Technological innovation is booming, and many financial institutions and financial service providers, including mobile phone providers, are increasingly adopting financial technology, or fintech, to offer easier and faster payments to consumers. In other words, the consumers who have traditional banking services such as checking and savings accounts naturally have access to solutions such as online or mobile bill pay, account and P2P money transfers, and customized saving options. But what about the people who don't have a bank account?

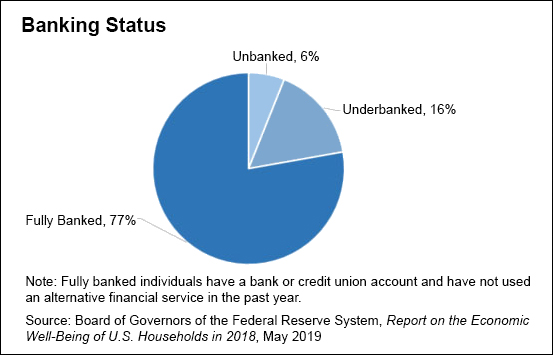

According to the Federal Reserve's Report on the Economic Well-Being of U.S. Households in 2018, approximately 6 percent of adults do not have a bank account, and approximately 22 percent are either unbanked or underbanked (having a bank account but relying on alternative financial services). How does the payments industry make sure that, in the words of the World Bank, all "individuals and businesses have access to useful and affordable financial products and services that meet their needs"? How can the industry help boost financial inclusion, which is "a key enabler to reducing poverty and boosting prosperity" (also in the words of the World Bank)?

Join us for the Atlanta Fed's latest episode in our Talk About Payments webinar series on Thursday, August 22, from 1 to 2 p.m. (ET). A panel of payments experts will focus on how fintech aims to improve financial inclusion by giving people who are un- or underbanked access to the payments system. Panel members will also discuss current research on financial inclusion and programs intended to support economic mobility.

Panel members are:

- Dr. Sophia Anong, associate professor, financial planning, housing and consumer economics, University of Georgia

- Nancy Donahue, Federal Reserve Bank of Atlanta

- Catherine Thaliath, Federal Reserve Bank of Atlanta

Participation is free, but you must register in advance. After you've registered, you'll receive a confirmation email with the login and toll-free call-in information. We hope you and your colleagues will join us and be part of the discussion as we delve into the ways financial technology is helping to meet the needs of the underserved.

By Catherine Thaliath, project management expert in the

By Catherine Thaliath, project management expert in the