Email A Friend

Overview

Our Q&A Digest derives from the Ask Us Anything session on “Unemployment Trends and Effective Unemployment Insurance Approaches” held May 20, 2020. In addition to providing the responses included in this digest, there are from the Atlanta Fed’s Center for Workforce and Economic Opportunity and Center for Human Capital Studies offers a number of data tools and publications to help you track unemployment, reemployment, and other potential policy and practice suggestions while you manage recovery from the pandemic:

Unemployment Claims Monitor provides data on initial and continued claims for unemployment insurance as well as claimants' demographic data.

Workforce Currents includes articles on various workforce topics addressing research, policy, and practice.

Opportunity Occupations Monitor tracks trends in jobs that offer salaries of at least the U.S. annual median wage (adjusted for local cost of living differences) for which employers do not require a bachelor's degree—opportunity occupations—in states and metro areas.

Labor Report First Look provides a concise view of the U.S. Bureau of Labor Statistics' Employment Situation Summary. It offers a quick look at current and historical data along with data constructed from the summary.

Center for Workforce and Economic Opportunity Events is a calendar of upcoming events and registration links for the next Ask Us Anything webinar sessions.

Q&A Digest

Claiming processes and analysis

Historically, there’s been a lag of up to 74 percent of those who become unemployed and delay their unemployment insurance filing for a number of weeks. What is the approximate lag and delay in filing unemployment claims in response to COVID-19 dislocations?

We know that Pandemic Unemployment Assistance (PUA), specifically, has had significant delays, but as of late May, it's estimated that roughly 80 percent of states are processing and paying the PUA claims.

It is difficult to assess the number of traditional unemployment insurance (UI) claimants who have delayed filing or been delayed in having their claim processed. Some number of workers who are eligible for UI will never receive a benefit or file a claim.

What is the mechanism for gig workers to apply?

Each state administers the Pandemic Unemployment Assistance program on behalf of the federal government. Each state has built a system to do this, and each is a little different. The first place to look for guidance on applications for the PUA program should be your state Department of Labor.

Has the issue of people who are hybrids (they get both W2 and 1099 income) been addressed?

Our panelist Alex Camardelle reached out to Michele Evermore with the National Employment Law Project to address this question. Here is her response:

“Unfortunately, a person has to not qualify for UI to get PUA, so the benefit will always be based on the W2 unless the person does not qualify with their W2 earnings for any UI benefit. This is a huge problem for artists and actors whose side gig is a W2 and make most of their money as a 1099. SAG-AFTRA [Screen Actors Guild-American Federation of Television and Radio Artists] and all of the performer unions are really pushing for a fix on this. I wish I had a better answer for you right now, but a fix may be on the way so either both incomes or the 1099 if it is higher can count.”

Do you have information on differential rates of UI and PUA uptake in the states?

The Unemployment Claims Monitor has some of this data—more will be included in the dashboard as more states report. States only started reporting on PUA the first week of May (looking back to mid-April). We are tracking that week over week and have about 30 states included in our April data. We'll update the Unemployment Claims Monitor to show some of these differences as more data come in.

Several local school systems are finding a good portion of their students have no internet connectivity or devices, which affects the ability to apply for unemployment insurance. Which organizations help with connectivity to apply for benefits?

There is a mobile-enabled app called DoNotPay. See its Unemployment Insurance Checklist, which processes paper claims on behalf of folks with limited to no internet access, but who have mobile phones. The app can capture all unemployment detail per the applicant’s state of residence to process claims by mail to work around overloaded online UI systems, which could not handle the initial increased strain on their platforms.

In Tennessee, an employer can file a single, mass UI claim on behalf of all its furloughed employees to increase efficiency for the state to process these claims. Do other states offer this option, and will the experience in Tennessee cause other states to adopt a mass claim procedure?

Some states do offer this option. Georgia, for example, also allows for partial claim filing from an employer on behalf of their employees. Tennessee had this program in place prior to the pandemic. It’s been a highly effective model to take the burden off of the furloughed employees and reduce the points of contact with the unemployment claiming process. We hope that as best practices arise from this crisis, that approach is seen as an effective model to replicate for ease of payment distribution and mitigates system capacity constraints.

Unemployment Claims Monitor

Have you requested occupational data from states? This would be helpful to track issues and the recovery.

