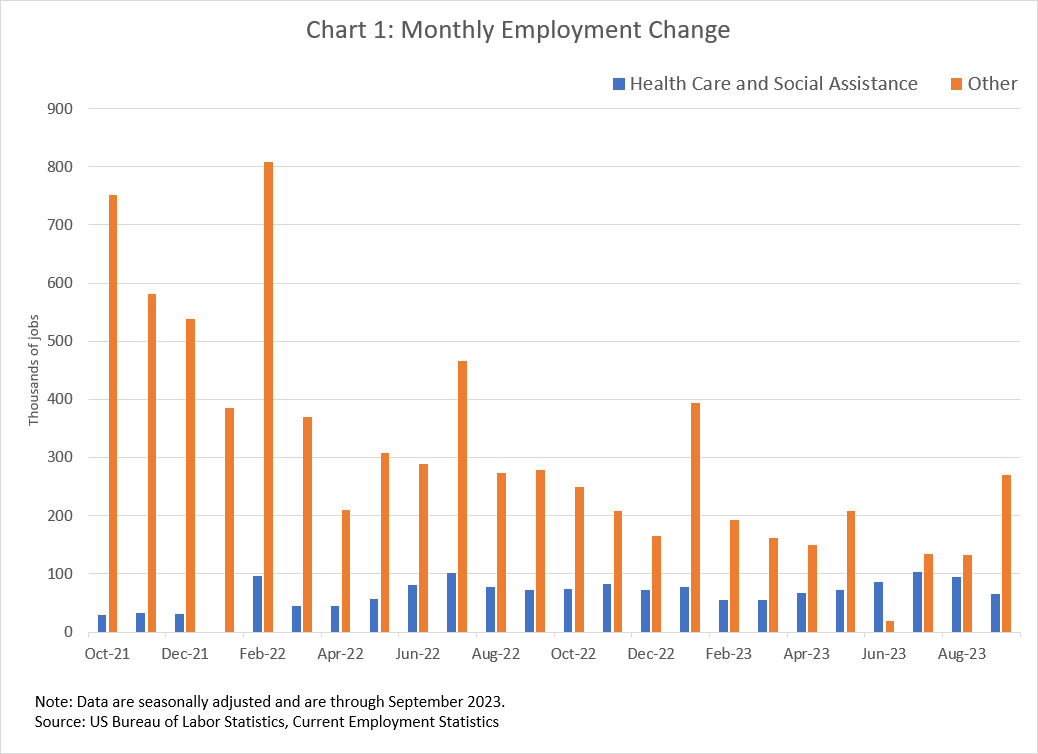

When thinking about changes in employment as a cyclical indicator of economic activity, it is useful to pull out the components of employment growth that are not cyclically sensitive. A case in point is employment in the health care and social assistance (HCSA) sector. This sector represents a bit under 14 percent of total nonfarm payroll employment but has accounted for about 30 percent of the employment growth so far in 2023 (versus 16 percent in 2022). This growth can be seen in chart 1, which plots month-to-month employment change for the healthcare and social assistance sector (blue), along with rest of nonfarm payroll employment (orange).

