Sometimes a person gets cornered into writing a paper check. Today, that person is me.

My final payment for a vacation rental is due this coming Friday. The rental starts in five days, on Saturday. But since the payee is a person, my online banking bill pay won't get the check there until the following Monday: three days late and two days after my check-in.

I'm cornered because two circumstances are colliding. (1) I absolutely, positively have to get the payment there by Friday. (2) My longtime landlord doesn't accept payment via p2p apps or cards. My preference for speed is in conflict with my landlord's preference for paper. And in a two-sided market, like payments, each side has to agree on how to conduct a transaction.

These circumstances call for 18th century technology: it's time to write a paper check. Cue quill pen and ink bottle, cue envelope, cue sleeve protectors, cue stamp.

My initial choice of online banking bill pay is what you would expect given new data from the 2021 Survey and Diary of Consumer Payment Choice, released in mid October. These data show that while the prevalence of checks has declined, they are still used.

On the "decline" side:

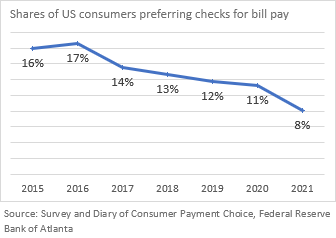

- The shares of consumers who prefer to use checks to pay bills dropped from 17 percent in 2016 to 8 percent in 2021.

- In 2020, checks were 19 percent of bill payments by number and 23 percent by value. This dropped to 12 percent by number and 12 percent by value in 2021.

- In the past 30 days ending in October 2021, more consumers used online banking bill pay (51 percent) than used a paper check (46 percent).

On the "still used" side:

- The average dollar value of check payments per consumer in October 2021 was $550.

- The average consumer wrote about two checks in October 2021.

- The share of consumer with paper checks on hand—three quarters of all consumers—has remained constant since 2019.

In combination, these data say that, sometimes when you're cornered, nothing says speed and acceptance like a paper check.

So while I go off on vacation in my paid-off rental, you can investigate the adoption and use of other payment instruments, as well as consumer ratings and preferences, at the data release of the Survey and Diary of Consumer Payment Choice.