In June 2019, eight Federal Reserve districts,1 led by the Federal Reserve Bank of Boston's Payment Strategies Group, surveyed financial institutions (FI) based in their respective districts about their current and planned mobile banking and mobile payment service offerings. The survey defined mobile banking as the use of a mobile phone to connect to a financial institution to access bank or credit account information (including to view balances), transfer funds between accounts, pay bills, set up account alerts, locate ATMs, deposit checks, and more. The term mobile payments described the use of a mobile phone to pay at the point of sale, remotely for a retail item (or items) using near field communication or a quick response code, or via mobile app or web for digital content, goods, or services (such as transit, parking, or ticketing).

You can find the full 2019 Mobile Financial Services Survey report, including the survey questionnaire, on the Boston Fed website. This collaborative survey effort previously took place in 2014

and 2016

.

The survey found that 96 percent of the respondents currently offered or planned to offer mobile banking services. (As expected, most of the respondents who indicated they had no plans to offer mobile banking—18 of the 23—were the smallest FIs [those with assets under $50 million]). Support for mobile payment services had increased significantly since the 2016 survey, going from 24 percent to 43 percent in 2019, with an additional 26 percent planning to support mobile payments within two years.

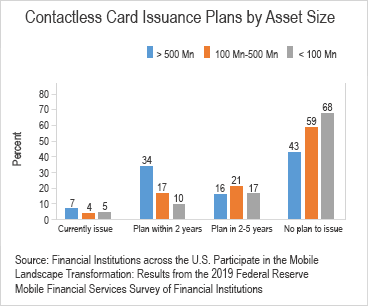

Especially interesting to me were the responses to a new survey question regarding FIs' plans to issue contactless payment cards. Many of the largest FIs began issuing contactless cards in 2019. The survey found that while only 5 percent of respondents were issuing contactless cards, 21 percent plan to do so within two years and an additional 18 percent plan to issue them in the next two to five years. As the chart shows, although nearly two-thirds of the smallest FIs indicated no plans to offer a contactless card, a relatively high percentage (43%) of the larger FIs also indicated no plans to do so. I am curious to see how these plan responses change, if any, in future surveys.

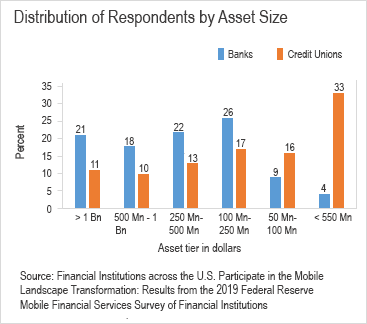

A total of 504 financial institutions responded—337 banks and 167 credit unions (CUs)—which represented 6 percent of all banks and 3 percent of all CUs in the United States. It is important to note that none of the top 100 banks by asset size and only four of the top 100 CUs by asset size are included in the survey. Almost half of the responding CUs have assets under $100 million. The distribution of survey respondents (displayed in the chart below) helps us better understand the development of mobile financial services in the mid- and small-sized FIs.

The Boston Fed's Payment Strategies Group will present a webinar on the full survey report later this year. We will be sure to keep Take On Payments readers apprised of those plans. In the meantime, if you have any questions regarding the survey or the results, please be sure to contact me.

1Atlanta, Boston, Cleveland, Kansas City, Minneapolis, Philadelphia, Richmond, and San Francisco

By David Lott, a payments risk expert in the

By David Lott, a payments risk expert in the