The Commercial Real Estate Momentum Index (CREMI) provides easy access to various metrics for individual markets by sector and facilitates comparisons of conditions across markets. The index tracks movements in specific metrics (such as occupancy/vacancy rate, rent growth, and the construction pipeline) and provides a targeted view of real estate conditions in the industrial, multifamily, office, and retail sectors. Additional metrics, including employment and population growth, provide information specific to each sector as appropriate. CREMI derives a momentum index value for each sector within a market and gives an overall momentum index value for the entire market. Upward and downward momentum correspond with aggregated trends in the market metrics, not necessarily indicating "good" or "bad."

July 2021 Spotlight: Comparing Commercial Real Estate Sectors

Every month we explore another aspect of the Commercial Real Estate Momentum Index (CREMI) and how it can inform us about commercial real estate conditions. This month, we will discuss what CREMI tells us about the differences between the recovery or lack thereof in multifamily, industrial, retail, and office properties.

The following graphics illustrate just how differently each property type has been affected by the pandemic and which type of commercial real estate has upward or downward momentum as of the second quarter of 2021. Each property type is discussed in order from highest momentum to lowest.

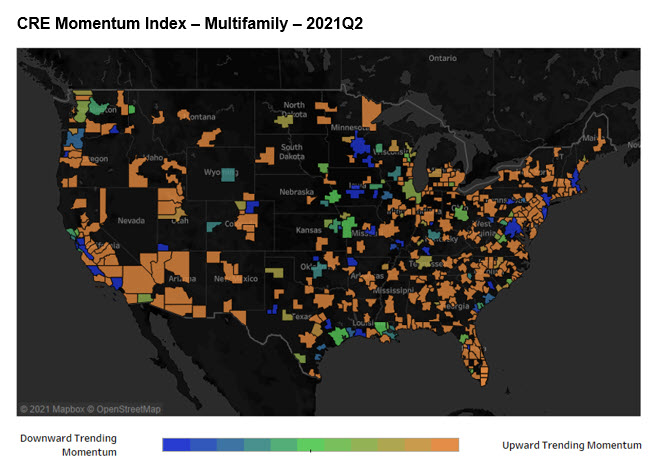

Multifamily: Higher rents and occupancy rates

The multifamily property type has the highest momentum of the four tracked CRE categories with nearly the entire country having upward momentum. As we discussed in the previous CREMI article, pandemic lockdowns kept multifamily construction flat while rapidly increasing housing market prices and limited inventory for those homes left an ever-increasing group of people resorting to multifamily living as the next best option. Rent growth and occupancy were the primary drivers in upward momentum for multifamily. The largest declines in momentum are seen in New York City, Boston, Los Angeles, Washington, DC, and Minneapolis. This is not surprising as these areas typically have had the highest rent rates in the United States and have come down due to COVID-19 and related migrations.

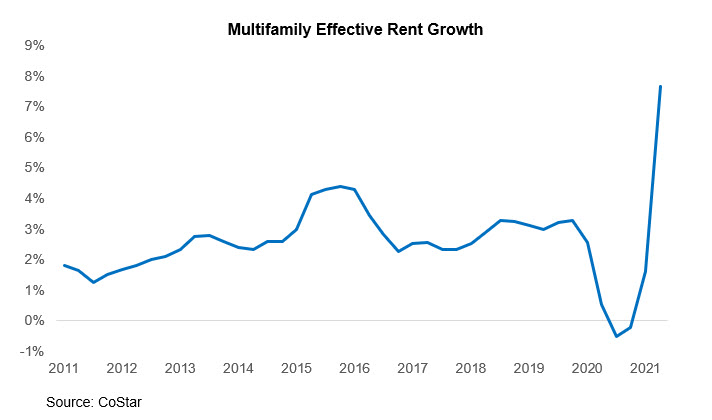

Effective Rent Growth has accelerated markedly from the decade lows at the onset of the pandemic in early 2020 and has grown robustly since the beginning of 2021. Robust rent growth, heightened occupancies, and modest new deliveries in the second half of 2021 are anticipated to continue to put upward pressure on multifamily market conditions. Strong overall national momentum indicates that it is not likely to reverse anytime soon.

