In late March—even before many states had issued shelter-in-place, stay-at-home, or shutdown orders—we noted that firms were bracing for a huge negative impact on sales revenues from developments surrounding the coronavirus. Results from our March Survey of Business Uncertainty (SBU)—a national survey of firms of varying sizes and industries—revealed that disruptions stemming from COVID-19 had led to sharp declines in expectations for year-ahead sales growth.

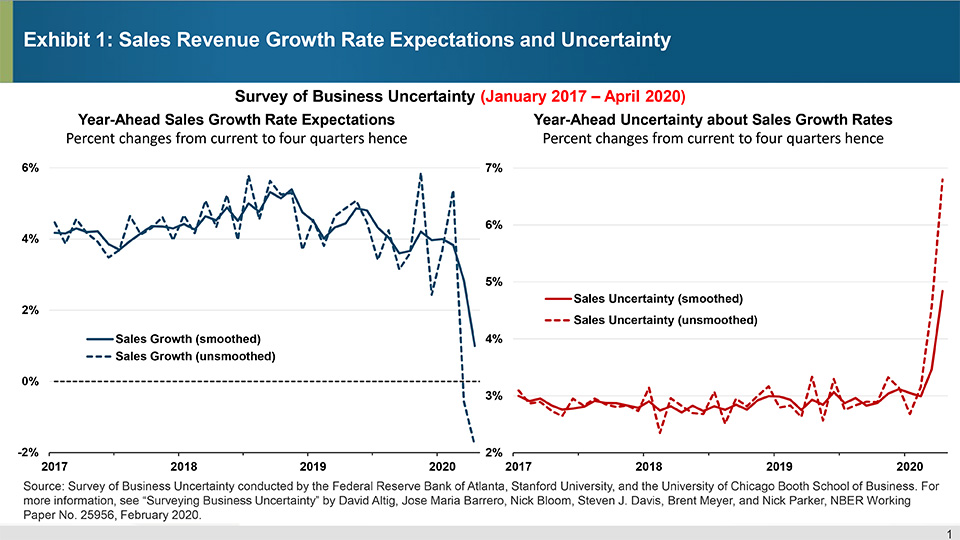

Our April survey, which was in the field from April 13 to April 24, suggests that year-ahead sales growth expectations have only grown bleaker and more uncertain. Exhibit 1 shows that year-ahead sales growth expectations followed up the largest one-month decline in the history of the SBU (which goes back to October 2014) with another sizable decline. Since February, sales growth expectations have fallen by nearly 7 percentage points, and firms' collective view is that by this time next year, aggregate sales levels will be about 2 percent lower than they are now.

At the same time, firms' confidence in those expectations has continued to deteriorate sharply. Year-ahead sales growth uncertainty has more than doubled since the beginning of the year, dwarfing any worries firms may have attached to concerns over trade and tariffs over the previous two years.

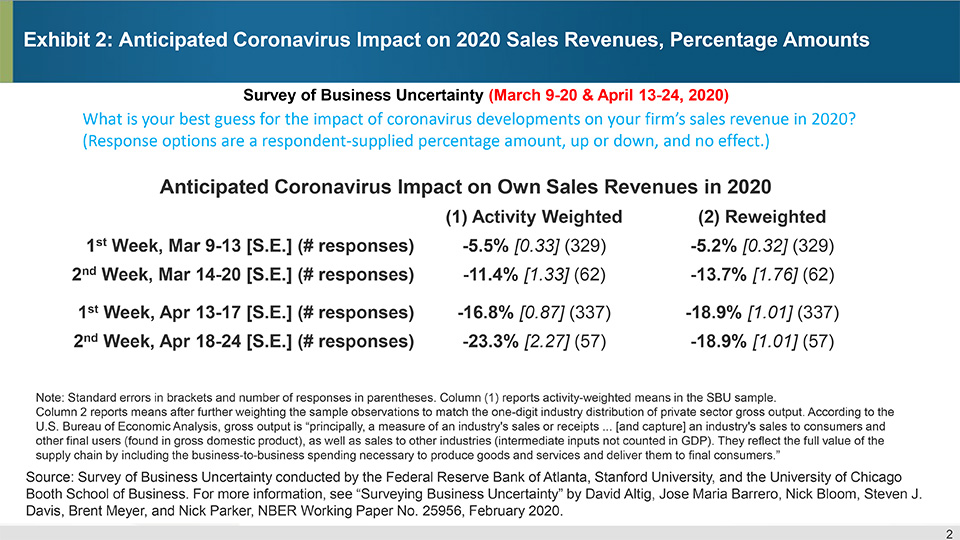

To better understand the impact of COVID-19 on panelists' sales outlook, we posed the following question in March and again (as a part of a larger battery of special questions) in April: "What is your best guess for the impact of coronavirus developments on your firm's sales revenue in 2020?" As exhibit 2 shows, that negative impact has intensified markedly from early March through the fourth week of April. From week to week, as the breadth and severity of COVID-19's impact on Americans' health and U.S. economic performance became clear, firms' collective judgment about the size of the impact has nearly quadrupled—from roughly a 5 percent impact in early March to around 20 percent by late April.

