The other day, I pre-ordered my coffee in an app, stopped into my local shop, and walked out with my drink. No wallet, no personal identification number, no paper receipt—just a quick, unremarkable moment. It made me realize how much payments have faded into the background of daily life. What used to be a clear step in the transaction process is now often barely noticeable.

This shift reflects the growing presence of embedded and invisible payments. The two are related but distinct. Embedded payments are integrated directly into an app or platform—still visible but streamlined. You might tap to authorize a purchase, but the experience is smooth and self-contained, like ordering ahead through an app and picking up your drink without interacting with a cashier. By the end of 2023, more than 31 percent of Starbucks' US transactions were processed this way.

Invisible payments go further—often requiring no active authorization step at all. Transactions are triggered automatically using sensors, account credentials, or behavior data. At Amazon Go stores, cameras and radio frequency identification technology track what you take, and your account is charged as you walk out—no checkout, no tapping, no scanning. Sam's Club has introduced a "scan and go" system that allows shoppers to scan items with their phones and skip the checkout line. Over the past three years, use of this feature has grown by 50 percent, with one in four customers now using it.

This evolution is reflected in data from the Federal Reserve Board of Governors, which shows a rise in card-not-present (CNP) debit card transactions; that is, those initiated online or through mobile apps. In 2021, these accounted for nearly one-third (32.1 percent) of all debit card transactions. CNP debit card volumes grew faster than card-present volumes every year since 2009. This sustained shift highlights a broader move away from traditional physical card use and toward digital payment interactions, reflecting the growing adoption of embedded and invisible payment experiences.

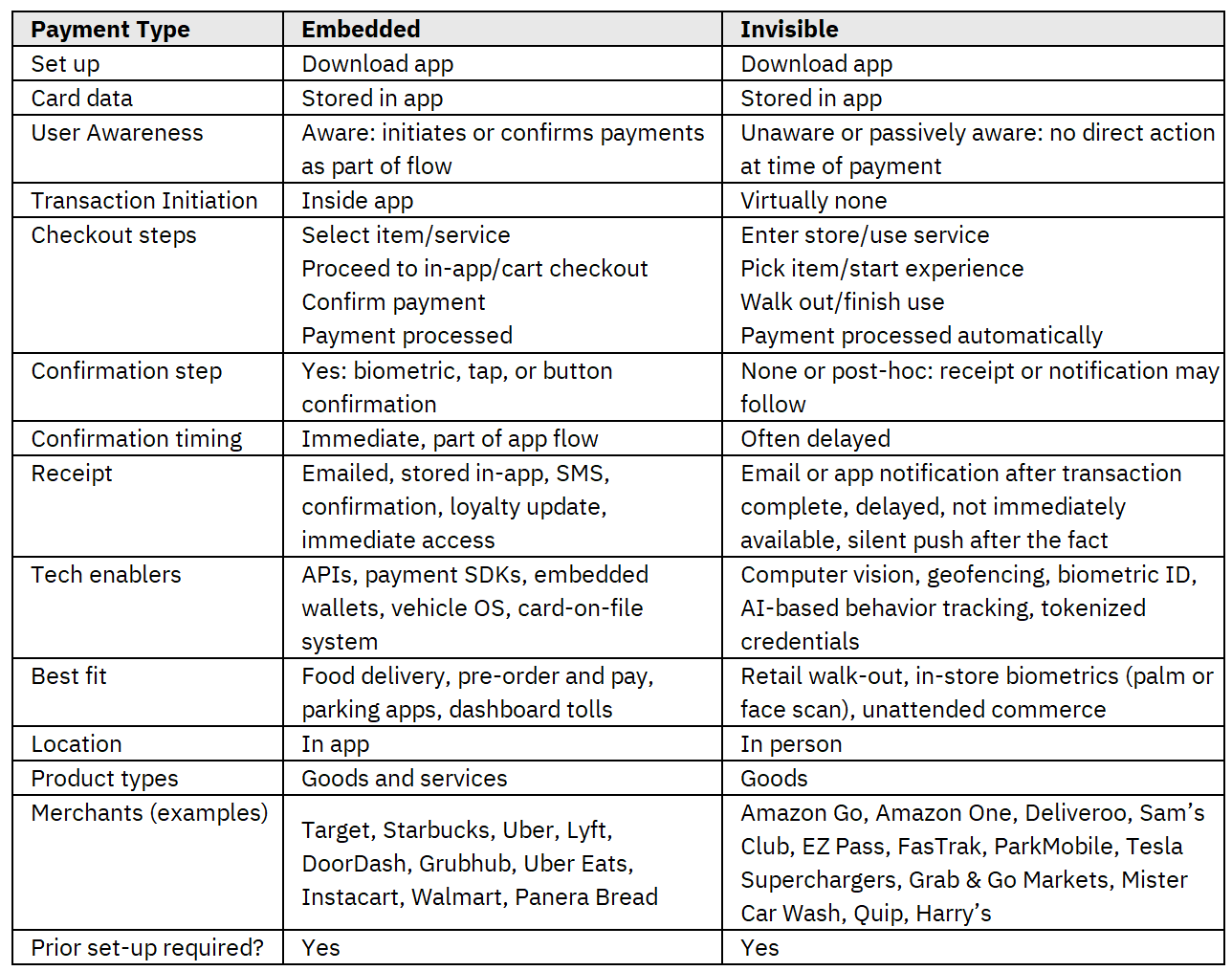

Here's a quick breakdown of what sets embedded and invisible payments apart:

As embedded and invisible payments systems scale, they bring benefits and trade-offs. They reduce friction, shorten wait times, and align with mobile-first lifestyles—making transactions faster and more convenient. But that ease can come at the cost of clarity. When payments fade into the background, losing track of spending, overlooking transactions, or feeling less in control of financial decisions becomes much easier. Privacy, data security, and budgeting all become more complex. The more seamless the experience, the more important it is to design for transparency, trust, and user awareness. The future of payments may be frictionless, but it's not thoughtless.