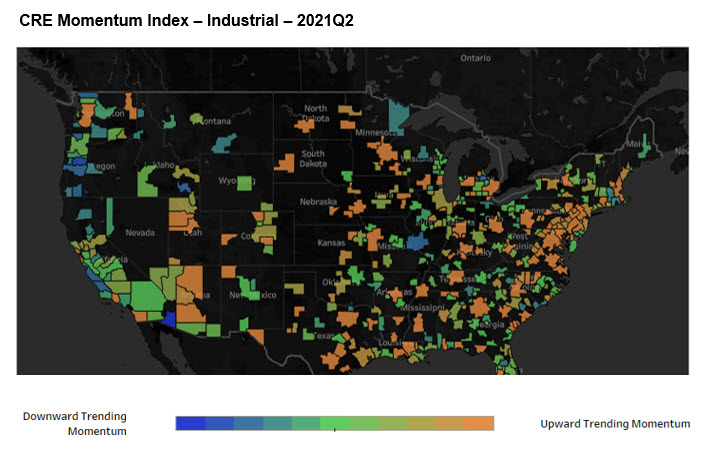

Industrial: Robust rent growth and absorption rates

The industrial sector continues to exhibit robust conditions. A number of the nation's largest industrial markets are experiencing accelerating momentum (Atlanta, Dallas, Houston, and New York/New Jersey). Momentum in the Mid-Atlantic region is among the strongest in the country. Southeast, Midwest, and Western industrial momentum is mixed, while West Coast momentum is slow to declining. Conditions in many markets with exposure to seaports continue to accelerate and remain tight. Overall, these trends are primarily driven by changes in industrial rent growth and strong rates of absorption that have mostly kept heightened amounts of new supply in check. Industrial warehouses are seeing rent increases in urban areas as more and more goods are ordered online and delivered.

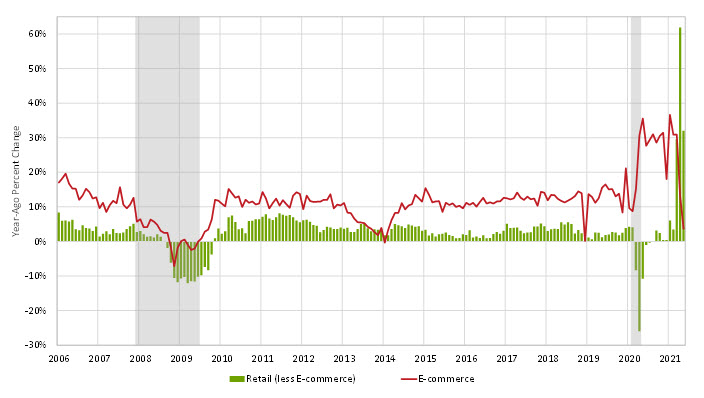

At this juncture, ecommerce is a significant driver of industrial market demand. Due to the onset of COVID-19 and shelter-in-place mandates, remote sales skyrocketed and contributed to the continuing need for distribution warehouses. Additionally, behavior instilled during the quarantine is partially behind continued robust conditions. However, a question has remained around future dynamics: will consumers' behavior permanently shift? Information from U.S. Census Bureau taken after widespread reopenings occurred shows that remote sales growth slowed from the astronomically heightened rates encountered during the pandemic. Following reopenings, in-person sales have grown markedly over the preceding two quarters. At the same point, growth in ecommerce sales has slowed drastically as pent-up consumers returned to some of their prior-to-pandemic in-person shopping behavior.

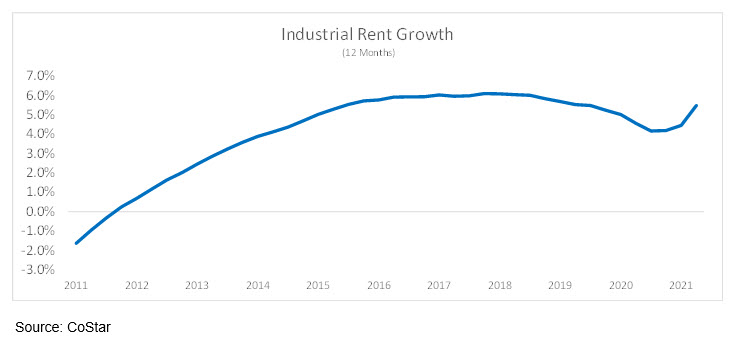

According to CoStar, industrial asking rents began trending upward in the early part of the decade and plateaued between 2016 and 2018 around 5 to 6 percent. Due to significant amounts of supply entering the market, rent growth began to decelerate as early as 2019. This slowdown culminated with the arrival of the pandemic, though the rate of growth only moderated to a rate of roughly 4 percent before it began to reaccelerate in mid-2020. Currently, industrial rent growth is roughly 5.5 percent and is anticipated to climb to at least 6 percent before the close of 2021.

Industrial storage for distribution space is cheaper than retail exhibit for distribution space, so companies are embracing online and mobile purchase demand. Industrial warehouse space is much larger than retail distribution space and eliminates significant expenses related to staffing, checkout registers and machines, advertising, and more expensive urban land locations required for retail distribution. Kroger, Amazon, Walmart, UPS, and Google are among companies exploring distribution by drone from industrial spaces, with several drone programs in the pilot phase. One of the most interesting is Kroger's use of drones to deliver up to five pounds of groceries to households within one mile of a store in Centerville, Ohio. This will require close monitoring since ecommerce has not been able to make significant inroads into grocery sales. In another pilot, Domino's Pizza and Nuro use autonomous vehicles to deliver pizzas in Houston, Texas. While both of these pilots bear watching, many logistical, safety, regulatory, and privacy concerns exist around the use of this technology. However, some form of drone distribution is likely forthcoming in the next few years.

