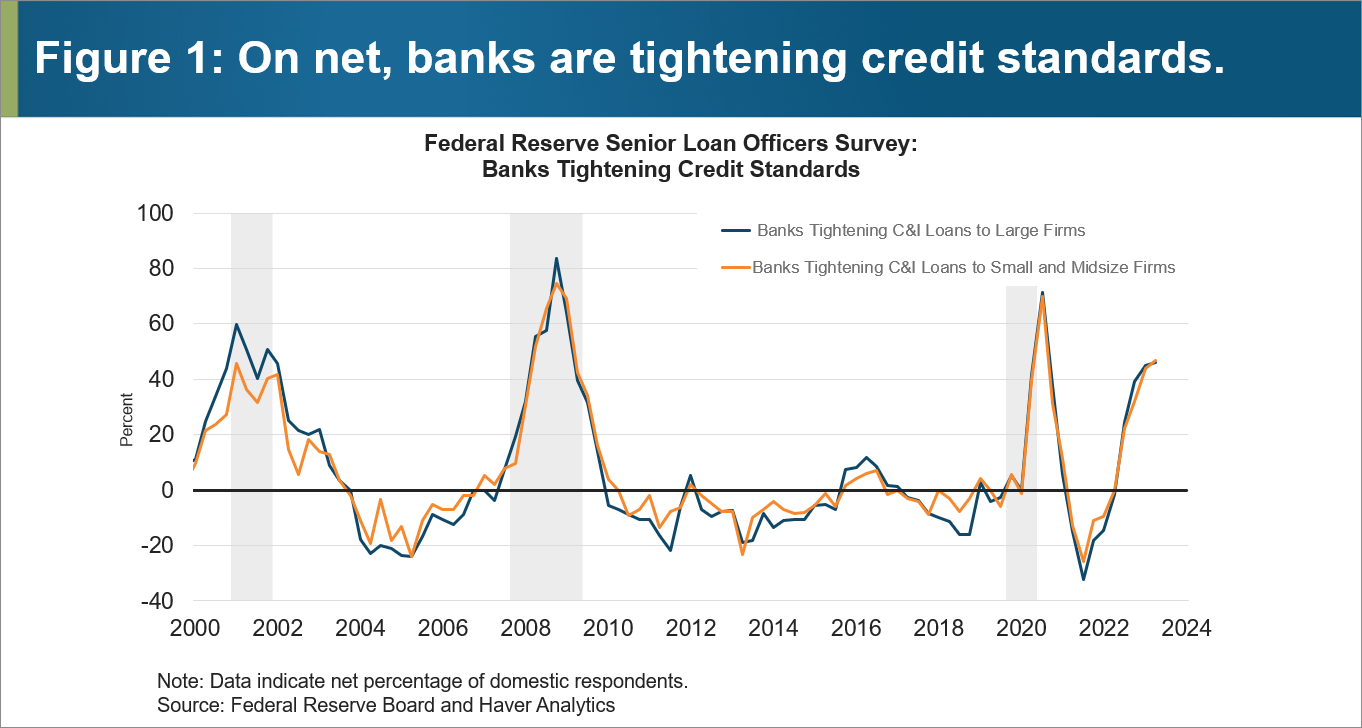

The recent banking turmoil has many folks talking about a credit crunch. Indeed, according to the Federal Reserve's latest Senior Loan Officer Opinion Survey on Bank Lending Practices

(SLOOS), just under half of banks surveyed have been tightening their lending standards, raising concerns that the flow of credit to the broader economy will choke off businesses' ability to engage in expansionary investment and fund operations (see figure 1).

