Earlier this year, the Financial Crimes Enforcement Network (FinCEN) issued an alert on a "nationwide surge in check fraud schemes." The surge showed up in checks collected by the Federal Reserve, where the value of possible check fraud grew 4 percent per year from 2018 to 2021. As my colleague Dave Lott pointed out in September, checks are easy to counterfeit or alter, making them an attractive target for criminals.

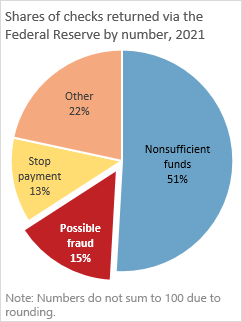

New data about checks processed by the Federal Reserve give some insights into how possibly fraudulent checks differ from returned checks and checks collected. By number in the United States, the Federal Reserve processes an estimated one-third of all checks written, collected, and paid as checks (also called "forward items"). The Federal Reserve processes about half of returned checks—that is, unpaid checks the paying bank sends back to the depositing bank (see the chart for return reasons).

Possibly fraudulent checks are a subset of returned checks:

- Checks are returned for all sorts of reasons, mostly not for fraud. In both 2018 and 2021, most checks were returned for nonsufficient funds.

- The average value of checks returned is higher than the average value of checks collected: $3,116 versus $2,395 in 2021.

- From 2018 to 2021, the value of checks returned grew faster than the value of checks collected.

- Compared to checks collected, consumer payers are responsible for an outsize share of returns. Consumers wrote about two-thirds of returned checks and half of checks collected in 2021.

- Checks written to businesses at the point of sale, while a vanishingly small share of checks collected, are responsible for an outsize share of returns.

The value of checks returned to the Fed as possibly fraudulent increased from 2018 to 2021:

- By number and value, 15 percent of returned checks were tagged as possibly fraudulent in 2021.

- From 2018 to 2021, the value of possible check fraud grew faster than the value of checks returned—and faster than the value of checks collected. Returned checks grew 4 percent per year by value.

In 2021, financial institutions filed more than 350,000 Suspicious Activity Reports (SARs) to FinCEN to report potential check fraud, a 23 percent increase over the number of check fraud-related SARs filed in 2020. Tracking data on returns and possible fraud is a good way to improve knowledge on the causes and prevalence of check fraud.

Checks Processed by the Federal Reserve in 2021: Report of the Check Sample Survey includes data on payers and payees by business and consumers as well as breakdowns by business type. You can read the full report on our website.