The story of payments over the past fifty years is like the story of a popular crème-filled cookie. In 1969, when my grandmother went shopping, she typically faced a simple choice: cash or paper check? If she wanted cookies with filling, she faced another simple choice: one package or two?

Fast forward fifty years, and the story of innovation in consumer products and services shows itself in the cookie aisle and at the cash register. The cookie shelves are double-stuffed with choices: birthday, lemon, gluten free, green tea, golden, etc.

At checkout, our wallets also are stuffed with choices. The typical American has many ways to pay: card or bank account info stored in mobile apps, direct payments from a bank account, physical cards, money stored in apps, cash, and more.

In 2024, more US consumers had payment cards than had bank accounts according to the Survey and Diary of Consumer Payment Choice . In the prior 12 months, 71 percent of consumers made a mobile payment, and more than 60 percent of bills were paid electronically from a bank account. The majority of those transactions were via the Automated Clearing House (ACH) network, which did not exist back in my grandmother's day.

But traditions live on—including the OG vanilla-filled chocolate cookie (invented in 1912) and older ways to pay. Here are some examples from October 2024:

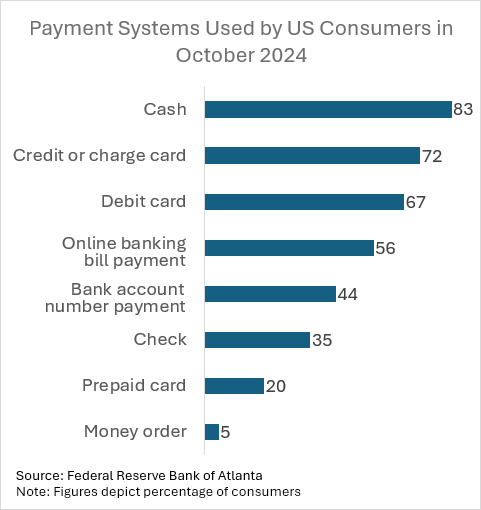

- More consumers used cash to pay at least once than any other payment instrument: 83 percent of US consumers 18 and older used cash in the prior 30 days.

- For the same 30-day period, 35 percent used a paper check.

The chart below shows that while we adopt new ways to pay, we keep the old. Even though almost all consumers had used some kind of payment card (credit, debit, or prepaid) in the past 30 days in the survey, they still used cash and checks, too. Our wallets, like the cookies, are stuffed.

For more data on consumer payments in October 2024, see the survey report and data release .