Population aging is the single biggest reason for the US worker shortage, fueling inflation. Eventually, aging likely will push prices down.

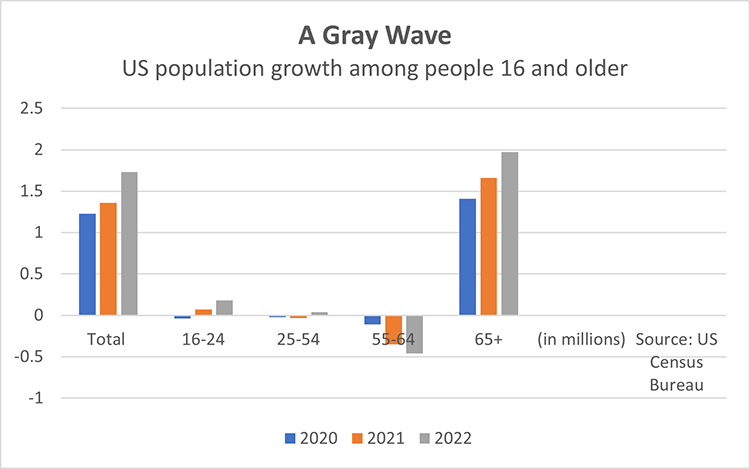

Since 2019, the population of US workers ages 25 to 54 has barely changed while the 65-and-older group has increased by nearly 5 million.

Getting old is tough. Just ask the US labor market.

An aging population is a big reason for the worker shortage that's helped fuel inflation over the past 18 months. Analysis by Atlanta Fed senior policy adviser John Robertson shows that the working age population has hardly grown over the past three years. Instead, virtually all of the recent increase in the population that's 16 and older has been among seniors.

The number of people aged 25 to 54, a group economists call "prime-age" workers, inched up just 40,000 in 2022. Meanwhile, the number of Americans 65 and older jumped by 2 million. That continues a pattern. Since 2019, the prime-age worker population has barely changed while the size of the 65-and-older group has increased by nearly 5 million (see chart 1). These differences affect labor force growth because the prime-age population is far more likely than seniors to be in the workforce.

Tepid working-age population growth can be attributed mostly to three causes—declining birth rates in the years after the baby boom, lower immigration levels, and a surge in mortality mainly due to the COVID-19 pandemic.

Fewer coming in, more going out

The labor force faces not just an entry problem, but also an exit problem. As fewer younger people join the work force, retirements have surged. When the pandemic gripped the United States in early 2020, the retirement rate—the share of the population 16 and older that is retired—leapt from about 18 percent to roughly 19 percent.

That might not sound like much, but it means about 1.6 million people have retired who probably would not have left the labor force had there been no pandemic, says a November 2022 paper by economists at the Federal Reserve Board of Governors. As of October 2022, the retired share of the US population was almost 1.5 percentage points above its prepandemic level, Board researchers found.

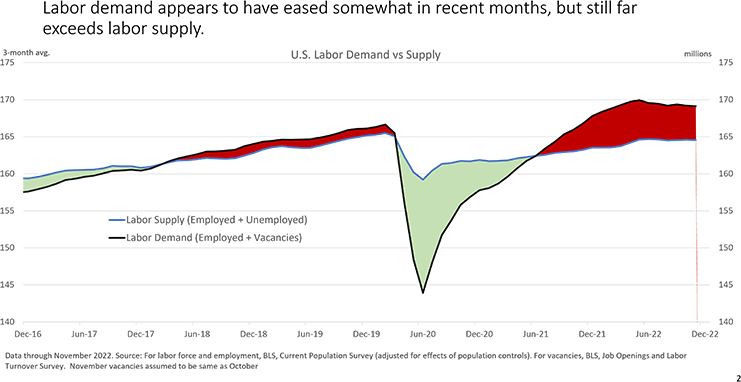

A retirement boom coupled with a shrinking pool of younger people means the labor force is not replenishing itself, Robertson explained, estimating that these demographic currents explain fully half of the gap between labor supply and demand. "This doesn't mean labor supply can't grow faster," Robertson said. "But rebalancing labor supply with demand will require pretty significant behavioral changes in labor force participation, or a more substantial reduction in labor demand."

