Last July, our Atlanta Fed colleagues concluded that the COVID-19 pandemic would not decrease demand for commercial real estate (here). As the COVID-19 pandemic passes the one-year mark, have expectations on what a "return to the workplace" looks like changed for businesses and their employees? Many firms continue to allow employees to work from home (here and here). Anecdotes suggest that many are reimagining their office culture as they scrutinize empty or underutilized office space in an effort to reduce structural costs. Has this also resulted in a significant shift in demand for office space?

To understand how office market performance fundamentals have changed since the COVID-19 pandemic began, we examine office-using employment, vacancy rate, and rental rate trends across the 10 cities with the highest office space square footage stock. We hypothesize that markets with higher office space inventories likely have more office workers and may experience larger, longer-lasting effects resulting from massive shifts to remote work arrangements.

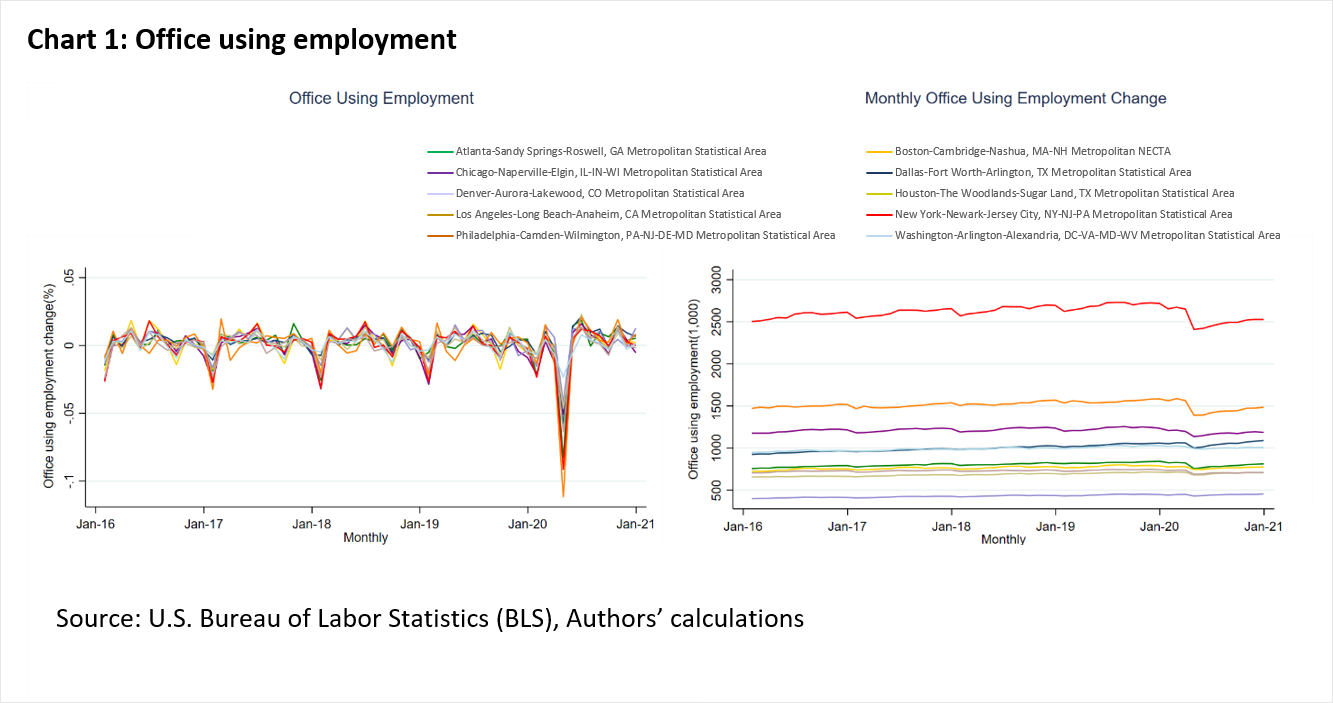

The United States experienced significant declines in employment due to COVID-19, but what was the effect on the office-based workforce? Using the Bureau of Labor Statistics' office-using employment series at the metropolitan statistical area (MSA) level, we observe in chart 1 that the number of employees using commercial office space has declined significantly in the pandemic. The graph on the right illustrates the monthly change in the number of employees using offices, which decreased by 6 percent on average from March 2020 to April 2020. The decline was most severe (11 percent) in the Los Angeles-Long Beach-Anaheim, CA MSA and mildest (2 percent) in the Washington-Arlington-Alexandra, DC-VA-MD-WV MSA. Although most markets saw a positive change in May 2020, the graph on the left shows that the number of employees using physical office space is still lower than it was before the start of the COVID-19 pandemic.

