Chatting with other payments experts, I find we have diverse and strong opinions on three payment terms: faster, instant, and real-time payments. Why do we have all three terms? Is there a difference? The short answer is yes, there are differences, but it depends on who you ask and what the reference is. Is the person you're speaking with referring to a payment rail, a formal name of a system, or description of a payment? In general, these words describe the speed of settlement, not speed of initiation. I should note that other payment options mimic the appearance of instant, but I won't get into those here.

At the core, the terms meet this definition of a faster payment system from the Bank for International Settlements (BIS) report to the G20:

They are retail payment systems in which the transmission of the payment message and the availability of "final" funds to the payee occur in real time or near real time, and on as near to a 24-hour and seven-day a week (24/7) basis as possible. Credit of final funds to the payee means that the payee has unconditional and irrevocable access to them.

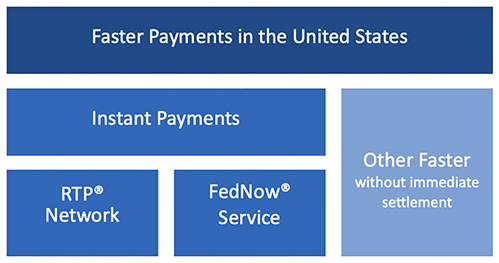

The term that came first and is often used globally is faster payments. It also has the broadest definition, meaning that instant and real-time could be in the faster bucket, but not all faster payments are instant. A faster payment system could be operated by a central bank, a private sector operator, or a combination. For example, the United Kingdom's formal name of its network is the Faster Payment System, which can be described as real-time by some, but funds may or may not settle instantly. Here in the United States, the Fed uses instant payments as a generic term that encompasses the central bank service, FedNow

®, and the private network RTP

® (Real-Time Payments), operated by The Clearing House.

The latest BIS Quarterly Review states that the countries with the highest volume of faster payment transactions as of 2022 were India, China, Thailand, and Brazil. The annual number of transactions ranged from 49 billion in India to 9 billion in Brazil. Compared to India and China, with more than 1 billion people each, I was surprised to see Thailand (around 71 million people) and Brazil (around 214 million people) in this list by transaction volume. These nations also have the highest per capita rates of use per month: 35 for Thailand and 27 for Brazil. In thinking about my own transactions, 35 would cover most of my payments in a month.

In comparison, the US RTP® network transaction volume in 2023 was about 249 million—up about 40 percent over 2022 but small in comparison to the world leaders. (Transaction data is not yet available for the FedNow® service, which launched in mid-2023.) As of March 2024, roughly 5 percent of US financial institutions participate in one or both US networks, with each service reporting more than 500 participants. This shows that we in the United States are still in the early phase of instant payments.

In my view, definitions of the three payment terms—faster, instant, and real-time—are blurring. Whatever term you prefer, the global and US data both imply that customers will continue to want faster and secure payments. The name probably will not (and should not) matter to them.