Not only can we see the growing intensity and widening reach of the pandemic in the mean responses, but a cross-section of respondents also makes it evident. In early March, just two-thirds of the panel reported being negatively affected by the outbreak (with a mean COVID-19 impact in that group smaller than minus 10 percent). However, by April, nearly 90 percent of the panel indicated they anticipate a negative hit to 2020 sales revenue as a result of COVID-19 (with a corresponding mean impact of minus 20 percent). Consistent with our findings regarding firms' staffing decisions, a small set (a bit more than 5 percent) of firms anticipate higher sales levels in 2020 as a result of the pandemic.

Perhaps it feels incongruous to use the word "good" as a descriptor at times like these, but perhaps the news from our analysis is that from the first to the second week of the April, the anticipated impact of the pandemic on sales revenue did not continue to worsen materially. This tentative stabilization brings up other fundamental questions regarding how firms' sales growth expectations are coalescing. Namely, when do firms think the cloud of uncertainty surrounding the pandemic will have largely dissipated, allowing them to revert to a more "business as usual" stance? And will they need to tap additional sources of funding to allow them to bridge the crisis?

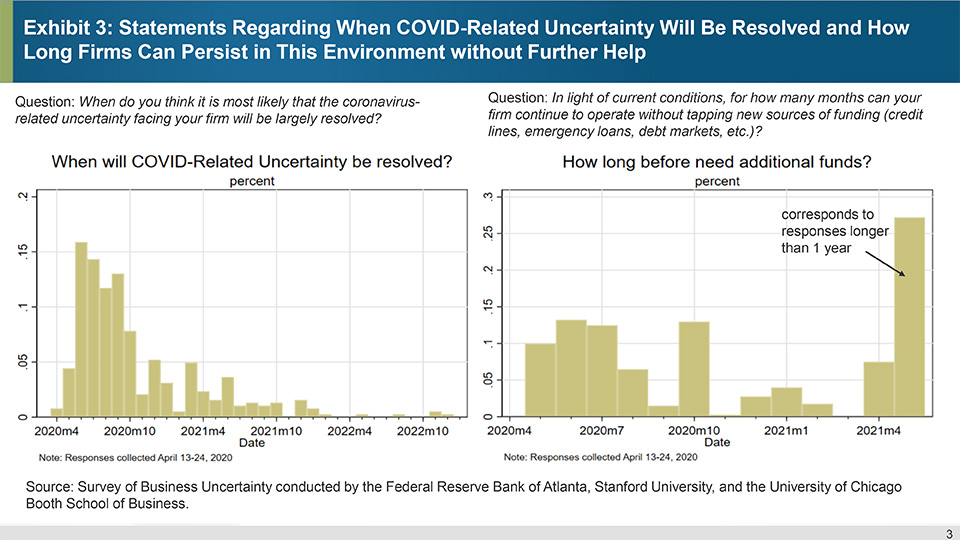

In April, we first posed this question to SBU panelists about their unusually uncertain environment: "When do you think it is most likely that the coronavirus-related uncertainty facing your firm will be largely resolved?" The second question was, "In light of current conditions, for how many months can your firm continue to operate without tapping new sources of funding (credit lines, emergency loans, debt markets, etc.)?" Exhibit 3 shows the responses to these questions.

Roughly three-fourths of surveyed firms expect COVID-19-related uncertainty will be in the rearview mirror by the end of the year. However, the tail of this distribution is quite long, with a few of the more pessimistic respondents anticipating COVID-19-related uncertainty to linger through 2022.

Interestingly, responses to the question regarding the need for additional funding vary quite widely. The typical respondent indicated they would be able to hold out until the start of the fourth quarter without needing to tap new funding sources, should these exigent circumstances persist. And more than a quarter of our panel indicated they'd be able to hold out for at least a year.

Taking a step back and viewing our April survey results as a whole, for the most part firms appear to indicate a relatively optimistic baseline outlook. Year-ahead sales growth expectations, though negative, are nowhere near as bad as the expected impact of COVID-19 on 2020 sales levels. This disparity suggests firms see a very strong snapback in sales activity in late 2020 through the first quarter of 2021, consistent with their collective statement on when COVID-related uncertainty will end. Although that narrative is appealing, let's keep in mind that firms' collective outlook for the year ahead can only be described as "highly uncertain."

By

By  Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School,

Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys