In a February 2020 post, I reminded myself—and you—that we shouldn't use ourselves for survey research. Isn't it pleasing, though, when the data line up with our personal experience and the anecdotes we are reading and hearing about?

That's the case with some of the data from the Federal Reserve Payments Study (FRPS) released in late October.

The study found that the number of general-purpose card payments for less than $5 grew 16 percent a year from 2015 to 2018, exceeding the 9 percent annual growth rate for all transactions on these cards, which include nonprepaid debit cards, general-purpose prepaid cards, and general-purpose credit cards. This higher growth is, in part, an indication of a continuation of cards replacing small-value cash payments over the period.

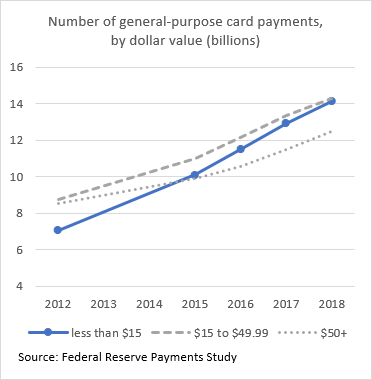

The chart below depicts data gathered from general-purpose card networks, showing that from 2012 to 2018, the growth in the number of card payments of less than $15—a category likely to see a lot of cash replacement—was faster than the growth of card payments of higher values.

Although the increase is less pronounced than for the smallest-value category, I chose "less than $15" for the comparison to align with research by Atlanta Fed senior policy adviser and economist Oz Shy who, using consumer payments survey data, has found it is likely consumers will choose cash for such small-value payments. (See his paper "How Currency Denomination and the ATM Affect the Way We Pay.") The data from the FRPS show that general-purpose card payments of less than $15 grew a total of 83 percent over the period compared with a total growth of just 46 percent for higher-value payments. (If you like, you can download the detailed data from the FRPS and arrange the value bins as you prefer.)

These data show what we know from personal experience: we are using cards more and more for micropurchases and have been for a while now. But we can also see the effect of this behavior at the high end of the dollar-value distribution: in 2018, 30 percent of general-purpose card payments were for $50 or more. That's a drop from 35 percent in 2012. Micropayments for less than $5 still have a ways to go, though: they make up just about 12 percent of card payments by number.

To learn more about these data on your own, check out the detailed data release of the 2019 Federal Reserve Payments Study.

By Claire Greene, a payments risk expert in the

By Claire Greene, a payments risk expert in the