Let's look at these questions through the lens of something we all do: eat. Carnivore and vegan, we gobble burgers. Lactose-tolerant and not, we slurp beverages. We shop in person and online, we order in, we eat out.

You and I—and US consumers generally—make many purchases of food to eat at home and away. Together, purchases of groceries, meals at sit-down restaurants and bars, and fast food accounted for four in 10 payments made by US consumers in October 2021, according to the SDCPC.

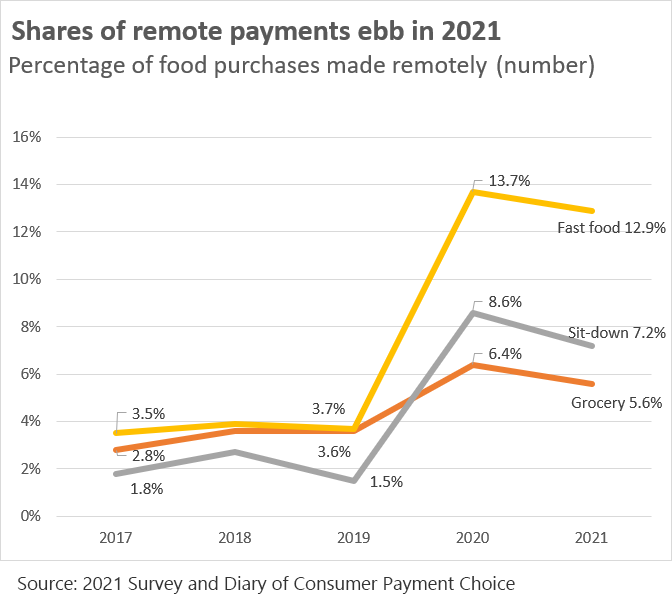

In a recent paper, Fed researchers Ruth Cohen, Oz Shy, and Joanna Stavins looked at payment instrument choice for these food purveyors, among other merchants, and found that the shift to remote payments during the COVID-19 pandemic was a driver of the decline in the use of cash in 2020. Their analysis, extended in the chart by Ruth Cohen to include the new 2021 data, found a jump in remote payments for all categories of food purchases during the pandemic year 2020.

The chart shows that the shares of remote payments in all three food categories are slightly down from 2020, but still well above their 2019 shares. Remote purchases remain a small share of all food purchases—less than 15 percent by number for each category—and the 2021 shares are similar to those seen in 2020.

So, no big jump from 2020, but no retreat either. In 2020, we all changed a lot. Now, we're consolidating and, as I wrote about data from September 2020, our collective reaction to the COVID-19 threat appears to be easing, along with some of the dramatic change from 2019 to 2020.