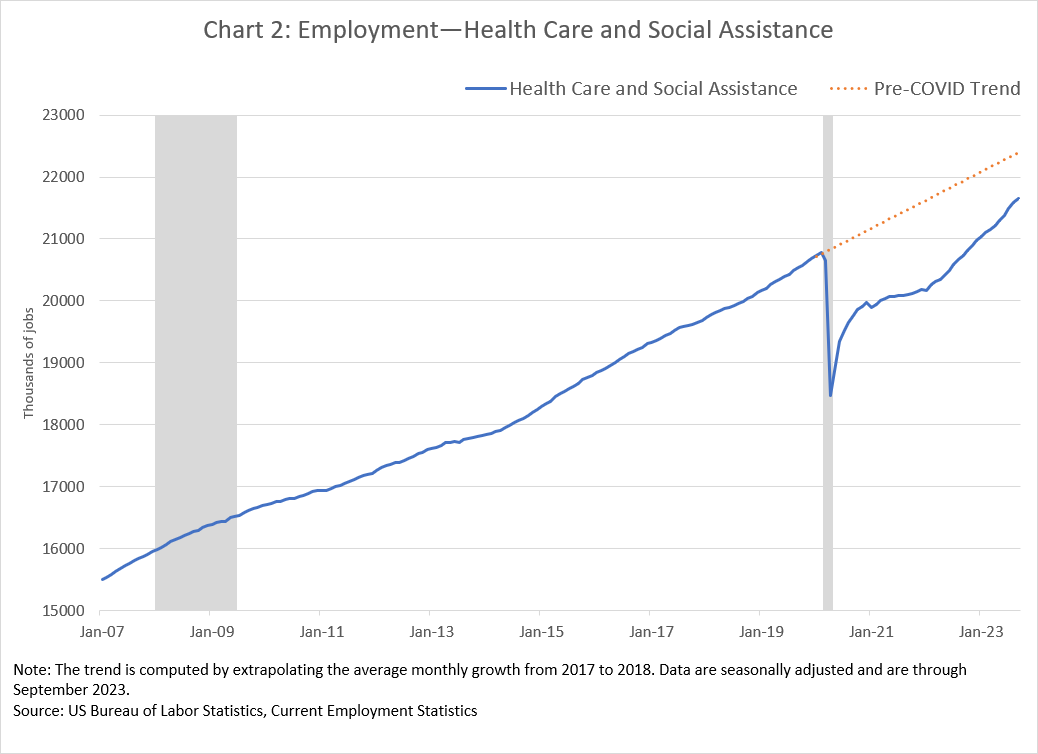

Overall, employment growth outside the HCSA sector has been slower in 2023 than in 2022. It's reasonable to think that employment in HCSA will remain strong, even if employment elsewhere slows. For one thing, employment in that sector is well below the prepandemic trend, as chart 2 shows.

As the chart shows, that sector experienced about a 750,000 shortfall in employment relative to an extrapolated prepandemic trend. Even at 2023's current average of adding 75,000 monthly jobs to the HCSA sector, regaining that shortfall would take about 10 months.

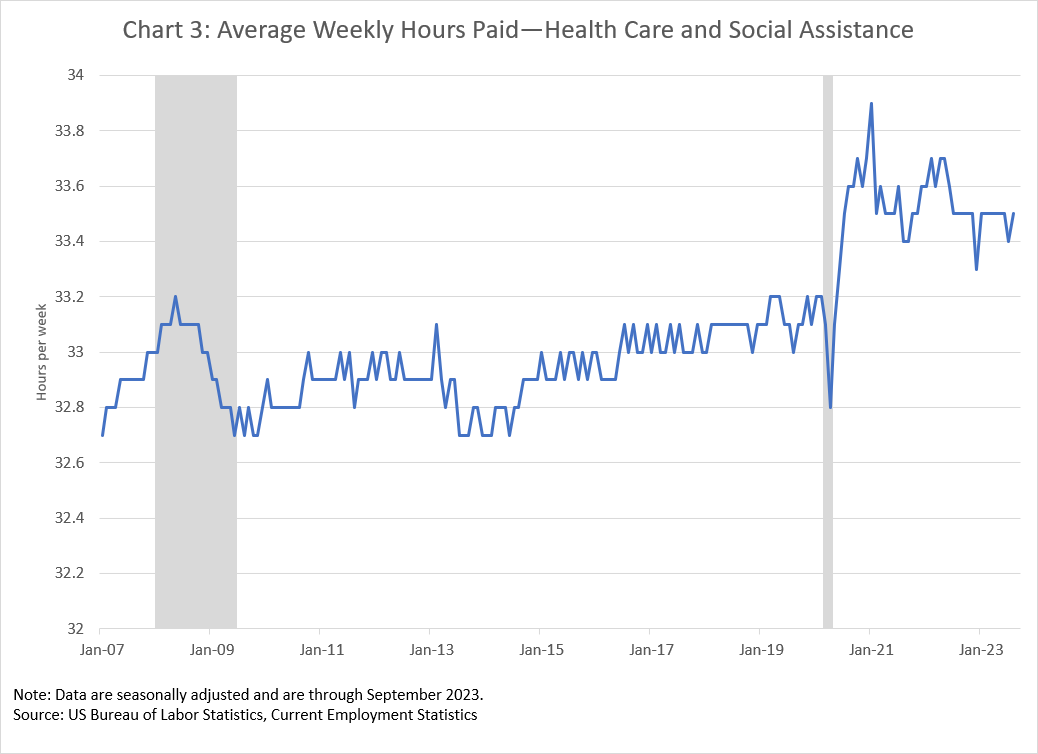

It is possible that increased weekly hours per job will mitigate some of that shortfall. As you can see in chart 3, average weekly hours paid per job in the HCSA sector rose relative to prepandemic levels and has remained elevated.

As a result, although the level of employment is about 3 percent below the pre-COVID trend, the level of paid hours is about 2 percent below. While the shortfall in hours is less, it is still substantial. Also, as noted in this recent Policy Hub: Macroblog post, more paid hours don't necessarily translate into more hours worked if paid time off has also become more prevalent.

More broadly, a good reason to think employment in the HCSA sector will, on average, remain positive over time is that the aging population will continue to put upward pressure on the demand for HCSA services. An older population uses more healthcare, and the US Bureau of Labor Statistics recently projected that the 65-and-older population will increase by 14.4 million over next 10 years and—given current birth and immigration trends—account for more than 75 percent of overall population growth. Of that age cohort, about 10.6 million will come from the 75-and-over group, which most baby boomers will enter.

Notably, during the Great Recession—which was the largest economic downturn since the Great Depression—employment growth in the HCSA sector did not really slow much, if at all (although the increase in hours worked did slow). For these reasons, outside the usual month-to-month noise in the data, it seems likely to us that employment in the healthcare and social assistance sector will continue to grow. We will continue to scrutinize that growth when trying to identify cyclical changes in labor demand.