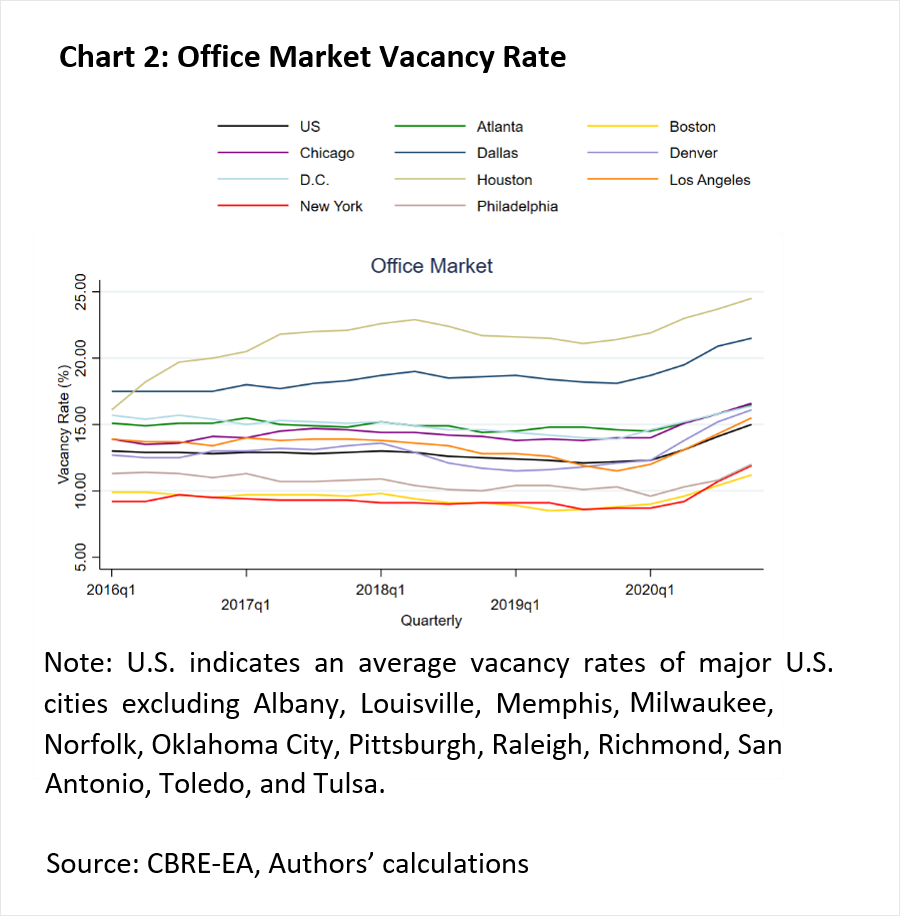

The survey conducted by our colleagues in June 2020 (here) indicated that roughly 80 percent of respondents had no plans to change their current floor space needs. It seems reasonable, however, that the significant decline in office-using employment across metro areas with the largest office stock might translate to higher vacancy rates. Recent office market data from the CBRE Economic Advisors (CBRE-EA)1 indicate that office market vacancy rates increased significantly in 2020. Chart 2 illustrates stable vacancy rates before the COVID outbreak. Following the outbreak, in the second quarter of 2020, vacancy rates moved up. The overall office market vacancy rate was 12.2 percent in the fourth quarter of 2019 and 12.3 percent in the first quarter of 2020, then steadily increased through the year to 15 percent in the fourth quarter of 2020. All markets experienced vacancy rate increases for office space, with markedly different changes. Changes for the Denver and New York office market vacancy rates, for example, were larger than for most other cities. Denver's increased by 30.89 percent from the first quarter of 2020 to the fourth quarter (from 12.3 percent to 16.1 percent) while New York saw the largest jump (36.78 percent, from 8.7 percent to 11.9 percent). Interestingly, although Denver experienced the second highest jump in vacancy rates in 2020, the Denver and Houston MSAs did not experience a dramatic change in the number of employees using office space in 2020.

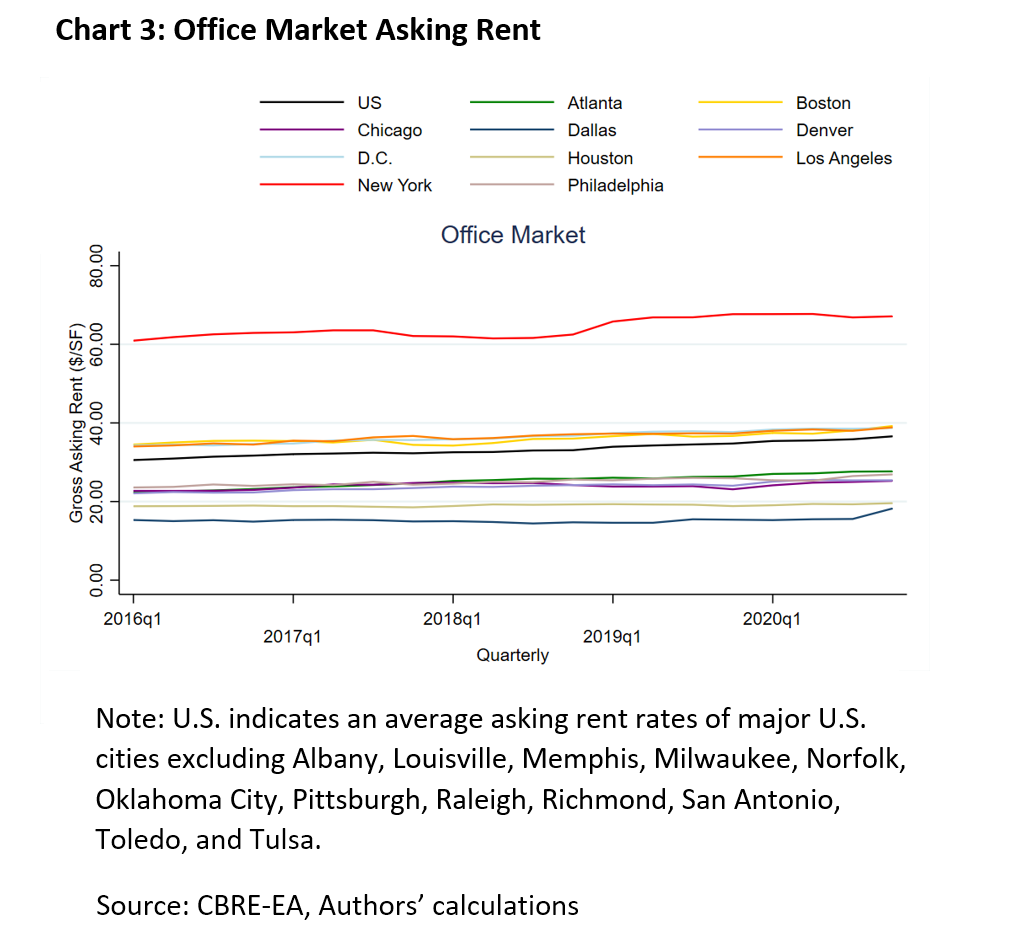

Observing that office space vacancy rates increased significantly during the pandemic, we wondered if landlords renegotiated rent rates, so we explored the trend in gross asking rent. This is the estimated rent rate for a gross lease type where a landlord is responsible for expenses such as utilities and property taxes. Chart 3 illustrates trends of gross asking rent per square foot from the first quarter of 2016 to the fourth quarter of 2020. The data indicate that the asking rent rate did not change significantly during the pandemic compared to the previous period. While gross asking rent in the Dallas market increased slightly from the third quarter of 2020 to the fourth quarter, it was a relatively minor change. With such a high level of uncertainty, it's possible that real estate firms and investors were not convinced they needed to adjust asking prices. Another possibility is that tenants received longer periods of free rent in exchange for not adjusting rent prices downward. This second scenario effectively makes rents cheaper, although contract rates appear to be the same. We are unable to investigate further due to the unavailability of prerequisite data.

Summary

We explored office market fundamentals since the onset of the COVID-19 pandemic and found that office-using employment declined while vacancy rates for office space increased significantly. How office property asking rent rates have responded to the pandemic remains unclear. Due to the long terms required for commercial leases, landlords appeared unwilling to lower rents because they expected that market conditions would soon improve.

Since firms remain uncertain as to when employees will return to the office, policymakers and investors should monitor current office market vacancy rates to best prepare to operate in an environment with sustained high vacancy rates. Will some firms have to reimagine their space and convert assets into different property types? We'll continue to monitor these market fundamentals, including property conversions, and report back. Meanwhile, you can track trends in market fundamentals with the Atlanta Fed's Commercial Real Estate Momentum Index.

1 [go back] CBRE- Econometric Advisors (EA) release quarterly data on the commercial real estate markets.