Three Lessons for Building an Inclusive Economy

In 2021, the Atlanta Fed explored the state of household financial well-being in the Southeast through two expert-led webinars within the Inclusive and Resilient Recovery series. We addressed this topic because the nation’s economy is healthiest when everyone can thrive economically. Household financial well-being provides a lens into what affects economic mobility and resilience for individuals and families.

Measures of financial well-being show disparities across the population by education level, age, marital status, and race and ethnicity.1 Although racial and ethnic disparities are not always the most pronounced, our Inclusive and Resilient Recovery webinar series focused on inequities between White and predominantly Black and Latino/a communities.

The Atlanta Fed aims to understand opportunities for economic participation for groups that have traditionally been excluded from the economic mainstream, recognizing that deeper inclusion through career pathways and access to financial services is needed for the economy to reach its full potential.

Our 2021 webinars asked experts in the field how we can keep the pandemic’s impact from widening the gaps in financial well-being—and even use it as an opportunity to close them. Read on for our top three takeaways.

1. Household financial well-being has a specific definition.

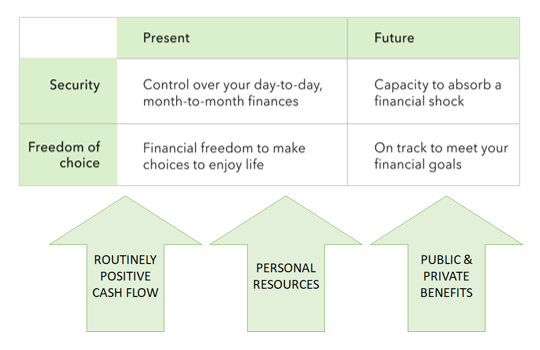

Experts in the May 2021 webinar defined household financial well-being as the ability to have both security and freedom of choice, in the present and in the future. The following table comes from a report that elaborates on this definition, discussed by Irene Skricki at the Consumer Financial Protection Bureau (CFPB). She and copanelist Genevieve Melford of the Aspen Institute helped develop it at the CFPB, along with a scale to measure financial well-being in any household.

Source: Adapted from the Consumer Financial Protection Bureau, Financial well-being: The goal of financial education, January 2015, and the Aspen Institute Financial Security Program, The State of Financial Security 2020, November 2020

Financial well-being rests on three critical systems. The Aspen Institute’s Financial Security Program describes them as three pillars, represented by the arrows above: routinely positive cash flows (income minus expenses), personal resources (savings and wealth), and public and private benefits (the government safety net and other types of insurance).2 In other words, Melford shared, people need to have income that is typically higher than the cost of their basic needs to build savings and wealth. She noted that benefits are important, too, whether they are "provided by the government, employers, [or] other institutions," because many households cannot self-insure against all events that would disrupt their finances, like a bout of poor health, the death of a loved one, the loss of a job, or a divorce.

2. To improve financial well-being, focus on systemic barriers.

Systems, through policy and practice, can affect household financial well-being as much as or more than individual financial choices do. A focus on systems means addressing the root causes of disparities in financial well-being. History and data indicate that these disparities can be inextricably linked to race, often resulting from instances of systemic racism. For example, the historic practice of redlining prevented many people of color from building wealth through homeownership.3 Other examples of how systemic barriers have created inequities, and strategies to address them, came up during the 2021 webinars and in related content:

- Labor market systems. Systemic factors affect the labor market, evidenced by the fact that the unemployment rate for Black workers has for decades been roughly double that of White workers. In the May webinar, former Atlanta Fed staff member Nisha Sutaria described how COVID-19 widened this gap, since pandemic-related job loss disproportionately affected people in low-paying industries. Black and Latino/a communities especially felt the burden of lost work because workers of color are highly represented in these industries, a situation often called occupational segregation.4 Evidence suggests that patterns of occupational segregation can be explained in part by discrimination in hiring and pay rates, as well as by educational attainment differences across racial and ethnic groups.

