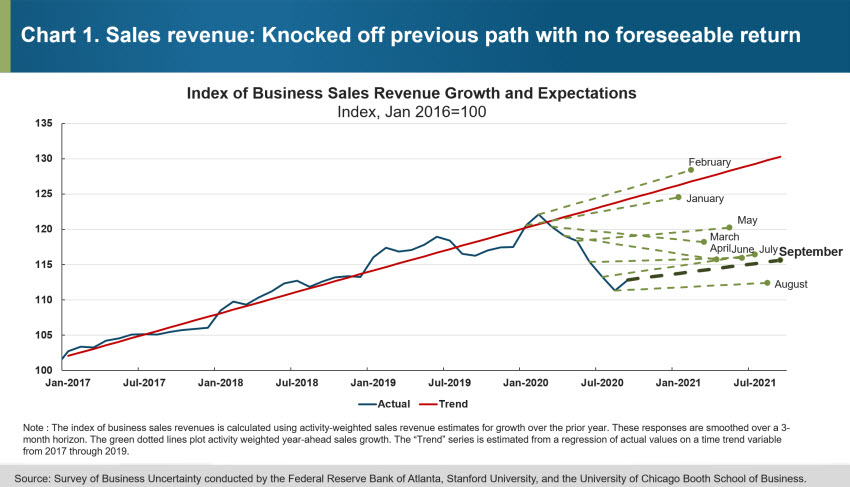

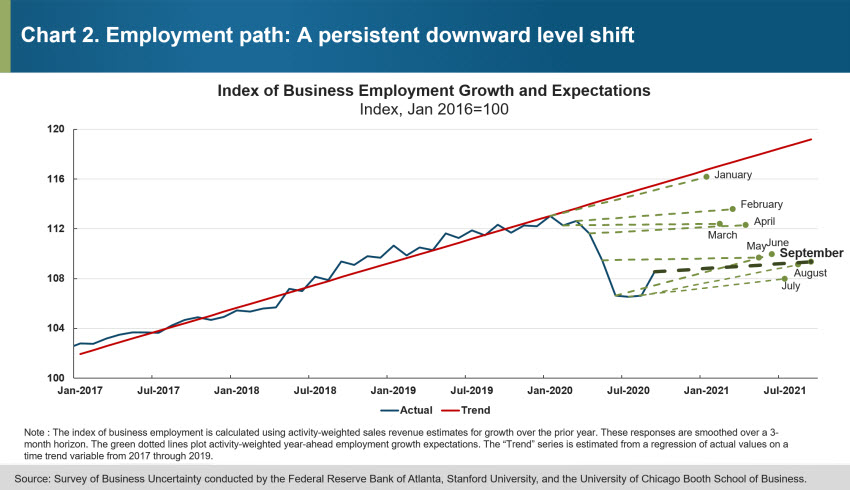

Charts 1 and 2 make use of SBU survey data on past sales growth rates and current and year-ago employment levels in addition to firms' forward expectations. The indexes plot the cumulative sales and employment growth using January 2016 as a starting point and use data and expectations through September 2020. For reference, we plot a trend line based on the actual, relatively stable and strong sales and employment growth firms reported over the 2017–19 period.

As the charts show, since the onset of the pandemic, firms' sales revenues have plummeted by more than 10 percent and employment levels, which have stabilized in recent months, are on average still about 5 percent below prepandemic levels. Essentially, the pandemic has erased all the growth that firms have enjoyed over the previous two years.

The evolution of firms' expectations since the beginning of the pandemic is also of particular interest. Before the pandemic, firms' expectations for both sales and employment growth remained relatively on trend. However, by April, firms appeared to have rapidly adjusted down their expectations for sales revenues over the year ahead, while holding to an expectation that employment levels would remain more or less constant. However, firms' expectations became much less optimistic over the summer months—perhaps as firms came to grips with the length of time COVID-related uncertainty is likely to remain with us. Firms now anticipate a modest increase in sales revenue and a mere 0.7 percent gain in employment over the year ahead.

So, when will the economy recover "back to normal"? Well, based on firms' latest projections, they do not anticipate regaining their pre-COVID (February 2020) employment level for another 55 months (or until April 2025). For sales revenue, the mean projection suggests that revenues will not retake their February 2020 levels until January of 2024. Effectively, COVID-19 has permanently shifted downward firms' expectations for employment and sales growth trends.

It's worth noting that these projections from firms are somewhat more pessimistic than those of professional forecasters. In a special question posed to the Blue Chip Panel of Economic Forecasters in September, the majority of professional forecasters see real GDP overtaking its prepandemic level sometime in 2022. However, the latest employment projections from the Survey of Professional Forecasters still have nonfarm payroll employment well shy (by roughly 8 million jobs) of its prepandemic peakby the end of their quarterly projection period in the third quarter of 2021. Projecting forward using their last quarterly forecasted growth rate suggests nonfarm payroll employment may return to its prepandemic peak by the first quarter of 2024.

Overall, our results indicate that our survey panel participants do not see the chances of the U.S. economy retaking its pre-COVID levels and getting back on its prepandemic trend anytime in the foreseeable future. As Lee Corso, ESPN college football analyst, would put it: "Not so fast, my friend."

By

By  Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School,

Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys