Two years ago, inflation as measured by the Consumer Price Index (CPI) topped out at a roughly 40-year high of 9 percent on a year-over-year basis. The speed and magnitude of the surge in consumer prices resulted in a sizeable decline in real (inflation-adjusted) wage growth—real average hourly earnings at the time had fallen 3 percent on a year-over-year basis—and led to many economists warning of a potential wage-price spiral associated with an anticipated sharp catch-up in real wage growth. This sort of dynamic would have posed a significant challenge for monetary policy makers to overcome without tanking the economy.

The argument was that amid the prevailing tight labor market conditions, workers would be in a strong position to bargain for higher wages. However, to minimize the impact on their bottom lines brought by higher wages, businesses would try to pass on these costs to consumers in the form of higher prices. In turn, so the argument went, this would propagate another round of wage and price increases, and these dynamics could potentially continue indefinitely. Short-circuiting these dynamics would have left policy makers in a pickle.

Fast forward to today. Inflation cooled quickly following the initial surge and by June 2023 was trending a bit above 3 percent (about the same range that it's in currently). And by some measures, real wage growth has turned slightly positive. The year-over-year growth rate in real average hourly earnings turned positive by mid-2023. Through May 2024, real wages are up 0.5 percent year over year.

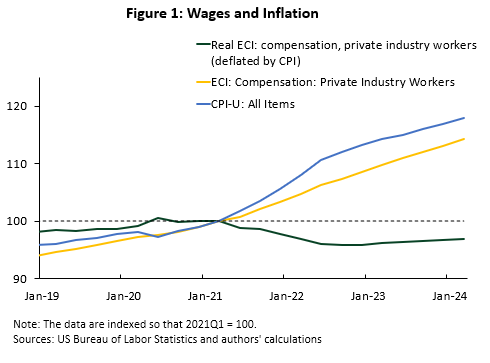

While real wage growth has turned slightly positive in recent months, the level of real wages is still below where they were at the onset of the inflation surge that we began to see in the first quarter of 2021. Simply put, real wages haven't fully caught up to the sudden burst in inflation. For example, the cumulative growth in the CPI since the beginning of 2021 is nearly 18 percent (through the first quarter of 2024). The Employment Cost Index (ECI)—one of the broadest measures of wage growth and which at least partially accounts for compositional shifts in the labor force—is up a little less than 15 percent over that period, leaving cumulative real wage growth roughly 3 percentage points below zero. This decline in real wages is unusual compared to what the ECI typically depicts. During the prior expansion, real growth in the ECI averaged around 0.5 percentage points per year. Projecting that over the period from the first quarter of 2021 to the first quarter of 2024 would have led to a cumulative increase in the real ECI of 1.5 percentage points (see figure 1). Surprisingly, the observed decline in real wages occurred during a very strong rebound in labor market tightness.

So, what happened to that worrisome, anticipated real-wage catch-up? Given where some of us work, we'd be remiss not to point out that monetary policymakers raised overnight interest rates from near zero to above 5 percent over a very short 17-month period ending in July 2023, perhaps arresting any additional unanchoring of inflation expectations. Real wage growth is typically tied to productivity growth over longer periods of time. Hence, declining productivity growth could also be a culprit for why nominal wage growth is failing to keep up with inflation, but the jury is still out on that notion. A third explanation pertains to changes in how we now live and work: More remote work means less commuting and more flexibility in where we live and how we manage our daily lives. That's a newly important, newly salient amenity in many jobs.

Further, our research suggests that firm execs were leaning on that nonpecuniary amenity-value of remote work to curb wage growth pressures leading to a sizeable offset to the anticipated real-wage catch-up. Using a set of novel special questions fielded in the Survey of Business Uncertainty (SBU) in April and May 2022, we found that the big shift to remote work curbed wage growth by 2 percentage points over a two-year period centered on April–May 2022.

