On the first day of a conference I recently attended, I participated in a town hall panel on the "right to choose cash." And on the last day, I presented key findings on cash usage from the Federal Reserve's Diary of Consumer Payment Choice (DCPC).

Between these bookend sessions, there were numerous remarks and discussions in other sessions and during networking breaks about how consumers' use of cash is changing. I heard the phrase "war on cash" quite a bit, although I think "battles against cash" is more accurate. Not surprisingly, the conference was the ATM Industry Association's annual conference.

For an industry whose primary product is currency, we can understand the importance of this topic to the ATM owner and operators.

There is no question that technology has permitted businesses that previously were cash-only to now either exclude cash or allow payment cards. Vending machines, mass transit fares, and parking meters—which all used to be cash-only—are prime examples of this transition. Since we have no federal law requiring businesses to accept cash, a few scattered private business owners have refused to take it. They cite the costs of handling cash and the security risks of robbery and employee theft as major disadvantages. Of course, every payment method has its advantages and disadvantages. On the positive side, cash payments are immediate and final, and are highly convenient, especially in natural disasters when electrical and connectivity infrastructure is disrupted.

Cash acceptance also has societal implications. The DCPC results show that unbanked households used cash for almost 62 percent of their payments, compared to 27 percent for underbanked households and 20 percent for fully banked households. (Unbanked households don't have checking or savings accounts, while underbanked households have accounts but also get financial products and services outside of the banking system.)

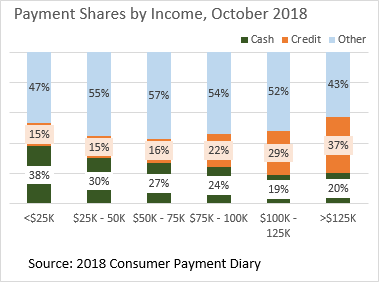

Additionally, lower income correlates to higher cash usage, as the chart shows.

It is largely because cash-exlcusion practices can harm the un- and underbanked and low-income households that politicians have introduced or enacted legislative action to ban businesses from refusing to accept cash. Massachusetts has had such a ban since 1978 and was recently joined by New Jersey as well as the cities of San Francisco, Philadelphia, Washington, DC, and New York City. The states of Oregon, Wisconsin, New Hampshire, and Vermont have seen similar bills introduced. At the federal level, H.R. 2650, the Payment Choice Act, has received bipartisan sponsorship (28 Democrats and 8 Republicans) and now sits in the House Financial Services Committee.

Federal Reserve Bank of Atlanta president Raphael Bostic in recent remarks noted that some of the new ways business owners are conducting business are biased in that they lock out those who still use cash. He suggested that perhaps the definition of financial inclusion needs to be expanded to include the notion that every person should be able to use anywhere the payment channels they rely on for their transactions.

Take On Payments will continue to follow these cash battles.

By David Lott, a payments risk expert in the

By David Lott, a payments risk expert in the