We are interested in adding a number of features to the Unemployment Claims Monitor in the near term, one of which is occupational data. Other additions include county-level data so that programs and policymakers can have a clear view into locally focused detail on claims and ongoing effects on industries/occupations. Not every state has this data publicly available, but we are working on a way to collect and share this data.

Does the Unemployment Claims Monitor track what percentage of people are receiving a benefit? Is there an estimate of those who are unemployed but have not yet filed a claim?

Our objective is to continue to update the details and analysis in the Unemployment Claims Monitor, including assessing percentage allocations to see breadth and depth effects on industries, demographics, and so forth. Prior estimates from the U.S. Bureau of Labor Statistics indicate that roughly 74 percent of workers who are unemployed do not file a claim, particularly because they think they are not eligible for the financial support. During this pandemic, given the massive business closures and temporary layoffs, there is reasonable evidence to suggest far more people are, in fact, filing for unemployment. Data on what percentage of those who could file but didn’t will not be clear for some time, as the job loss and UI data continue to be collected through the economic recovery.

Does the Unemployment Claims Monitor include historical data to review economic trends? If so, how far back does it go?

Yes, the tool has claim data back to 1984.

Pandemic Unemployment Assistance

Who qualifies for Pandemic Unemployment Assistance?

Under the new program, states are permitted to provide Pandemic Unemployment Assistance to individuals who are self-employed, who are seeking part-time employment, or who otherwise would not qualify for regular unemployment compensation. This includes independent contractors and gig workers, those without sufficient work history or who generally do not have enough wages reported as an employee during the last 18 months, or those who have exhausted unemployment benefits but remain unemployed or partially unemployed as a direct result of COVID-19.

Would a person whose compensation was reduced from 40 hours per week to 32 hours per week apply for the PUA? If not, where would an individual apply?

Depending on the state, such an individual would be treated differently—the PUA program is likely not where they would look. They would look to short-time compensation or workshare programs. Some states, including Georgia, are also running Partial Unemployment Claims programs through the traditional unemployment system. Check with the state Department of Labor guidance about where to apply.

Extended Unemployment Benefits

Is there a concern about the impact of exhaustion for extended unemployment benefits ($600 weekly increase) and what effect it is having on incentivizing, or disincentivizing, claimants to return to work?

For most people who have lost a significant share of income during this time, the additional income is very effective economic relief and supports continued consumer activity. In most cases, traditional unemployment is not sufficient on its own to provide enough spending power for the affected individuals. There is a concern when this aid runs out, considering that many states will be in a position to make tough budgetary decisions, which could change the availability of other social support programs, that workers will be even more underserved in a phased economic recovery plan. We are tracking national and state policies that could offer a bridge to economic security so workers can avoid the benefit and fiscal cliff as they seek safe employment. See additional research and policy recommendations associated with bridging benefits cliffs conducted by the Federal Reserve Bank of Atlanta through the Advancing Careers for Low-Income Families project.

As an important note, the $600 weekly increase ends—along with other unemployment benefits—should an employee refuse to return to his or her job for an unjust cause, the definition of unjust being determined on a state by state basis. It’s considered fraud to claim unemployment benefits when a job offer has been declined. This does present an opportunity to have a larger conversation on what a quality job really means and how to have access to a dignified job with livable wages. It is our hope that this economic recovery will result in a much more robust policy response around quality jobs and high-road employment opportunities. Further detail on job quality insights can be found in the Investing in Work volume of the three-part Investing in America’s Workforce book.

Has the additional $600 in extended benefits for unemployment insurance been extended, and if so how long?

That benefit has not been extended yet, though we are actively watching new discussions on expansion for this payment and other systemic workforce investments. In addition, two recent bills have been introduced that include workforce system support: the HEROES Act, which includes $2.75 billion in workforce funding, and the Relaunching America's Workforce Act (RAWA), with $15 billion in workforce investments.

Recovery, reemployment and upskilling

What information are you seeing regarding how the workforce will be changed as a result of the pandemic? What are the changes in the types of jobs employers are seeking that might indicate what jobs might not be coming back?

