How big a problem is imposter fraud? In its 2023 consumer complaints report, released last month, the Federal Trade Commission (FTC) reported more than 850,000 complaints about imposter fraud, resulting in about $2.7 billion dollars in losses. For comparison, credit-card-related identity theft, defined by the FTC

as "use of a person's identifying information to open a new credit card account or to make charges to a person's existing credit card account without their permission," totaled about 417,000 complaints. Reported incidents of imposter fraud were up 60 percent over the five years from 2018

.

Imposter fraud is committed by "someone [who] pretends to be a trusted person to get consumers to send money or give personal information," according to the FTC. Growth in this fraud is troubling because it is at the heart of authorized push payment fraud (APP), where victims voluntarily hand over their money to criminals. APP fraud presents operations and reputation risks to financial institutions that must balance account holders' ability to access funds easily (on the sending side) or to smoothly open new accounts (on the receiving side) with fraud prevention.

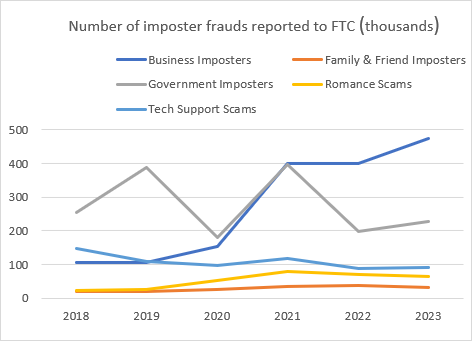

The chart below shows that business and government imposters are most prevalent, together representing almost 80 percent of imposter fraud reported to the FTC. The steady growth of business imposter fraud contrasts with the yearly fluctuation in the popularity of government imposter scams, which include reports of tax refund scams. And while we hear a lot about grandparent and romance scams, they are less common.

Source: FTC data reports for 2023 and 2020

, author's chart

Of all types of fraud reported to the FTC in 2023, about 300,000 events involved a phone call. Reports of email contact are more common than phone call contact, but phone calls result in the largest losses per event for victims: $1,500 median amount lost compared to $600 for email. A caller might impersonate an alphabet soup of government agencies (FTC, FBI, SSA, CIA, IRS), a business, a family member in trouble, tech support, or an imaginary romantic partner. Eventually, the call or calls turn to urgent demands for money.

While criminals often victimize older adults, younger people, too, can be scared into turning over cash, wiring funds, or purchasing gifts cards. You probably have read of working-age people who have lost tens of thousands or even hundreds of thousands

of dollars due to emotional manipulation by phone calls pretending to come from some government agency.

To curtail APP fraud, we must stop phone scammers. It's National Consumer Protection Week, and the Social Security Administration (SSA) is warning consumers to slam down that phone.