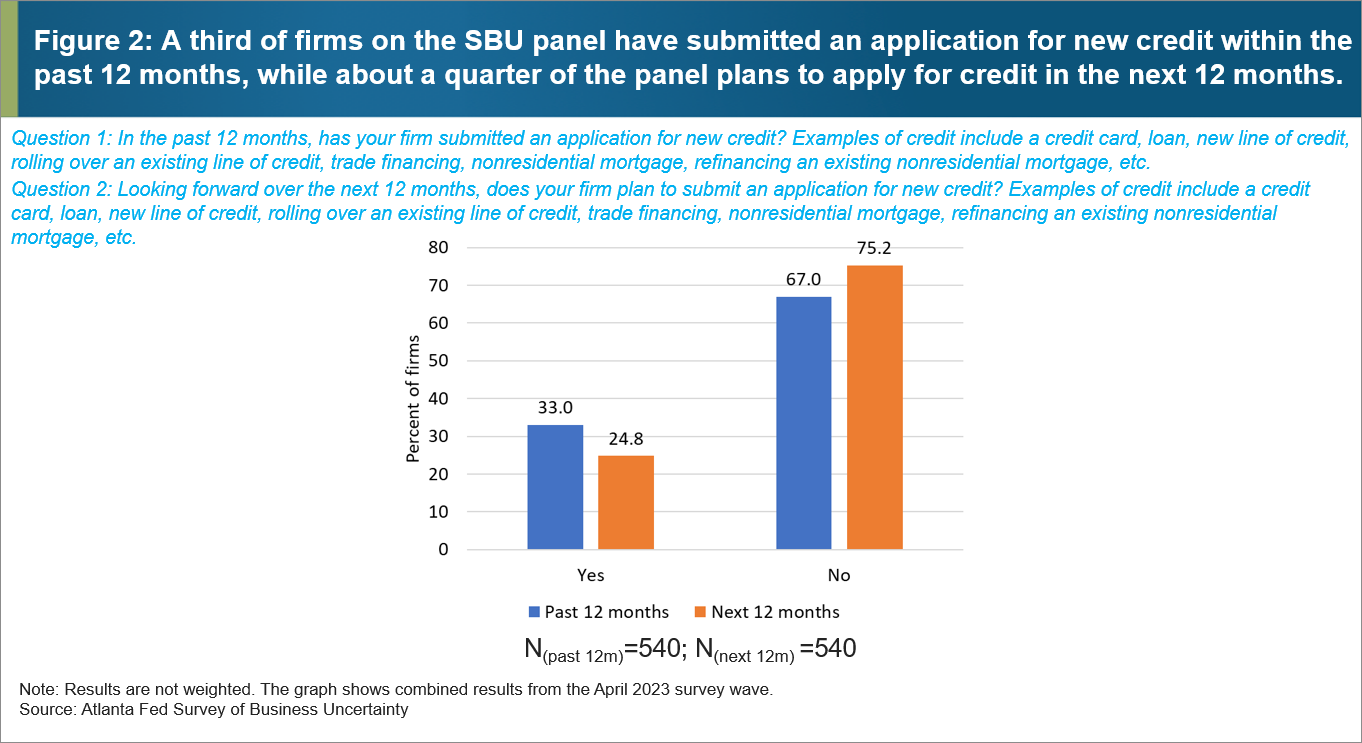

Given the recent turmoil and reports of a constrained flow of credit, in mid-April (April 10–21) we posed a series of special questions to panelists in our Survey of Business Uncertainty (SBU)—a national, monthly survey that gathers responses from private, nonagricultural employer firms across all major industries and firm sizes—to gauge the demand side of the credit equation and see if firms are feeling the squeeze. What we found was quite interesting. Only about a quarter of our firms anticipate applying for new credit (or rolling over an existing line of credit) during the next 12 months, down from about a third of firms over the past year (see figure 2). Most firms do not anticipate seeking funding, and about 60 percent of respondents indicated having enough cash on hand to execute on their current plans. Additionally, about one-third of these firms said they did not want to accrue further debt. Put simply, if a pending "credit crunch" is going to send the economy into a tailspin, it might take a while for Main Street businesses to feel it.

In response to a backward-looking question on whether firms have recently applied for credit (or extended an existing line of credit), roughly a third of our panel indicated submitting a credit application during the past 12 months. About two-thirds of those applications were during the prior three months, with the overwhelming majority (89 percent) receiving the entire amount requested. Looking forward, only around 25 percent of the panel anticipates applying for credit during the next 12 months.

There are some differences across firm size embedded in these results. A greater share of large firms (those with 250 employees or more) applied for credit during the past year—roughly 40 percent, compared to about 30 percent of small firms, with a similar disparity over the year-ahead horizon. When looking across broad industrial classifications, the share of firms that sought credit during the past year was highest among firms in construction, real estate, mining, and utilities (42 percent) and in retail and wholesale trade (42 percent).

We can also relate these special question results to our core survey outcomes to see if firms that experienced or anticipate strong employment and sales revenue growth were disproportionately those that sought credit. A surprisingly similar share of the fastest-growing firms in terms of sales revenue compared to slower-growing firms submitted a credit application during the past year. For example, 35 percent of firms in the top tercile of sales revenue growth during the past 12 months sought credit, statistically indistinguishable from the 33 percent of firms in the lower two terciles of sales revenue growth.