How significant? The prime-age population's labor force participation rate was rising before the pandemic, from a low of 80.6 percent in 2015 to 83.1 percent in January 2020, but was around 82.4 percent in November 2022. To make meaningful gains in the size of the labor force, Robertson said, the prime-age participation rate would need to rise above its pre-COVID level.

Big demand, small supply, high price

Today, there are roughly 1.7 job openings for every available worker, according to data from the Census Bureau and the US Bureau of Labor Statistics Job Openings and Labor Turnover Survey. That number has gradually declined, but since the summer of 2021 the monthly number of employed people plus open jobs—labor demand—has exceeded the count of employed plus unemployed people—labor supply—by roughly 5 million (see chart 2).

The effect on inflation is clear. When demand for anything exceeds the supply, that raises the price, which in the labor market means wages. Wage growth is good, certainly. Yet the recent high levels—around 5 percent year over year—are not conducive to price stability, Federal Reserve officials explain. Therefore, bringing labor supply and demand closer together is instrumental in the Fed's quest to put inflation on a sustainable path toward its objective of 2 percent, as measured by the Personal Consumption Expenditures (PCE) price index. PCE inflation was 6 percent in October.

Labor market dynamics are especially relevant to inflation today because a key source of inflation now and likely in the months to come is prices for so-called core services, a category that excludes housing-related services such as rent. Goods prices surged earlier in the pandemic as homebound consumers ramped up purchases of furniture, workout gear, computers, and other stuff. Those prices are rising more slowly as consumer spending has reverted to a more typical services-heavy mix, so upward momentum in services prices is now the main impetus to inflation.

Sapping that momentum will require closing the gap in labor supply and demand, thus moving wage growth to a level more in line with lower, stable inflation. Wages are the largest cost in delivering core services—from health care and education to haircuts and hospitality. So, if the biggest cost in providing services levels off, then the prices of those services figure to climb more slowly.

Core services also represent a huge chunk of overall consumer spending, accounting for more than half of the core PCE price index, the batch of prices federal statisticians use to calculate the inflation rate. Core services are the largest of the three major categories of prices, more than goods and housing services.

A return to secular stagnation?

Economists have offered numerous explanations for why more people have not joined or rejoined the labor force. Sickness from COVID, concerns about contracting COVID, lack of childcare, higher-than-usual savings that allow more financial freedom, and even rising levels of opioid addiction have helped to shrink the labor force since early 2020. But the inexorable process of aging appears to be the single biggest reason.

In the here and now, bringing labor market supply and demand into better balance is essential to tackling elevated inflation, and an aging population is not helping. Over the longer haul, an older citizenry is more likely to put downward pressure on inflation and economic growth, Atlanta Fed economist R. Anton Braun wrote in an October article in the Bank's online publication, Policy Hub.

The longer-range effects of aging are nuanced. Braun's research suggests that aging will continue to limit labor supply and help push up wages. At the same time, huge numbers of older people, who generally save more than younger people, will create a "savings glut" that will put sustained downward pressure on real interest rates—rates adjusted to remove the effects of inflation to reflect the real cost of funds to a borrower—and the inflation rate. The second factor, Braun said, probably will prove more powerful.

"The savings glut overwhelms the upward pressure on the inflation rate," he said.

Braun points out that the United States and other industrialized countries slogged through a long period of low inflation, low real interest rates, and low economic growth before the pandemic. The aging of the population, he said, was a major reason for conditions that economists call secular stagnation.

As the logistical and other disruptions of the pandemic fade, Braun figures industrialized economies likely will face slow economic growth, low real interest rates, and downward pressure on prices.