We are hoping to gain this very insight from the Unemployment Claims Monitor. As the economy starts to reopen and we see drops in continued unemployment claims for various industries, we can then start to track state and regional employment demand and examine what is different in terms of skill requirements, daily job tasks, and expected credentials. Tracking your local labor market needs will be critical for policymakers and practitioners as we move into recovery. Upskilling will likely be necessary, as will investments in incumbent worker training to move the workforce through a career pathway that could be transformed as a result of the pandemic.

Has Georgia, or any other state, considered replacing work search requirements with a requirement to upskill or reskill for those collecting UI benefits during the pandemic?

Yes, however, it depends from state to state whether a wavier program is in place. We don’t believe that any state will permanently remove the work search requirement, but many are allowing training and upskilling activities as an alternative to a work search. Georgia, for example, has a Claimant Trainee Program, which allows continued payments of UI benefits while a recipient is attending an approved school or training program. Marketing these programs and alternatives to focus on upskilling and reskilling is an important strategy, especially during this period.

Are people seeing employers/industries “trading” or shifting workforce? For example, are laid off hospitality workers being hired into hospitals and long-term-care facilities in environmental services jobs?

We are seeing this. One great example is the Tennessee Talent Exchange. Find some detail on the program here and below.

The Tennessee Talent Exchange, powered by Jobs4TN, is a new initiative to help you find work in the grocery, retail, and logistics industries now.

Tennessee Grocers & Convenient Store Association, the Retail Association, and Hospitality TN partnered with the Tennessee Department of Labor and Workforce Development to quickly connect job seekers to hiring companies in the grocery, retail, and logistics industry.

Our previous Ask Us Anything session highlighted this program. View the recording of that session.

What is happening with cuts to Georgia’s state budget and will that affect WIOA funding? When will funding be available for workforce programs in Georgia, and how quickly can these programs expand and get to scale?

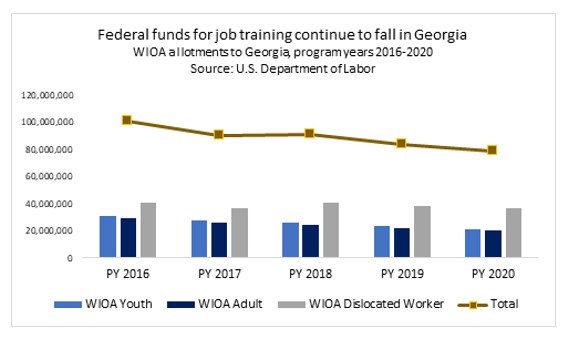

There is a 14 percent state budget cut in Georgia. However, this is not a cut to WIOA (Workforce Innovation and Opportunity Act) funding itself, which is federal funding, this is just a cut to the agency’s staffing capacity. Unless there is a federal authorization in workforce funding through the HEROES or RAWA congressional proposals (see above), there will likely be no expansion of WIOA. WIOA dollars are formula driven (in response to poverty and unemployment rates) and based on the prior program year, which represents the “historically low” pre-COVID-19 unemployment rates, so the funding allocation will be lower than in previous years.

What is happening with cuts to Georgia’s state budget and will that affect WIOA funding? When will funding be available for workforce programs in Georgia, and how quickly can these programs expand and get to scale?

There is a 14 percent state budget cut in Georgia. However, this is not a cut to WIOA (Workforce Innovation and Opportunity Act) funding itself, which is federal funding, this is just a cut to the agency’s staffing capacity. Unless there is a federal authorization in workforce funding through the HEROES or RAWA congressional proposals (see above), there will likely be no expansion of WIOA. WIOA dollars are formula driven (in response to poverty and unemployment rates) and based on the prior program year, which represents the “historically low” pre-COVID-19 unemployment rates, so the funding allocation will be lower than in previous years.

Alex Camardelle provided this chart to show the decrease in WIOA spending in Georgia since 2016. Additional program funding in Georgia has been authorized through Dislocated Worker Reserve Grants under the CARES Act in the amount of $12 million (details here). Those funds are now available and services provided with them can be accessed at local workforce development agencies or through WorkSource Georgia.

Sarah Miller: Good afternoon, everyone. Thank you so much for joining us for the Ask Us Anything webinar with the Center for Workforce and Economic Opportunity. We are very excited for our conversation around unemployment trends and effective unemployment insurance approaches. Obviously, a very top of mind issue as we see the numbers coming through week after week, so welcome to the conversation. We're very excited to have you here with us today in the second installment of the Ask Us Anything series.

