From 2015 to 2018, payments made by businesses using general-purpose credit cards grew almost 25 percent by value year over year, according to the Federal Reserve Payments Study (FRPS). What drove such strong growth? An increase in the number of U.S. businesses over that time? An increase in corporate travel? The convenience and familiarity of using a card? What about businesses waking up to a way to reduce the costs of products and services, through loyalty programs allowing them to earn points or cash back dollars?

It's common to associate business credit cards with travel to visit a customer or to attend a convention. And smaller businesses may use cards in lieu of a traditional line of credit to buy goods and services and then pay over time. Credit cards also are a way to “make accounts payable a revenue producer,” one expert recently commented to me. A retailer I spoke with estimates that its annual rebate due to sharing interchange fees with its card issuer is well into six figures—in effect, a vendor discount you can't get directly from the vendor.

By value, from 2015 to 2018, payments made by businesses via general-purpose credit cards grew faster than consumer credit card payments, as reported in the detailed data release of the Federal Reserve Payments Study last fall. Let's take a minute to dive deeper into businesses' credit card paying trends. (Private-label fleet cards and prepaid and nonprepaid debit cards are outside the scope of this discussion.)

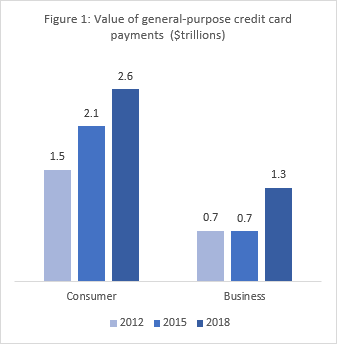

As you can see in Figure 1, businesses' total value of credit card payments was less than consumers' in all three years. In 2018, for example, just one-third of the value of general-purpose credit card payments was for business payments. This reflects the underlying numbers: in 2018, the U.S. population 18 and older was about 250 million, compared to about 32 million nonemployer and employer businesses. Consumers held 408 million general-purpose credit cards; businesses, 38 million, according to the FRPS.

General-purpose consumer credit card payments also grew strongly by value in the years between 2015 and 2018 and on a higher base: by 7.4 percent year over year. In absolute terms, however, the increases in consumer and business credit payments by value over the three years were very roughly the same: $500 billion for consumers and $600 billion for businesses, reflecting, in part, the higher-value payments that businesses make. The average value of a business credit card payment was $263 in 2018, compared to $70 for consumer credit card payments.

Businesses make most of their card payments with credit cards. They make relatively few payments with non-prepaid debit cards. Of general-purpose business card payments by value, 83 percent are credit card payments.

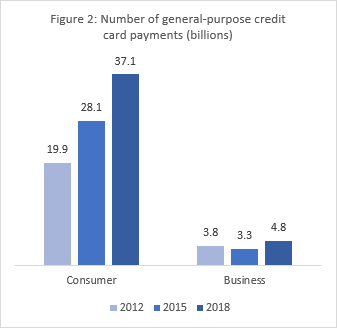

Looking at the number of general-purpose credit card payments (shown in Figure 2), we see less dramatic growth for business credit card payments on a small base. The number of general-purpose credit card payments by businesses grew 13.2 percent per year on average from 2015 to 2018, after declining between 2012 and 2015.

To learn more about these data on your own and to explore businesses' and consumers' use of cards, check out the detailed data release of the 2019 Federal Reserve Payments Study.

By Claire Greene, a payments risk expert in the

By Claire Greene, a payments risk expert in the