Cryptocurrencies have been around for over a decade, yet the way they operate, their value, and their impact on traditional payments remains puzzling—even to me. While Bitcoin and Ethereum dominate the headlines, stablecoins are quietly becoming a significant part of our daily lives.

When I first heard about stablecoins, they were a niche tool for crypto traders seeking to avoid volatile price swings. Today, stablecoins are moving into the mainstream and showing up in unexpected places like food delivery services, gas stations, and retailers. This evolution made me wonder: how did stablecoins go from being a safe haven for crypto investors to a credible payment method?

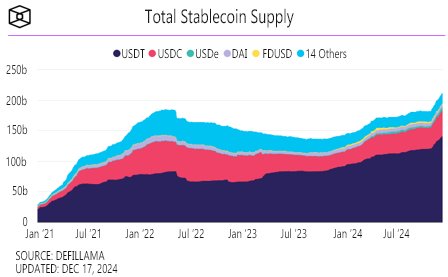

Stablecoins first gained attention around 2014 with Tether (USDT) which offered the speed and efficiency of digital currencies without wild price swings. Pegged 1:1 to real-world assets like the US dollar or commodities like gold, stablecoins brought the stability that Bitcoin and Ethereum lacked, making them practical for everyday transactions. Over time, they have bridged traditional finance and blockchain technology. Today, the total value of all stablecoins in circulation exceeds $200 billion, of which more than 98 percent are backed

by US dollars. To put this into perspective, their value is comparable to the gross domestic product of countries like New Zealand or Greece.

Stablecoins have grown beyond trading tools. Retailers such as Overstock, Chipotle, Whole Foods, and GameStop now accept them, though their impact is minimal. Stripe recently enabled merchants to accept USD Coin (USDC), the second most popular stablecoin. Regal Cinemas offers a 10 percent discount on tickets and concessions for USDC payments, becoming the first major movie theatre chain to do so.

So why are businesses suddenly embracing stablecoins? They reduce transaction fees, settle almost immediately, and attract crypto-savvy customers, helping businesses stay competitive in a digital-first world. Beyond retail, platforms like Travala lets users book travel services with USDC or USDT. Bitrefill

meanwhile, enables customers with gift cards purchased with stablecoins to shop at merchants like Amazon, Walmart, and Starbucks even if those merchants don't directly accept digital assets.

The future of stablecoins as a payment method is still unfolding, but as digital assets gain wider acceptance, their adoption could grow, potentially rivaling credit or debit cards. However, risks remain, including concerns over the stability of the assets backing them, regulatory uncertainty, and security vulnerabilities like cyberattacks. Stablecoins used in decentralized finance platforms also face risks such as smart contract failures and liquidity issues. Despite these challenges, ongoing development and regulation will shape stablecoin's future in payments.

While it's hard to predict whether or not stablecoins will become a universal payment method, the foundation is forming. Once seen as a hedge against crypto volatility, stablecoins are establishing themselves as a new, innovative payment type. These digital currencies are influencing the future of payments such as purchasing a coffee with a gift card purchased with stablecoins or buying a ticket for a movie at a discount.

One thing is certain: the future of payments looks a lot more stable.

Keep an eye out for more posts on stablecoins as we continue to explore this growing market.