Just quickly as we get going, a quick overview of the Center for Workforce and Economic Opportunity. We were launched in October 2017, with the mission to focus on unemployment policies and labor market issues that affect the low and moderate income populations. Our function essentially is to be that connector between research and the real world. We work across the entire Federal Reserve System. We do play that connective role, that broker role between research and the doers, the businesses and the policy makers through innovative approaches, which create economic opportunity through education and employment. So, we really do take a lens of economic mobility and resilience as it relates to the low and moderate income populations, and how we can help them navigate and be successful within the workforce. A little bit about the team: I'm Sarah Miller.

It's great to be with you here this afternoon. Also, joining us today for the conversation is the center director, Stuart Andreason. We also have two wonderful analysts on our team, Pearse and Katherine, who I'm sure that you will see in future Ask Us Anything conversations. Just a quick reminder—through this series, we are going to have regular sessions covering a number of different topics that focus on workforce, general issues that relate to economic mobility and resilience, both from a policy and a practice perspective. We do aim for this to be conversational, so very light on the presentation and heavy on the discussion. We have some great expert insights on the call today, but really we want you to bring your voice to this conversation. Please do bring your thoughts and insights. Don't be afraid to ask us any questions, even share some of the work that you're doing on the ground.

This is a way for us to be able to provide you with some high level learning at the top, but really just to shed some light on the challenges that you're facing and elevate some solutions that you're implementing. This is without a question, a two way road. We really want you to give us some insight as to what's working for you and what the barriers are you're encountering, so that we can address those. That's to say, we may not have all the answers, by any stretch of the imagination, but we're listening, we're responding through research, through data, through discussions like these and others, and we are committed to keeping this conversation going with you all. Today's conversation, we're very excited to have us joined today with Alex Camardelle with the Georgia Budget and Policy Institute. Alex is a senior policy analyst and has been our go-to to really understand, specifically how Georgia has been responding to this crisis, and get some insights for us as well.

Today, the conversation is really going to flank between some national trends and then also Georgia specific kind of case study. On the national trends side, we want to dig into the data that we have thus far in terms of the unemployment claims, both initial and continuing. We want you to have a greater understanding of what those numbers are telling us right now and what we've seen between March and April with the initial data that's come through on the number of different unemployment programs, and then highlight for you a dashboard that we've put together and walk you through a handful of use cases. How can you take this information and really apply it to some of the work that you're doing locally? On the Georgia side, we want to give you a little bit of a sense as to what was happening in the state prior to the pandemic, and then look at what happened as we were dealing with this unprecedented crisis.

What's the demand that, that system has been trying to support and policy responses as they've seen the work come through and how nimble they've been in addressing how they can better serve Georgians in this very specific time of need. Then of course looking forward to the future—Georgia, as is, I believe 49 of the states now have some semblance of a ruling reopening in a phased kind of businesses coming back online. What does that mean for the people that we're serving and specifically as it relates to unemployment insurance? Just a quick reminder, this is heavily Q and A. We're using Zoom. I know it's one of a dozen different web platforms that were all very well versed at, at this point, but please do click the Q and A button, send us your comments. It doesn't even need to be a question. If you have suggestions or wanted to uplift and surface some of the work that you're doing, we'd love to hear about that as well.

We're going to do our level best to answer as many questions as we can live throughout the conversation, but rest assured, we are recording this session. You will get a copy of the recording, the full slide deck, and we'll be capturing all of the questions that you submit throughout the course of this webinar, and we'll provide a digest read out to you as well. If we don't get to your question live, we will certainly address it after the fact; but, please do submit as many questions as you can or has come to you so that we can get to those during this conversation. Thinking into the future, on the next Ask Us Anything, we wanted to alert you of the next conversation that we're having and save the date. We're very pleased to be joined by Jane Oates and Carl Van Horn. Jane is the current president of Working Nation. Previously, she was appointed by the Obama administration to be the assistant secretary for the Department of Labor Employment and Training Administration.

