During the past few months, alongside an increase in COVID-19 vaccinations and amid a fresh round of fiscal support, optimism about the economic recovery from the COVID-19 pandemic has grown. Although reasons for concern over the potential unevenness of the recovery still exist, many economists, policymakers

, and market participants

have ratcheted up their growth expectations for 2021.

This growing optimism extends to decision makers who participate in The CFO Survey—a collaborative effort among the Atlanta Fed, Duke University's Fuqua School, and the Richmond Fed. CFOs and other financial decision makers in our survey grew more optimistic about the U.S. economy and their own firms' financial prospects, according to the first quarter's data released on April 7. Moreover, these firms see stronger prospects for sales revenue and employment growth in 2021 (similar to results from other business surveys, including the Atlanta Fed's Survey of Business Uncertainty).

Many people think the recently passed $1.9 trillion American Rescue Plan Act (ARPA) is behind these brighter expectations. However, the results of our CFO Survey suggest that many firms anticipate that the fiscal stimulus will have only a modest impact on their own future business activity.

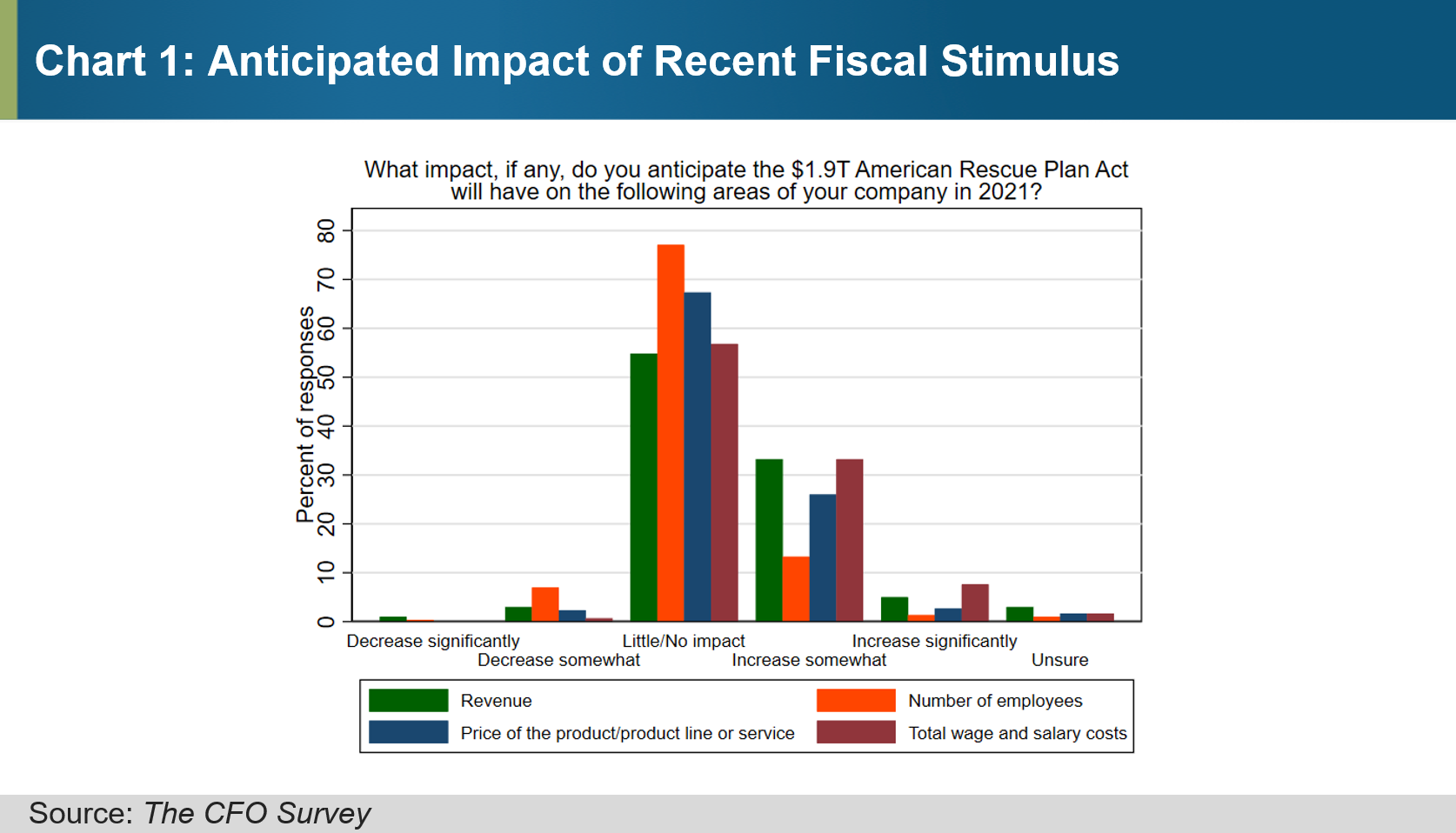

In the first-quarter CFO Survey (fielded March 15–26, 2021), we posed a question asking respondents about the impact that ARPA might have their own firm's revenue growth, number of employees, representative price (the price of the product, product line, or service that accounts for the majority of their revenue), and total wage and salary costs (see chart 1). Firms had five response options, ranging from "decrease significantly" to "increase significantly." A majority of firms expect the recent fiscal measure to have "little to no impact" across all areas of their business activity. The results are perhaps most striking for employment, as nearly 80 percent of firms anticipate ARPA to bring little to no change in that area.

Considering the tepid impact of the stimulus on employment expectations, the survey results for total wage and salary costs are also interesting. Here, nearly 30 percent of the panel anticipates modest to moderate upward pressure on wage and salary costs, with another 5 percent or so expecting "significant" impact on their wage bill. The reasons for the expected effect on firms' total wage and salary costs are unclear, but we should note that labor quality and availability remain very high on CFOs' list of most pressing concerns.

Expectations around ARPA's impact on revenue growth appear a bit more diffuse. Though the survey's typical (or median) firm still anticipates that the bill will bring little to no change in sales revenue growth, nearly 40 percent of respondents expect the legislation to have a positive impact on sales, and a very small share of firms anticipate a negative impact on revenue.

