The 2020 pandemic drove many people into digital banking, and they haven't looked back. According to a survey the American Bankers Association conducted in September 2023, consumers use mobile and online banking services (48 percent and 23 percent, respectively) more than they visit branches (9 percent). Many banks have adapted by closing branches and enhancing their digital capabilities, which has sometimes created banking deserts.

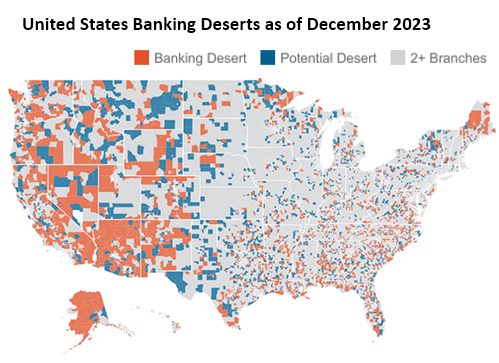

Technically, a banking desert is a census tract without a physical bank branch within a specified radius from its population center or within the tract itself: two miles for urban communities, five miles for suburban communities, and 10 miles for rural communities. A potential banking desert is a census tract that will become a banking desert if one bank branch closes within that same radius. The Federal Reserve has developed a dashboard of such deserts

.

With the rate of bank branch closures doubling since 2020, where are the concentrations? The map shows banking deserts by census tract. When we look at the radius groups, we can see that 66 percent are in suburban areas, 20 percent in urban areas and 14 percent in rural areas.

In 2023, the Philadelphia Fed published a report on branch closures by asset size and demographics. They provide a deeper lens into closures using the same banking desert data and estimate that 12.3 million people are living in banking deserts. Overall, the number of bank branches declined by 5.6 percent from 2019 to 2023. By community type, the number of branches for suburban areas decreased 6 percent and urban areas decreased by 6.1 percent. Rural areas experienced a smaller decrease of 4.2 percent. By asset size, large banks ($10 billion to $50 billion) and very large banks (greater than $50 billion) had the most closures, dropping by 11 percent and 12.6 percent, respectively. Community banks, which have assets of less than $10 billion, increased their footprint by adding 1.1 percent more branches.

The Philadelphia Fed also reported that among census tracts with higher concentrations of older people, 4.8 percent of residents are in banking deserts. Likewise, among tracts with more disabled people, 5.8 percent of residents are in deserts. And among tracts with majority American Indian and Alaska Native populations, an eye-popping 46.4 percent of residents live in banking deserts —more than 12 times the national average.

Banking deserts may hurt vulnerable populations like these, who are already less likely to have access to online and mobile banking. According to the Fed's banking deserts dashboard, broadband is hard to come by in 39 percent of banking deserts. With restricted access to financial services, these populations may not be able to participate fully in the economy. The Federal Reserve is committed to helping the United States economy work for everyone so that it can accomplish its mandate of maximum employment. That is why the Atlanta Fed is researching barriers to financial inclusion and helping bring awareness to programs like the Native Economic and Financial Education Empowerment program, headquartered at the St. Louis Fed, which is working to support the financial well-being of tribal nations and Native communities.

Stay tuned for more thoughts on improving access to the financial system.