Cast your mind back to spring 2020, the early months of the COVID-19 pandemic. With my apologies for the bad flashback, did you change how and where you shopped that spring? Maybe you ordered groceries online for the first time. Maybe you decided to skip browsing at your favorite clothing store. Maybe you exchanged eating out for ordering in.

You can see glimmers of your behavior—and that of consumers and businesses here in the United States—by looking at fluctuations in the mix of credit and debit card payments made remotely and in person in spring 2020.

Perhaps you remember making fewer in-person payments in spring 2020 because you were reluctant to be out and about, you worked at home, or businesses were closed. The Federal Reserve Payments Study (FRPS) recently reported that the number of in-person card payments dropped 19 percent from the first quarter of 2020 to the second.

Perhaps you moved some shopping online. The number of remote payments (including purchases and bills) was up 18 percent from Q1 to Q2 2020.

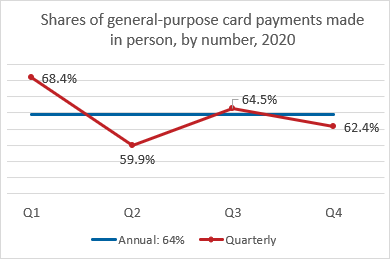

You can see the combined effect of these changes in the chart below. As a percentage of general-purpose card payments by number, in-person payments dropped from more than 68 percent in the first quarter to less than 60 percent in Q2 (shown by the red line in the chart below).

In-person payments as a share of all card payments recovered somewhat in later quarters to total 64 percent of all general-purpose card payments for the year 2020 (the blue line in the chart), a substantial drop from 72 percent in 2019.

The December report, Developments in Noncash Payments for 2019 and 2020: Findings from the Federal Reserve Payments Study, also contains quarterly data for depository institution accounts with digital wallet activity and with P2P activity using bank-sponsored apps.