Carl is the director for the John J. Heldrich Center for Workforce Development at Rutgers. He's also a visiting non-resident a scholar for the Federal Reserve of Atlanta. They are working on a paper jointly together that they'll be able to talk about some of those findings as it relates to how we can apply lessons from the Great Recession into this current recovery. Just looking at some comparisons with federal investments, addressing some of the long-term inequities that economic downturns have on various populations on health outcomes, and really be able to dig into some effective rescaling principles in the outgrowths that came from Great Recession investments. Please do join us for that conversation. It's Wednesday, June 17. You can register now. Formal invitations will be going out in a few weeks, but for this session and for all future sessions, please do go to the Events landing page for the Center's website. We'd love to keep the conversation going with you all. With that, I want to turn it over to the center director, Stuart Andreason to talk us through what we've seen so far and some of the national unemployment trends.

Stuart Andreason: Thanks, Sarah. Today, we're going to get to dive into, hopefully, some of the details behind the big headlines that everyone's been hearing over the last several weeks and since early March, when the COVID-19 pandemic made its way across the country. We're going to talk a little bit about some of the immediate responses that have made headline information on claims a little bit more nuanced and detailed. One of the things that happened early in the pandemic is that there have been a number of important pieces of legislation that have been passed which helped to expand coverage for unemployment compensation beyond the traditional unemployment insurance system. One that I'll focus on quite a bit today is the Pandemic Unemployment Assistance program, which expanded unemployment compensation programs to workers that did not typically qualify.

Typically, those that qualify for unemployment insurance are those that worked in very traditional W2, employer and employee relationship jobs. Workers that were self-employed, people call them gig workers, contract workers, or 1099 workers - they were not covered by the unemployment insurance program. Starting in early March through the PUA program, many of those workers are now eligible for compensation for some period of time. We wanted to know what some of those numbers looked like. There were also expansions in terms of the benefits paid to workers to help replace some of the wages that they lost that are not covered by unemployment insurance programs, but there's also been some big kind of thought about how we administer unemployment program, including growth in support for the short time compensation program are also known as workshare programs.

Basically, those are unemployment compensation programs that help people who haven't actually lost their job, but have been furloughed or are working a reduced number of hours due to changes in demand. In this case, limited work availability because of the pandemic. We're also interested in understanding how people navigate ending up unemployed and then working towards reemployment: How do people kind of rescale and retool themselves while on unemployment insurance? We know that the unemployment insurance was traditionally for temporary layoffs, but many people won't get their jobs back. Their jobs will be permanently lost, and they'll need to work their way through that. We've been tracking ways that states have been developing waivers for people to pursue training and be able to stay on unemployment.

We're interested in chatting a little bit about some of those today and questions that people have. We'll also just point to the fact that there's a couple of pieces that will probably significantly, or a couple of pieces of proposed legislation that should they pass would significantly affect the Workforce Development unemployment insurance systems. The Heroes Act, which has been proposed includes $2.75 billion in funding for workforce development and education programs, and the Relaunching America's Workforce Act includes another proposed expansion of about $15 billion for workforce development programs. Many of those are actually kind of looking back to programs that we ran relatively, significantly during the Great Recession and many are expansions of programs that are currently in place, including programs in WIOA.

We'll talk a little bit about those. But I want to talk about what does it mean when we see that more than 30 million people have filed for unemployment insurance in the last two months? Well, it was a question that we took really seriously, and so we actually knew that there was more that people needed to know behind that top headline number that we're now hearing every Thursday. We developed a tool called the Unemployment Claims Monitor, which you can find on the Center's website. What you're seeing now is actually a screenshot of that tool. Every Thursday, new data's released on what happens in terms of unemployment claims. We know how many people filed a new initial claim. We get some information on how many people are still making claims, which not always, but typically means that they're being paid. They've been certified as someone who's covered by unemployment insurance.

We particularly wanted to know how many people were in these new programs. How many of those contract workers and people that weren't eligible for our traditional unemployment insurance programs? We're also making claims in how many more people were losing their jobs. We know that geography matters a lot. Certainly both states and cities and regions that have high concentrations of industries that are more effected, are dealing with higher levels of unemployment and dealing with greater economic consequences and workers are really having to navigate that much more significantly than other places. We wanted to take everything that we could find about the geography of where claims were coming from. What we have today is this tool—the Unemployment Claims Monitor. It's an interactive tool. On our website, if you go to it, you can look at national data. If you're interested in just diving in on a specific state, you can click that state.

