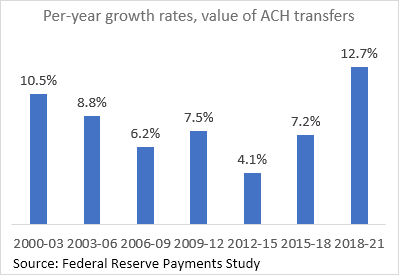

Late last week, the Federal Reserve Payments Study (FRPS) announced unprecedented growth in the dollar value of ACH (automated clearing house) payments from 2018 to 2021: 12.7 percent per year. This is the highest rate of growth by value for ACH over all the years for the FRPS (chart below).

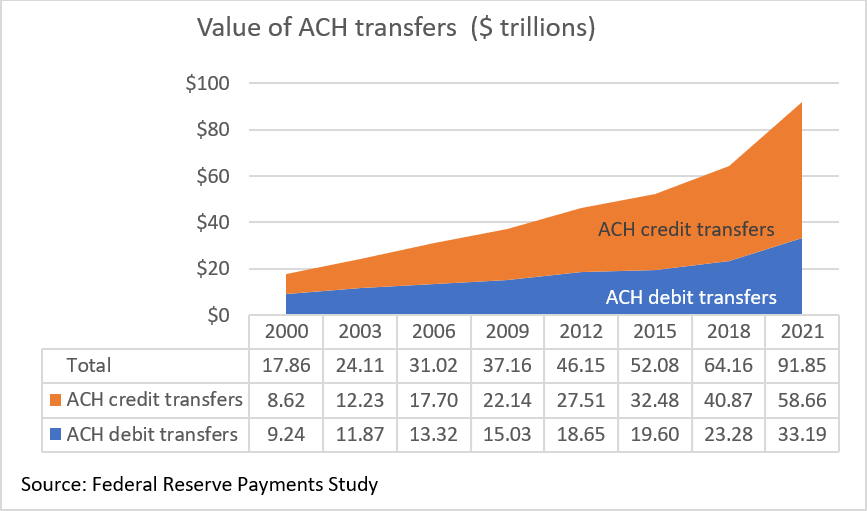

The large increase in the value of ACH transfers accounted for more than 90 percent of the increase in the value of noncash payments from 2018 to 2021 (comprising ACH, cards, and check). The chart below, based on table 1 in the FRPS data release, shows that the values of both ACH credit transfers and ACH debit transfers grew strongly from 2018 to 2021, 12.8 percent per year and 12.5 percent per year, respectively.

In addition, you can see that the value of ACH transfers was less than $20 trillion in 2000 and grew to more than $90 trillion in 2021. By value, ACH credit transfers have grown faster than debit transfers over the past two decades and now make up about two-thirds of ACH transfers. Together, ACH transfers were more than 70 percent by value of all noncash payments in 2021.

We're all familiar with the myriad uses of ACH transactions. Since the mid-1970s, consumers and businesses have used the ACH system to transfer funds between accounts and to pay bills electronically. Consumers benefit from direct deposit of paychecks; businesses, from paperless payments directly to their bank accounts. These data show the phenomenal growth and longevity of this 50-year-old payment method.

The value of card payments also increased more rapidly than in past years: 10 percent per year from 2018 to 2021. You can see details and download the data table here.

There's lots to explore in the new data release, and I hope you'll take a look.