- Wealth-building systems. Assets such as homes, savings accounts, and other investment vehicles are primary pathways for building wealth and increasing net worth. However, presenters at the webinars discussed how the systems that govern these pathways can produce persistent wealth gaps along racial and ethnic lines. While median household wealth has grown across all racial and ethnic groups, median wealth for White families is nearly eight times that of Black families: $188,200 versus $24,100. It is over five times the median wealth of Latino/a families, which is $36,100.5 Research suggests that at the current growth rate, it will take 228 years to close the Black-White wealth gap. Such large disparities did not grow simply from individual financial choices. Redlining, as mentioned, allowed the housing market to prevent Black people from building wealth through home ownership for much of the 20th century. Occupational segregation today can make it harder for Black and Latino/a workers to save enough to build wealth. In addition, May webinar panelists pointed out, wealth and credit systems are connected. Lenders can inhibit wealth building when they charge higher fees and interest rates to borrowers with low or no credit scores. The CFPB estimates that people with limited credit histories are disproportionately Black, Hispanic, Asian, or another non-White race or ethnicity. Our May webinar featured discussion of the Capital Good Fund, just one example of how to make safer, affordable credit more accessible.

- Safety net systems. The webinars also identified how systemic factors can inhibit access to benefits, the third pillar of the household financial well-being framework outlined above. Alex Ruder presented the Atlanta Fed’s Advancing Careers project, which highlights the issue of benefits cliffs. A worker experiences a benefits cliff when even small wage increases result in loss of public benefits eligibility and the raise isn’t sufficient for the family to make ends meet independently. In other words, career advancement with increased wages in some situations can lead to a loss of public benefits, leaving the worker financially worse off and creating disincentives for career progression along a path to economic self-sufficiency.6 To support the financial well-being of people facing these and other obstacles, carefully designed cash transfer programs can play a role. The webinars highlighted two innovative transfer examples. Alex Camardelle at the Joint Center discussed how the Expanded Child Tax Credit (CTC) implemented nationwide in 2021 had a positive impact on its recipients’ financial security and other measures of well-being. Additionally, Hope Wollensack at the GRO Fund previewed an Atlanta-based guaranteed-income pilot, a program that, like the Expanded CTC, provides monthly cash payments to qualifying households.7

Interventions focused on financial literacy and individual decision-making are an important piece in the puzzle of household financial stability, noted webinar panelists Andy Posner and Monica Rodriguez Lucas of Capital Good Fund. They indicated, however, that up against these systemic forces, financial coaching and literacy programs are not a panacea. Without taking systems and structures of inequality into account, they have a limited ability to eliminate disparities in financial well-being.

3. Design interventions to address disparities.

In the July 2021 webinar, panelists explored why systems related to financial well-being continue to produce disparate outcomes by race despite appearing race-neutral by design.8 As noted in the San Francisco Fed’s Racial Equity Primer, many policies and practices do not account for the fact that "communities of color, particularly Black communities, have a different starting line and continue to face ongoing discrimination." Webinar panelist Talethia Edwards with Tallahassee’s HAND-up Project pointed out that programs and policies can be "created from a place of privilege" when developed independently by policymakers or agency leaders in more economically and socially empowered groups. These policy creators may be unaware of and fail to account for barriers specific to racially disadvantaged communities, she said.

How can we remedy the disparate impacts of certain race-neutral policies? July panelists agreed that more equitable outcomes require programs designed through authentic collaboration with people from predominantly Black, Latino/a, and other marginalized communities. Alicia Johnson at Step Up Savannah elaborated, "people-centered community investment is necessary to reach the groups that need it the most." Walmart’s Monesia Brown shared how the business sector can model this kind of collaboration. Her company’s philanthropic arm learned to support already existing initiatives instead of creating new programs "from scratch." For example, they expanded a Florida housing authority’s effort to improve community members’ income and thus their financial well-being by training and hiring workers in property maintenance trades. This example, grounded in the experience of underserved families and communities, highlights how collaboration and funding made use of an existing opportunity to expand economic participation.

Household financial well-being is an important lens for the Atlanta Fed’s community and economic development work to examine economic disparities. It clarifies complex relationships among systems that affect earnings, wealth, and benefits. It also underscores the value of partnerships that place household needs at the center. The Atlanta Fed aims to collaborate to learn about and advance financial well-being across the Southeast. Reach out to Julie Siwicki to share examples of efforts to improve household financial well-being in your community and to learn more about the work of the Atlanta Fed.