If you happen to be interested in several states, you can control-click them. Click the first states and then hold down control, click a couple other states, and then we'll give you combined data for those. We also want them to know about who was filing for unemployment. We wanted to know what industries were actually filing for unemployment and everything that we could about the demography of who was filing for unemployment because we wanted to know who lost their jobs. What you can see is we've tracked as much of this information as we possibly can. I'll also note that there's not only kind of the brand new special unemployment programs, but there's also a number of other unemployment programs that have long existed, including special programs for veterans or ex-service members. Federal employees are a part of another unemployment insurance program.

Then, we've got the short time and workshare program in there. What you'll see in this graph is that while last week we heard about over 2.3 million workers filing for unemployment insurance, there were another over 800,000 workers that also applied for unemployment compensation through that Pandemic Unemployment Assistance program. Now, on the right hand side, we wanted to create just some information to kind of show the scope of how many workers that actually touched. The percentages that you see are our ratios of the workers that are covered by unemployment insurance and that filed for the traditional system. In the early weeks of April, over 4 percent of all traditional W-2 unemployment insurance eligible workers applied for unemployment insurance. I'll just say that, to wrap up on this one, on this slide in particular, all of this is interactive.

If you're particularly interested in the trends for veterans and ex-service members, you can eliminate all the other data and look just specifically at that, or you could look specifically at what's happened with the Pandemic Unemployment Assistance program. You can change the dates on this too, to zero in on areas that are of specific interest. Now finally, I'll actually just show that this is our attempt at picking up the total number of continuing claims, people that are still on unemployment and to create a more specific number of people that are on the unemployment assistance programs collectively to get a slightly more comprehensive view of the number of people that are claiming or receiving unemployment compensation. We know that, that is all just one view, but what you'll see here is that brown area is the number of workers that are receiving compensation through that Pandemic Unemployment Assistance program. Those are less traditional applicants to the unemployment insurance system. I encourage you to take a look at the tool and to find ways that you can hopefully use this data and have it integrated into your work.

Miller: Quickly before we move on, I just wanted to take your temperature with everybody on the phone as it relates to specifically this Pandemic Unemployment Assistance. Quickly. I'm going to launch a poll here just so that we get some understanding on how this is working locally to your area and to your state. Ultimately, we want to understand your level of understanding on the Pandemic Unemployment Assistance. Again, it's that insurance for 1099 and gig workers. How is that processing? We have a little bit of data on that since it did take some time per state to be able to ramp up and make those payments and add this new population to the system, but wanted to get a sense from your perspective where that's at. Let me give you just another moment or two…

I'm going to go ahead and end the poll here and let's share the results. Wow, I think that makes a lot of sense and tracks with what we were thinking that it's hard to really have a good view into this as the program is obviously new. It was a different kind of setup that the states need to have, but it's good to know that at least some that there's only some problems, but this is improving. We definitely understand, and that tracks with our kind of thinking that there will be some backlog of this. I'm going to go ahead and just launch one more poll here to help us to understand the awareness around this.

While we believe that this Unemployment Claims Monitor is going to help you to better understand what's happening, it is a concern that we have that not everybody that is eligible for this new program is even aware of that. If you could take a moment and just give a sense of where you think that level of awareness and knowledge that they can even claim for this unemployment assistance and really what's available to them since it hadn't been prior. Let me give just another moment here. I'll go ahead and end the poll. Yup, that's actually very encouraging to me that a third of you believe that this is kind well known to the populations that can benefit from this financial support. Definitely again, like I said that this is in keeping with just at least anecdotally what we've been thinking in terms of awareness on that.

Andreason: Yeah, and just on those two questions, it'd be interesting if people can submit comments and questions about them. I will say that for states and quite frankly for the federal government, this is really kind of creating something new in having to—for lack of a better metaphor—fly a plane and build it at the same time. The CARES Act passed this new program just in March, and by mid to late April, states were accepting and filing claims in the program. From the worker's perspective, even a few weeks delay in getting that up and running, because this is not as simple as just opening up the administrative system that the traditional unemployment insurance system uses, that costs stresses for workers in just waiting for that period, even if the ultimate competition is retroactive. It's very difficult to follow, I think even for people that spend 40 hours a week thinking about these things.

