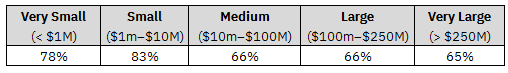

The 2024 Federal Reserve Payments Insight Business Study by Federal Reserve Financial Services (FRFS) found that paper checks remain a leading payment method among the nation's small businesses. Despite the growing availability of digital alternatives, businesses with less than $10 million in annual revenue continue to rely on checks for their outgoing payments. The study found that nearly 80 percent of "Very Small" firms with revenue under $1 million use checks while "Small" firms lead all segments with 83 percent using paper checks for business payments.

By contrast, check usage drops sharply among larger companies. Two-thirds of "Medium" and "Large" firms report using paper checks, highlighting an inverse relationship between company size and check utilization. The FRFS data suggests that even as digital payment adoption increases, small businesses remain the exception, keeping paper checks at the forefront of their day-to-day financial operations.

Table 1: Past 12 Month Check Payment Usage

Source: 2024 Federal Reserve Business Payments Study

Despite their popularity with smaller firms, checks come with significant risk of fraud. A 2024 study by the Association of Financial Professionals (AFP) found that checks continue to be the payment method most often subject to fraud. Since 2020, about two-thirds of businesses reported check-related payment fraud in every year of the AFP study.

Given the risks and other digital payment options available, why are firms sticking with checks?

- Familiarity and controls: Smaller firms may rely on long-standing accounts payable practices that feel tangible and secure. Physical signatures and approval chains are familiar procedures and touching a payment can feel safer than relying on a digital rail.

- Hefty system upgrades: In some cases, upgrading to digital payments requires investment in new platforms, leading to more employee training and redesigning established processes. As one industry expert told me, there's a "misalignment of incentives" where payees reap the benefits of digital payments in the form of faster settlement and increased cash flow visibility, and payers don't see the same return on their investment.

- Remittance details travel with checks: Checks are often accompanied by remittance data in the form of purchase order number or a copy of the invoice. This simplifies the invoice-matching process for accounts receivable staff and plugs neatly into accounting software. Because digital payment formats can vary depending on the accounts payable platforms, they may require manual interpretation.

- Float as a liquidity tool: The time delay between writing a check and the funds leaving a bank account can be a form of short-term liquidity management. An additional day or two can be meaningful for smaller firms with a tight cash cycle or unpredictable inflows. Some small business owners take advantage of having the weekend to reconcile their books since a check written on Friday won't clear until Monday.

- Avoiding acceptance fees: For payers, checks can feel cheaper than alternative payment methods, which may involve interchange or acceptance fees. However, one study

shows that processing fees costs an average of $4 per transaction once labor, bank, printing, and postage fees are included. In contrast, the average electronic payment costs $0.28 per transaction.

Research from the Federal Reserve along with industry reports suggest that paper checks serve a practical and strategic purpose for smaller firms. Although data shows that paper checks are most frequently exposed to fraud, they still meet the operational needs of small businesses. Their persistence demonstrates the tradeoff smaller firms make between efficiency, cost, and control.