In 2007, the term "QR code" appeared in the New York Times just once and was called "something straight out of a futuristic film." This characterization shows how challenging it can be to explain evolving technology or predict where it may go.

When something is new, it can take time for us consumers and businesses to decide that the benefits of change offset the costs. We may not see an obvious need. We may not understand how it works. We may expect the price to come down. We may, as Henry Ford is supposed to have said, want "faster horses."

For all kinds of new technology—from electricity in the first half of the 20th century to the smartphone more recently—adoption tends to begin with a very tiny number of first adopters. Eventually, however, successful technologies approach near-universal adoption. This pattern can be seen with financial, communications, and other electronic technologies over the past century—for example, television, computers, debit cards, online (then called "computer") banking:

- Nine percent of US households owned a TV in 1950; in 1960, 85 percent, according to the Census Bureau

.

- Between 1984 and 2003, the percentage of US households with a computer in the home grew from 8 percent to 62 percent, also per the Census Bureau

.

- Over two decades, debit cards became ubiquitous. In Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom, and the United States (also known as the Group of 10) between 1988 and 2008, debit card transactions per person per year grew from fewer than one in 1988 to almost 100 transactions in 2010, as reported by the Swift Institute

.

- Just 4 percent of households had "computer banking" in 1995, according to the Survey of Consumer Finances

. Twelve years later, the proportion of households had grown to 53 percent.

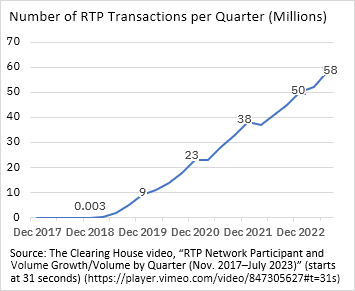

Long way of saying, when I look at the steady growth in the number of real-time payment (RTP) transactions per quarter since 2017 (chart), I see technology that is taking off. Often, successful technology builds ever so slowly, and then reaches a liftoff point when more conservative consumers and organizations decide they are ready to fly. Instant payments that provide for the immediate transfer of money could be the next technology to follow this trajectory.

Every day, I read about new product introductions, new investments, new players, new uses, the latest on RTP from the Clearing House, updates on the FedNow Service. Although the ubiquitous use of instant payments may not be instant, the climb to cruising altitude has begun.