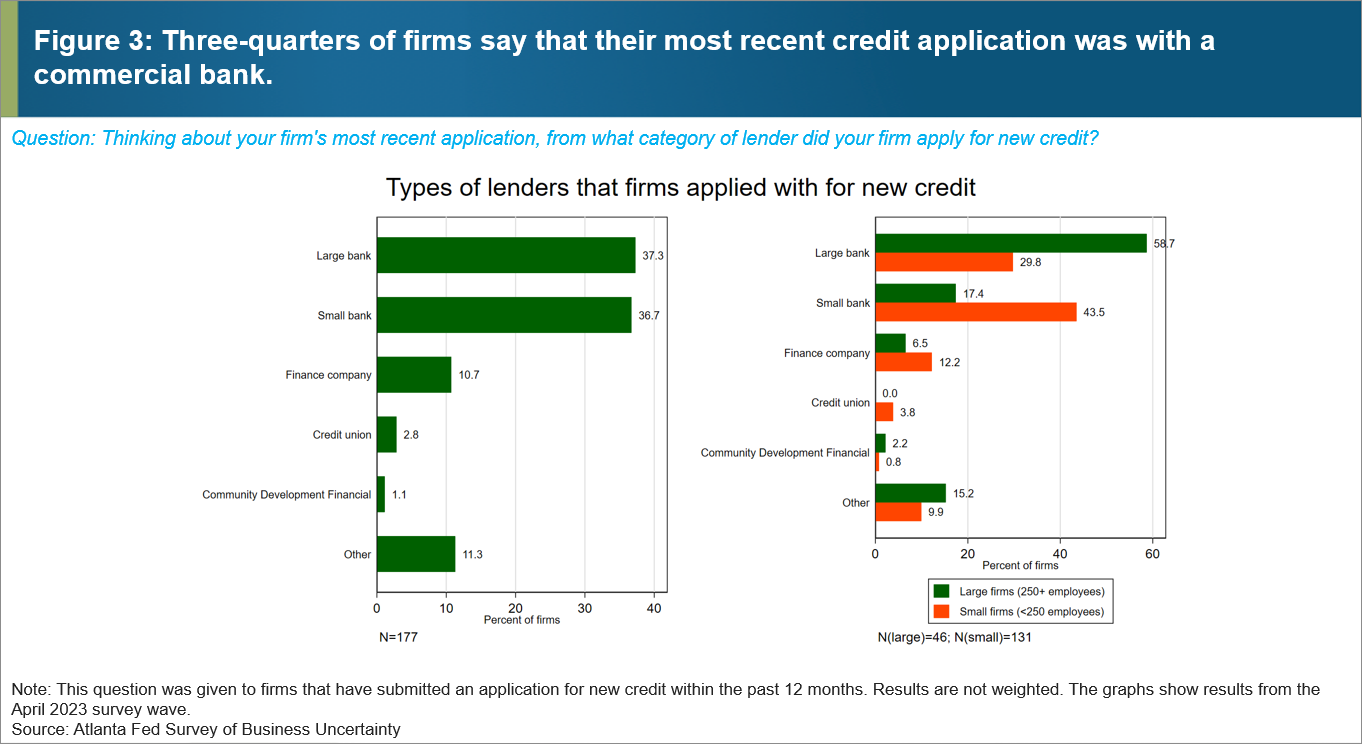

Although the majority of firms do not anticipate applying for credit in the next 12 months, to the extent that turmoil in the banking system disproportionally affects smaller banks, it is also more likely to crimp smaller firms' access to credit. In our results, roughly 60 percent of large firms' most recent credit application was at a large bank (see figure 3). Smaller firms, on the other hand, are more likely to bank with small banks (44 percent, compared to just 17 percent of larger firms), which could increase smaller firms' exposure to a contraction in bank lending.