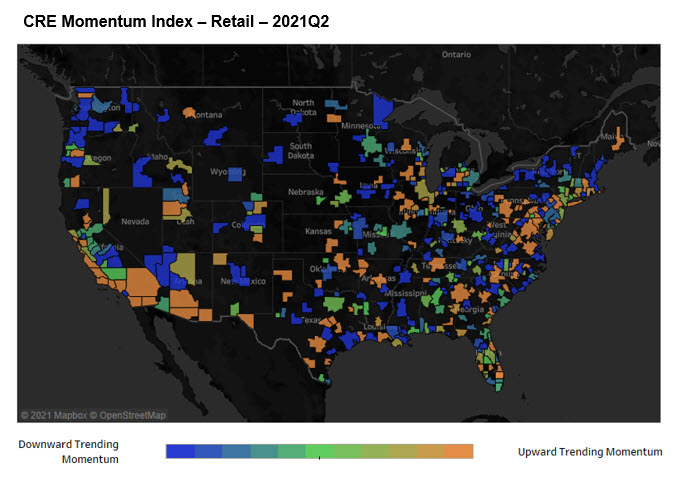

Retail: Up in cities, down in suburbs

Retail momentum is split between urban areas, which are more positive, and suburban areas, which are more negative. The drivers of this trend are primarily higher population density, income, and liquidity that can support more retail activity in large cities. Areas where retail momentum is declining are in many cases affected by a dramatic decline of available labor that would accept going back to lower-wage positions. Many of these workers found ways to earn similar or better incomes working from home during the pandemic. The sale of goods has been impacted by ecommerce as noted above, but the sale of services has been relatively less impacted. Cities also offer a much higher volume and variety of retail services than rural areas.

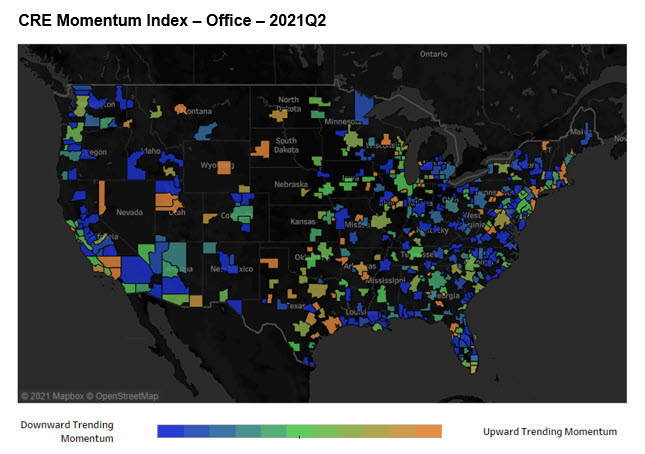

Office: Workers staying home

Office momentum is flat or negative almost everywhere. This is no surprise due to the work-from-home impact of COVID-19 and is expected to continue until more workers return to their offices. Low vaccination rates in some parts of the country and the impact of coronavirus variants could extend office closures indefinitely. Those factors make predicting a rebound in office momentum difficult. Vacancy rates, high across the country, could remain so well into the future as coronavirus variants continue to develop. Companies are taking differing stances on return to work and so are workers. The new model may not return to a pre-pandemic level as some employers opt for a new fully remote workforce model, some elect to have employees work a flexible work week, and some decide that a full return to the office and 5-day work week is necessary. Regardless of these employer decisions, many workers are deciding to quit for quality of life and/or to work for other employers who have decided to allow workers to work from home. Cities with more collaborative and service-related office spaces will see higher occupancy rates than cities and towns with more technology-related office workers who can work from home and be significantly more productive due to significant reductions in commuting time, distractions, and stress.

Conclusion: Differing dynamics drive change

CRE is undergoing sizeable change, whether driven by recent economic data, or longer-term shifts driven by businesses and consumers. This evolution in CRE represents opportunities for both growth as well as increasing risk and depends upon a number of factors. Those dynamics include myriad variables, such as local and national economic, property and financing conditions. One of the biggest influences on CRE momentum is population growth. Shifting population will impact commercial real estate momentum for the foreseeable future, but rates of influence vary widely due to local market conditions.

Bill Poole, senior financial specialist, and Brian Bailey, a subject matter expert in the Real Estate Intelligence Team/Risk Analysis Unit, both in the Atlanta Fed's Supervision, Regulation, and Credit Division