Today's post features a guest blogger from Credit and Risk within our Supervision, Regulation, and Credit Division.

When we talk about funds flowing through the financial system, it isn't a stretch to compare it to plumbing. For example, plumbing is largely invisible: open the tap, water comes out. Likewise, the smooth-flowing payments system is often invisible. Open your bank app, enter some information, a payment leaves your bank account, and your water bill is paid.

One of the roles the Federal Reserve plays is to keep the payments and settlement system flowing smoothly, and to do so, it has to manage some risks. Let's talk about liquidity risk, which is the risk that a bank may struggle to meet obligations. This can happen during a recession, for example. In normal times, institutions manage their liquidity risk through effective asset liability management, which is managing assets and cash flows to satisfy obligations.

The Federal Reserve manages liquidity risk by providing liquidity to the financial system. One tool Federal Reserve Banks use to do this is the discount window, which offers loans to financial institutions through three credit programs:

- Primary, for depository institutions (DIs) in generally sound financial condition: $47.5 billion in 2021, down 79.8 percent from $235.2 billion in 2020. DIs can request a primary loan on a no-questions-asked basis.

- Secondary, for depository institutions not eligible for primary credit: $10.0 million in 2021, up 809.1 percent from $1.1 million in 2020.

- Seasonal, for banks with deposits less than $500 million and a seasonal need: $138.8 million in 2021, down 50.1 percent from $278.0 million in 2020. Qualifying DIs experience fluctuations in deposits and loans due to servicing seasonal types of businesses such as construction, college, farming, resort, or municipal financing.

A quick two-minute same-day phone call to the discount window of a financial institution's local Reserve Bank is all it takes to have funds deposited by the close of Fedwire at 7 p.m. (ET).

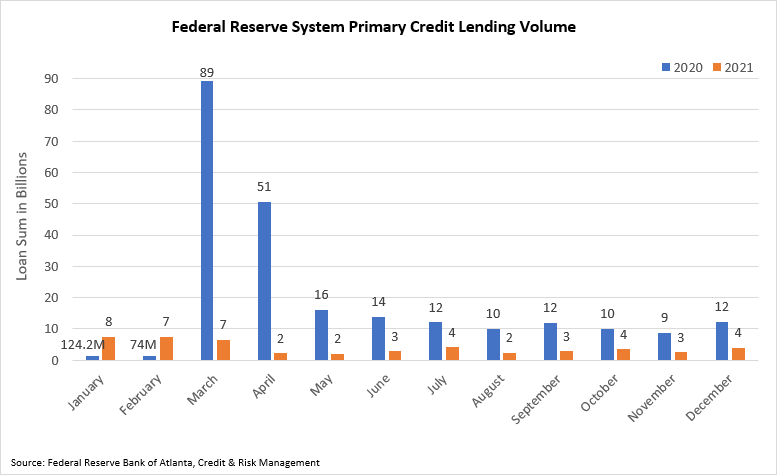

As you can see in the chart below, COVID-19 significantly affected loans to financial institutions in the Federal Reserve System. Before COVID, primary credit lending was in the $74 million to $124 million range and skyrocketed to $89 billion in March 2020.

Another way the Federal Reserve manages payment system risk is to ensure the smooth operation of payment systems by allowing depository institutions to overdraft their Fed account. Known as intraday credit, daylight overdrafts minimize disruptions to payment and settlement systems and support the efficient movement of funds. Fed account holders can overdraft their account up to a specified limit without incurring an overdraft fee. While financially unhealthy institutions are not permitted to overdraft their account at all, qualifying institutions have a few creditworthiness-based options for daylight overdraft limits for their account. (These limits are known as net debit caps.)

Circling back to the plumbing analogy, it's easy to see how these short-term loans from the Federal Reserve help keep credit to households and businesses flowing—and the economy bubbling along.

You can find more information about Federal Reserve discount window liquidity options on the Fed's discount window web page. You can read about the Fed's policy on payment system risk and intraday credit on the Board of Governors website

.