Read more from our expert panelists:

- Brittany Birken and Alex Ruder, Federal Reserve Bank of Atlanta, Advancing Careers for Low-Income Families

- Monesia Brown, Walmart, In Fight against COVID-19, Walmart Foundation Grants Go Local

- Alex Camardelle, Joint Center for Political and Economic Studies, Cash Matters: Reimagining Anti-Racist TANF Policies in Georgia

- Talethia Edwards, HAND-up Project, Pop-Up Preschool Prganizers Plan for Summer Return

- Alicia Johnson, Step Up Savannah

- Genevieve Melford, Aspen Institute Financial Security Program, The State of Financial Security 2020: A Framework for Recovery and Resilience

- Andy Posner and Monica Rodriguez Lucas, Capital Good Fund

- Irene Skricki, Consumer Financial Protection Bureau, Financial Well-Being Resources

- Nisha Sutaria, Federal Reserve Bank of Atlanta, Financial Resilience Challenges during the Pandemic

- Hope Wollensack, Georgia Resilience and Opportunity Fund, O4W Community Survey on Financial Well-Being

By Dontá Council, CED adviser, Mary Hirt, CED research analyst II, and Julie Siwicki, CED adviser. The views expressed here are the authors' and not necessarily those of the Federal Reserve Bank of Atlanta or the Federal Reserve System. Any remaining errors are the authors' responsibility.

_______________________________________

1 These include the Consumer Financial Protection Bureau’s 2017 report, Financial Well-Being in America; the Federal Reserve Board’s report, Economic Well-Being of U.S. Households in 2021; and the Financial Health Network’s Financial Health Pulse 2021 U.S. Trends Report.

2 Aspen Institute Financial Security Program, The State of Financial Security 2020: A Framework for Recovery and Resilience. A related model of household finance is outlined in Jonathan Morduch and Rachel Schneider, The Financial Diaries: How American Families Cope in a World of Uncertainty (Princeton, NJ: Princeton University Press, 2017).

3 For more on redlining by bankers and brokers, see Richard Rothstein, The Color of Law A Forgotten History of How Our Government Segregated America (New York, NY: Liveright Publishing, 2017), and supporting materials for the Federal Reserve’s March 2021 event, Racism and the Economy: Focus on Housing. A look back through American history shows numerous other instances of institutionalized racism limiting economic and other opportunities. Examples include slavery, the Indian Removal Act, Jim Crow laws in southern states, and segregation in housing and schools.

4 The US Bureau of Labor Statistics indicates that in 2019, Black or African American workers made up 12.3 percent and Hispanic or Latino/a workers made up 17.6 percent of employment across all industries for workers 16 years and older. However, Black or African American workers made up 21.4 percent and Latino/a workers made up 19.8 percent of those employed in the transportation industry, and 13.9 percent and 27.0 percent, respectively, of those working in the accommodation and food services sector. (Data accessed December 15, 2020.) Both industries are among those defined as "hardest hit" by the pandemic in a 2020 study by the Federal Reserve Bank of Philadelphia.

5 Neil Bhutta, Andrew C. Chang, Lisa J. Dettling, and Joanne W. Hsu with assistance from Julia Hewitt, "Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances," Board of Governors of the Federal Reserve System, September 2020. See also Dedrick Asante-Muhammed, Chuck Collins, Josh Hoxie, and Emanuel Nieves, The Ever-Growing Gap: Without Change, African-American and Latino Families Won’t Match White Wealth for Centuries, CFED and the Institute for Policy Studies, 2016.

6 For a discussion of disparities related to benefits, specifically benefits cliffs, see Elias Ilin, Alex Ruder, and Ellyn Terry , "The Racial Income Gap and Benefits Cliffs," Partners Update, Federal Reserve Bank of Atlanta, September/October 2020.

7 The Federal Reserve Bank of Atlanta does not provide grants or funding to the general public or to partner organizations. We do not endorse or make any representations as to the suitability of partner organizations or their programs, and we do not advise on distribution of funds by partners.

8 For further evidence on disparate outcomes by race, see resources connected to the Federal Reserve’s Racism and the Economy series, including for Racism and the Economy: Focus on the Wealth Divide and Racism and the Economy: Focus on Employment.