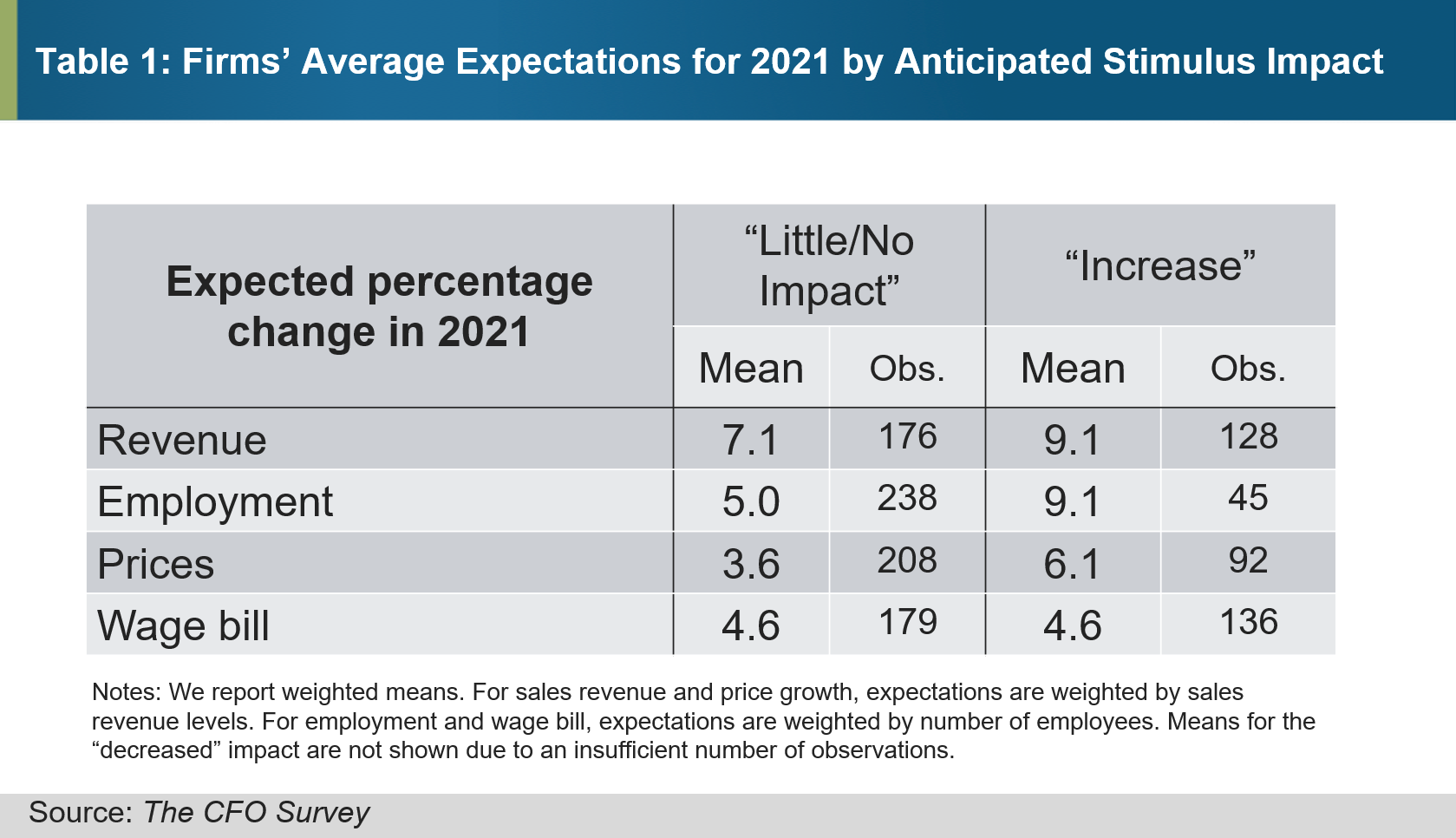

Given the nature of these responses, we were curious whether CFOs who anticipated a positive impact from ARPA also held higher quantitative expectations for firm-level growth than firms who saw little-to-no impact. t. The CFO Survey elicits firms' quantitative expectations for sales revenue, employment, price, and wage growth early in the questionnaire, providing a useful way to check for consistency. Table 1 reports these results.

Apart from firms' anticipated growth in wage and salary costs, it does appear that firms that foresee a boost from the fiscal stimulus also hold higher growth expectations. The increase in expectations is particularly stark for employment growth and prices.

If we dig a little deeper into the small share of firms anticipating increased employment due to the stimulus—45 total—we find that 40 of them are in service-providing industries and employ fewer than 500 workers. We know from academic research, government statistics

, and anecdotal reports

that the COVID-19 pandemic has hit smaller, service-providing firms particularly hard, so it's perhaps not surprising to see these types of firms expecting the stimulus to aid in a rebound. These firms are also anticipating a stimulus-induced boost to the prices they can charge. The price growth for services has slowed markedly since the onset of the pandemic. As the economy begins to open up more fully

, these firms might believe that measures to bolster household income (among other aspects of ARPA

) will lead to a bit more pricing power.

Overall, however, our results suggest that the majority of firms anticipate ARPA to have little to no impact on their sales revenue, employment, prices, and wages. The smaller share of firms that do anticipate increased activity resulting from the stimulus largely expect the increase to be modest to moderate.

Importantly, these results do not rule out a surge in growth as the pandemic recedes and the vaccination rollout continues. As we've noted, most CFOs expect growth to occur regardless of ARPA's role in that growth. But the survey shows that firms, in general, do not pin any surge in demand on the legislation.