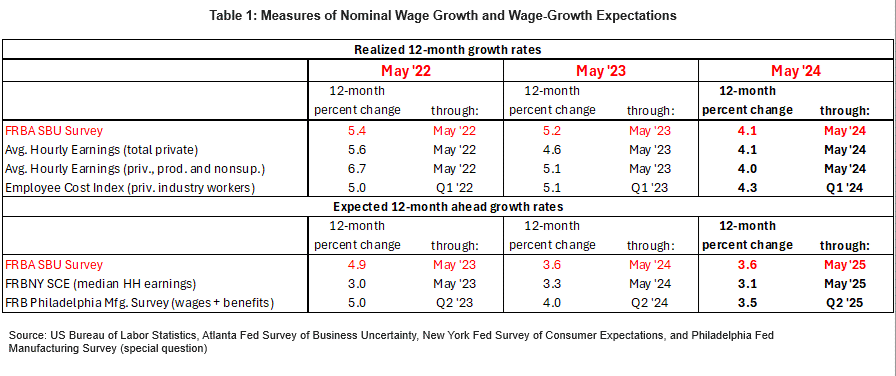

In addition to eliciting quantitative estimates of how much expanded remote-work opportunities have moderated wage-growth pressures, we also asked respondents about their average wage growth realizations over the past 12 months and expectations over the next 12 months. Reassuringly, the backward-looking growth rates reported by the SBU panelists were about on par with the official statistics produced by the US Bureau of Labor Statistics, such as average hourly earnings and the ECI. In fact, panelists were so accurate that we started asking these questions every May.

Table 1 tells us that in May 2022 firms expected wages to grow at an average of 4.9 percent over the following twelve months. The actual growth of average hourly earnings during that period was 4.6 percent. Similarly, in May 2023, firms expected wages' 12-month-ahead growth rate to average 3.6 percent, which was slightly below than the 4.1 percent average hourly earnings growth realized over that period. Consistent with figure 1, firms' wage growth expectations continued to suggest slowing wage growth over the year ahead. And the most recent results from May 2024 are telling us the same thing.

SBU panelists reported that on average wages grew at 4.1 percent over the 12 months through May 2024, which is right in the ballpark of official estimates. It's also slightly below the four-quarter change of the ECI for private industry workers, which grew at 4.3 percent in the four quarters ending in the first quarter of 2024. These results continue to highlight the credibility of the wage-related information we are gleaning from firms.

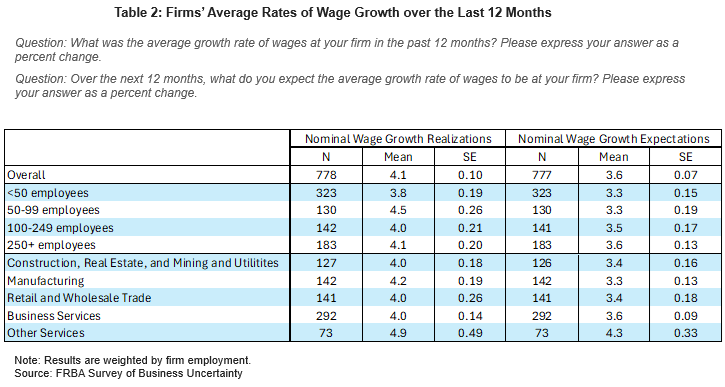

Going forward, firms on the SBU panel expect wage pressures to continue slow. On average, firms believe that wages will grow at 3.6 percent over the year ahead. Wage growth realizations and expectations vary across firm sizes and producer types, but in each one of these instances, business decision makers anticipate wage growth over the year ahead to be slower than last year's wage growth (see table 2).

In sum, the data have unfolded in a way consistent with the notion that the big shift to remote work provided a substantial offset to the real wage growth catch-up that many economists were anticipating in the wake of the 2021–22 inflation surge. Moreover, firms continue to see nominal wage pressures slowing over the year ahead. Our results suggest that it will still be some time before real wages return to their pre-inflation surge level (first quarter of 2021), let alone catching back up to the trend they were on prior to the surge. Indeed, we may have seen a permanent downshifting.