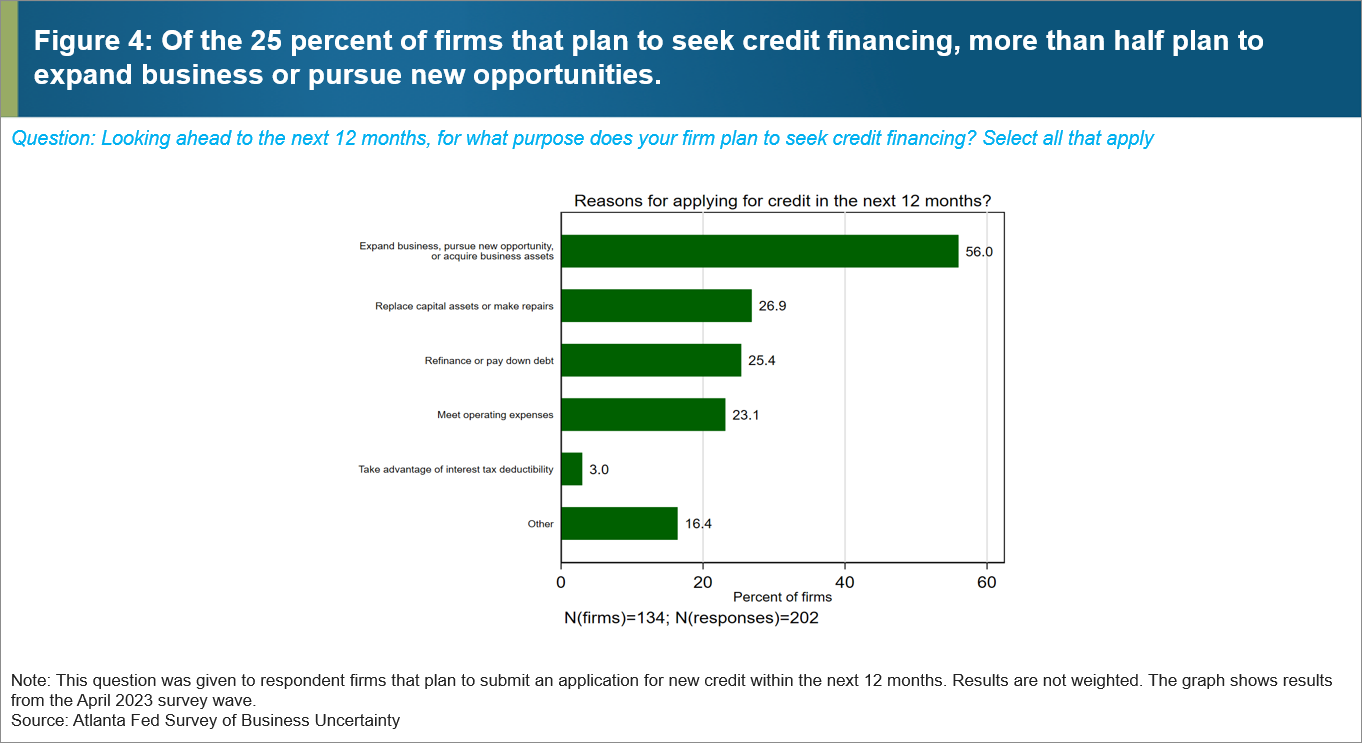

Among the one-quarter of firms seeking new credit, the rationale for why these firms plan to borrow sheds further light on the potential impact that tightening credit conditions may have on economic growth. In our April survey period, we posed a follow-up question to the one-quarter of firms that plan to apply for credit: "Looking ahead to the next 12 months, for what purpose does your firm plan to seek credit financing?" The question allowed respondents to select all applicable reasons from a list that included options such as expanding business, pursuing new opportunities, or acquiring business assets; meeting operating expenses; refinancing or paying down debt; and replacing capital assets or making repairs.

The results shown in figure 4 suggest that just over half of those anticipating applying for credit financing—or roughly 14 percent of the overall SBU panel—plan on using those funds to expand their business, pursue new opportunities, or acquire business assets. Another 27 percent (just under 7 percent of the overall panel) plan to replace capital assets or make repairs, and 25 percent (roughly 6 percent of the overall panel) anticipate seeking credit to refinance or pay down existing debt. To some extent, tighter credit conditions could affect these plans. However, the firms arguably most vulnerable in the event of a significant credit contraction—those anticipating seeking credit to meet operating expenses—amount to just a little less than 6 percent of our panel.

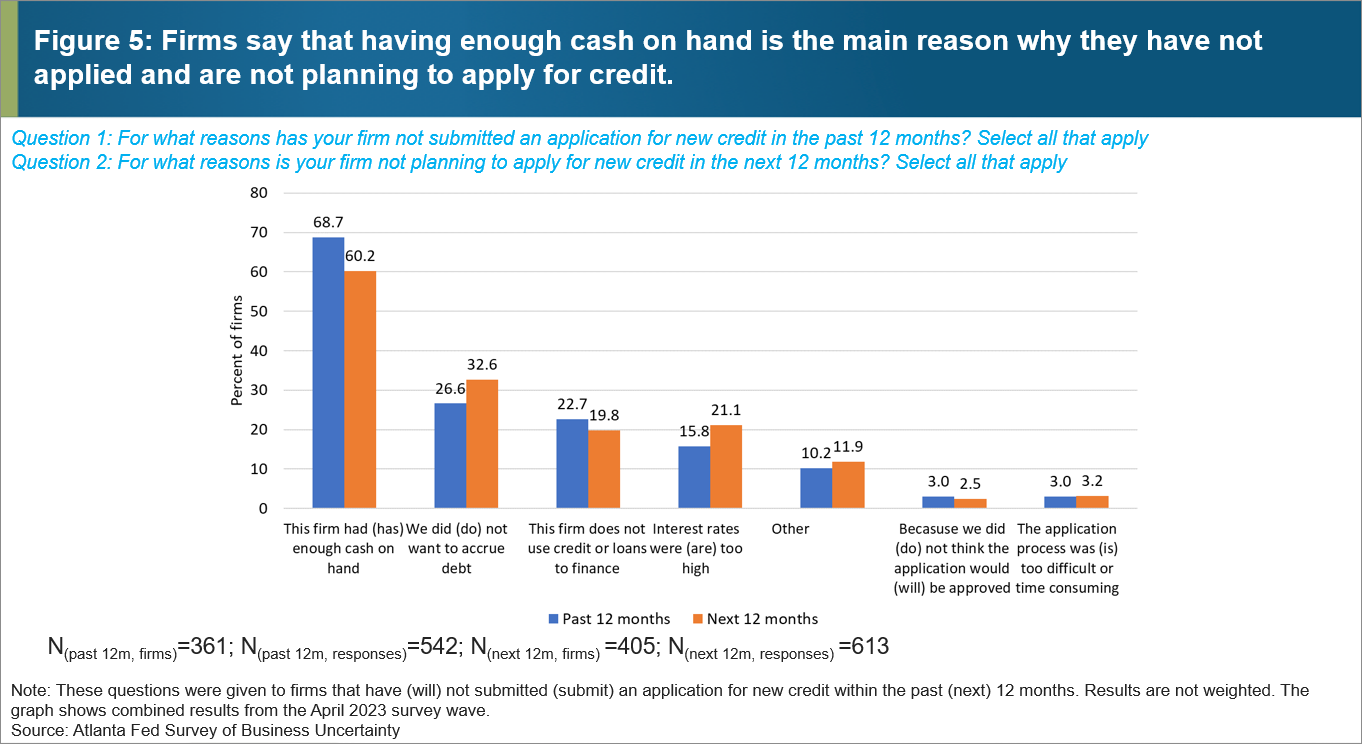

Given that the overwhelming majority of firms in the SBU have not sought credit in the past year and do not anticipate seeking credit in the next 12 months, one obvious question is: why not? The results in figure 5 detail the reasons firms gave for why they either didn't plan to apply for credit, or why they don't plan to.

For almost half the firms in our panel, the answer was that the firm had (or has) enough cash on hand to follow through on their current (anticipated) slate of activities. Looking at the year ahead, 60 percent of the 405 firms that received this follow-up question indicated they weren't seeking credit because they have enough cash on hand to cover their expected activity during the next 12 months. Out of a total of 540 responses, this amounts to 45 percent of the panel. Another third of the firms not planning on seeking credit said they did not want to accrue further debt. And—perhaps especially interesting to those attuned to monetary policy—just 21 percent of those not planning on seeking credit financing in the next 12 months (or 16 percent of our overall panel) indicated that interest rates are too high for them to consider taking on additional credit financing.

These results are consistent with longer trends in corporate financing. A recent article out of Northwestern's Kellogg School of Management reports that firm's cash holdings have risen sharply since 2000—from $1.6 trillion to $5.8 trillion. The article cites uncertainty, tax strategy, and the need for some firms (especially those in the intellectual property space) to be nimble. After-tax corporate profits have risen sharply since the early 2000s, rising from around 5 percent of nominal gross domestic product (GDP) to roughly 10 percent by late 2019. Since the onset of the pandemic, they've only moved higher—reaching a peak of 12.3 percent of GDP in the second quarter of 2021.

Our results suggest that any significant tightening in credit conditions that has occurred in the wake of recent bank failures may take some time to impact the broad swath of Main Street businesses, as just 25 percent of firms in the SBU anticipate seeking credit financing during the next 12 months. And the majority of firms not seeking credit financing report having enough cash on hand to cover their plans during the next year. Indeed, although the SLOOS indicates that, on balance, the share of banks tightening credit has increased markedly, only a very small fraction of banks have tightened lending standards "considerably." To be clear, a significant and protracted contraction in the supply of credit would certainly constrain firms' ability to sustain and grow their businesses. However, our results do suggest that firms' demand for credit is expected to wane relative to the year prior and many firms report having ample cash on hand to move forward on business plans, perhaps splashing a bit of cold water on near-term fears of a looming credit crunch.