Editor's note: In December, macroblog will become part of the Atlanta Fed's Policy Hub publication.

The book A Mathematician Plays the Market, written by the mathematician and writer John Allen Paulos, includes this line, which is a fitting description of the current economic outlook: "Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security." At the moment, two sources of uncertainty in particular—COVID-19 and the 2020 election—appear to be weighing very heavily on firms' decision-making. And firms in our Survey of Business Uncertainty (SBU) also appear to know how to "live with insecurity," as they are slashing their capital expenditures budget over the next two years by 20 percent, on average.

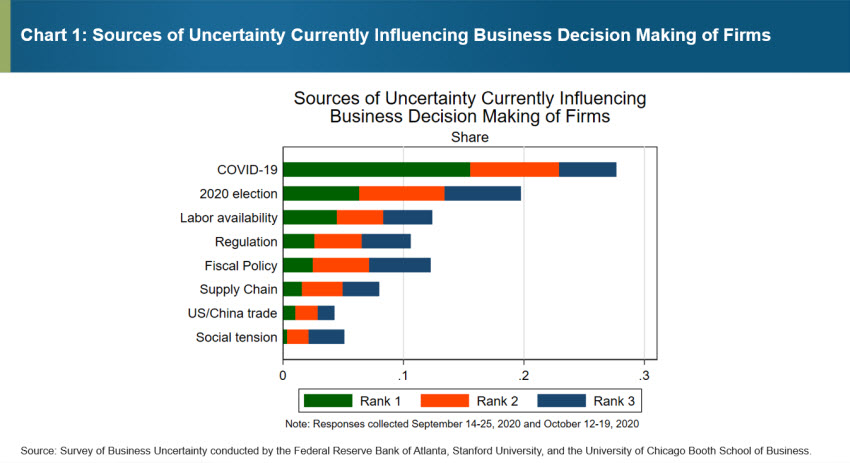

During the past two months, we've asked firms in our SBU to rank the top three sources of uncertainty influencing their business decisions at the moment. The results, seen in chart 1, show that firms are most concerned about uncertainty surrounding the coronavirus and the upcoming 2020 election. Together, these were firms' top sources of uncertainty and account for close to half of all responses, regardless of whether they are ranked as the first, second, or third source of uncertainty.

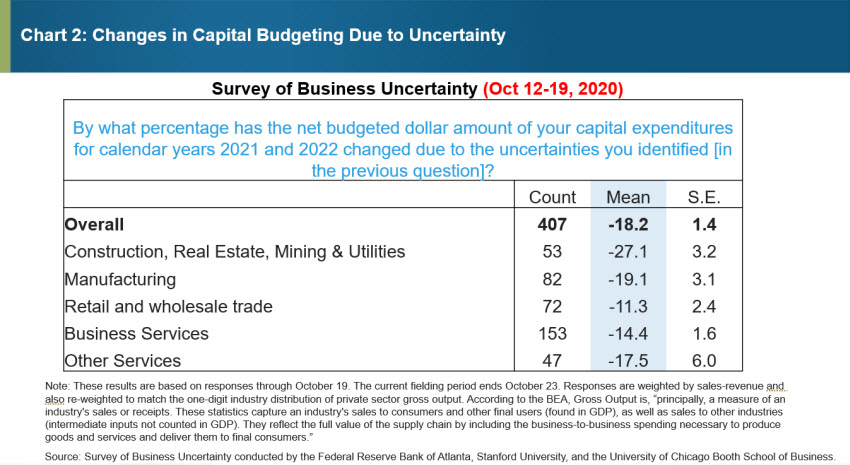

While it likely comes as no surprise that COVID-19 and the pending election are front and center as sources of uncertainty affecting business decisions at the moment, what is interesting is how firms are choosing to deal with these uncertainties. In October, we asked a follow-up question: "By what percentage has the net budgeted dollar amount of your capital expenditures for calendar years 2021 and 2022 changed due to the uncertainties you identified [in the previous question]?" The responses, shown in chart 2, suggest that uncertainty is weighing quite heavily on firms' collective outlook for capital investment.

Of the 407 responses we've collected so far, more than half of firms responded that the uncertainties they identified caused them to decrease their net budgeted amount of capital expenditures over the next two years. Furthermore, just 5 percent (20 firms) have increased their capex budget as a result of uncertainties they identified (with the remaining 44 percent leaving their current budgets intact). On average, firms are slashing their capital spending budgets over the next two years by nearly 20 percent. Across major industry sectors, the impact of uncertainty on capital budgets is uniformly negative. However, it appears more severe for capital-intensive industries such as manufacturing, construction, and mining and utilities.

To put these results in context, we previously posed a battery of special questions to this panel in 2018 and 2019 concerning the impact of tariff hikes and trade policy uncertainty on capital expenditures and found only modest (low single-digit) impacts for the overall panel and across most broad industries.

Turning to comprehensive gross domestic product (GDP) data for the U.S. economy, business fixed investment posted its second steepest decline on record (decreasing at an annualized pace of 27.2 percent) in the second quarter of 2020. Our current results imply a sluggish trajectory for business fixed investment for continuing firms (those that are not just starting up), which may contribute to a tepid recovery for overall GDP growth. One caveat worth mentioning is that recent business formation statistics from the U.S. Census Bureau suggest an increase in high-quality business startups, potentially offsetting some anticipated weakness in business fixed investment.

In sum, it's fairly certain (to us at least) that uncertainty—particularly surrounding the COVID-19 pandemic and the outcome of the 2020 election—is weighing heavily on firms at the moment. Consequently, many firms have chosen to slash their capex budgets over the next two years.

As current uncertainties become eventualities, it will be interesting to see if, and to what extent, firms reassess their plans. We'll continue to put the SBU to good use for just that purpose, so watch this space.

By

By  Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School,

Jose Maria Barrero, assistant professor of finance at Instituto Tecnológico Autónomo de México Business School, Nick Bloom, the William D. Eberle Professor of Economics at Stanford University,

Nick Bloom, the William D. Eberle Professor of Economics at Stanford University, Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Steven J. Davis, the William H. Abbott Professor of International Business and Economics at the Chicago Booth School of Business and a senior fellow at the Hoover Institution,

Nick Parker, the Atlanta Fed's director of surveys

Nick Parker, the Atlanta Fed's director of surveys