I'm really interested to hear more and would love to hear more about ideas and experiences that everyone sees. I will also note that we have some demographic data. We have data on gender, we have data on ethnicity, we have data on race as well. Just one thing that we hope that this can do is help figure out where there are stresses happening in the system. Now, this data, the demographic data and the industrial data that I'll talk about in just a second doesn't come in quite as regularly as the claims data. It doesn't come in weekly, it typically comes in monthly and it will kind of slowly get added to the tool. I'll say from a mechanical standpoint, if you are interested in a specific state, we won't report national data until we have all 50 states, but some states have already reported data for their monthly demographic and industrial data.

We add that data on a regular basis, and so if your state happens to have reported, it will be in the tool. If you drill down on Indiana, for example, you can see more complete and up to date monthly data because it's already been reported. Just to note, we hope that this can help direct some attention to who's feeling it. Female claims for unemployment insurance rose drastically between March and April. You can see that as that green area fanned out, there was significant growth among women who had lost their jobs, and is likely worth targeting for support and outreach. The same is true of age as well. You can see that since March, 30 percent of all of the claimants are under 34 years old, so it's a relatively young population that has been claiming for unemployment insurance in the recent months. Finally, this graph shows our information on industrial claims and where claims are coming from.

Not surprisingly, the data showed that many of the areas that we know have been affected by the pandemic have had claims. 40 percent of claims have been in accommodation and food service, waste management agriculture, and then also some more of our hospitality areas like arts and entertainment, as well as construction, where clearly people, it's difficult to build buildings remotely. We hope that, that will provide some information and provide perspective. I actually hope that in the future we can start to use it as a way to track where reemployment is actually happening, where we can see that the claims are starting to go down and we can actually look at it for some bright spots coming up, hopefully very soon as well. Now, I'm going to turn it over to a friend and someone who always helps me and the Atlanta Fed understand what's happening in state policy and the real, detailed nuance of how a lot of programs kind of happen in place. We're going to get the chance to talk a little bit about Georgia with Alex Camardelle who's going to give us a little bit of a look into unemployment insurance in Georgia in particular.

Alex Camardelle: Awesome. Good afternoon, everyone. Thank you, Stuart and Sarah and all of our friends at the Fed for inviting me to come in and talk about our situation in Georgia. I want to speak with you all about some of the implementation of unemployment insurance in the context of COVID-19 over the last couple of months. Just to quickly reintroduce myself, I'm Alex Camardelle. I'm an analyst at the Georgia Budget and Policy Institute, or GBPI. For those who are unfamiliar with the organization, GBPI is a Georgia-focused nonpartisan research and action organization. We're laser focused on tax and budget policy as it is in our name, but we also focus on research and advocacy in the areas of health care, corrections, criminal justice integration, immigration, and K-12 education and higher ed, as well as general workforce and economic mobility issues.

Before jumping into where we are currently during the pandemic with implementation of unemployment insurance, I wanted to provide some historical perspective about our state's UI system. Just before the virus struck, George's UI system was a little bit weak. It was weakened over time by some policy decisions at the state level that were made as early as the 2000s leading up into the Great Recession. A decade before the Great Recession, just for example, Georgia essentially cut payroll tax revenue for the States Trust Fund, which is what pays out the benefits directly leaving it completely insolvent by the time the financial crash of 2007 occurred. Completely insolvent, I mean the UI trust fund at that time was zero dollars. There was no state money in the Trust Fund to continue paying benefits.

As a result, Georgia like many states who were cash strapped at the time with their UI systems and the recession, had to take out a loan from the federal government to continue meeting its obligation to pay out benefits; but to begin paying back that loan, unfortunately Georgia had to enact a variety of policies that essentially placed some of the burden of repayment more on the unemployed. For example, Georgia cut the duration of benefits for unemployment insurance to 14 weeks at the time, which was among the lowest in the nation. The state also passed a law that would trigger a tax surcharge if UI trust fund balance ever fell below a billion dollars. This created somewhat of an incentive, quite frankly, to keep access to unemployment insurance restrictive as the last thing. Oftentimes, decision makers want to do, especially during a financial downturn or economic downturn is raised taxes.

As a result though of some of these decisions, only a mere fewer than 1 in 5 unemployed Georgians were able to access unemployment insurance. It's about 17 percent of unemployed population right before the virus struck our state and our economy. The take uprate for UI was extremely low in Georgia. We were among near the bottom in terms of the list of states that had folks able to access UI all the way up until 2019. Next file. This brings us to today, where in Georgia and unprecedented 1.8 million Georgians have been laid off from work between March and now, and have filed in unemployment insurance programs. This is nearly 40 percent of Georgia's entire labor force, and we'll know George's official unemployment rate this Friday when the Bureau of Labor statistics reports.

Nationally, we already saw that the unemployment rate surged to 14 percent, again nationally for April, and that even only tracks through the middle of that month. It's not even showing the full magnitude of the employment situation for the month. I do apologize, the numbers that you see on the chart on this slide are about two weeks delayed, so that'll explain kind of the differences there, but the magnitude, I think is the same. This lists 1.6 million, and that still is pretty dire. Additionally, the UI Trust Fund balance as of this week because fallen $1.5 billion. We started out with about $2.5 billion in the bank, now we're down about $1.5 billion. It's getting pretty close, in terms of our ability to remain solvent to continue paying out benefits during this time.

Of course, a lot of the federal benefits are being paid out through the US Treasury, and that's helping relieve pressure for the demand of folks who are accessing other programs such as Pandemic Unemployment Assistance, which are fully federally funded. The enormous surge in benefits can probably be attributed to a number of provisions in the law or administrative rule changes that were made in response to the Coronavirus pandemic. On March 14, 2020, our governor, Brian Kemp, the day after the president declared a state of emergency, public health emergency, we declared our own public health emergency in the state. Almost instantly, we saw Georgia Department of Labor enact a number of emergency rule changes that were designed to ease access to unemployment insurance in anticipation of a huge surge and folks turning to UI.

All of those changes even predate those that were made in the CARES Act, which is very encouraging to see our state step up to the plate in that way. For example, the state acted swiftly to extend the duration of benefits of unemployment insurance from 14 weeks to 26 weeks, which is the maximum allowed under the law. This in combination with the provisions in the CARES Act for unemployment insurance would extend the full duration of benefits for Georgians to 39 weeks. The Department of Labor also implemented guidance from the US Department of Labor that extends eligibility to unemployment insurance to individuals who have either contracted the Coronavirus or they're caring for someone who has contracted the disease, or finally, they have to quarantine themselves as a result of exposure. You are eligible if you meet either of those conditions.

Georgia also extended unemployment insurance eligibility to parents with children whose school or childcare providers or not currently in operation. We also suspended the work search activities for those who file claims on or after March 14, 2020. In order to remain eligible for unemployment insurance under normal circumstances, you have to continue to demonstrate that you are actively seeking what's considered suitable work, making an attempt to reenter the workforce. That provision was waived during this time. The Department of Labor also mandated partial unemployment claims, and this mandates employers to file weekly claims on behalf of employees that they have laid off completely, or that they've significantly reduced hours for. What this does is, it limits the amount of time it takes actually start receiving payments as someone who's drawing down on unemployment insurance.

It normally could take quite a few weeks to actually get that first payment. With mandated partial filing, having your boss or your employer filing your behalf, you're actually expected to see a payment made within a matter of 48 hours. Mind you, this was the provision that was put in place almost instantly whenever we declared a public health emergency in our state, but I can't report on how successful the partial employment claims turnaround has been since the increase or the demand has been astronomical because the pressure for employers to file on a weekly basis when they themselves don't know if they will be able to remain in business has grown exponentially. Lastly, I also wanted to mention that the state increased its income disregard from $50 per week to $300 per week. Those who have to continue going to work or are recalled back to work can ease back into it and still continue receiving some benefits.

They would get those benefits still in addition to the Pandemic Unemployment Assistance or the $600 supplement because the federal statute rules that if you even received just $1 of regular state benefits, that you are eligible for the PUA. Those are all of the state policy changes I wanted to run through that Georgia made. Stuart did a fantastic job of running through the Pandemic Unemployment Assistance. He was absolutely right on the nose about the delay in implementation, and I saw some questions come in about that. It took Georgia about a month to get our PUA form up and running to direct folks to that application online. Mind you, the only way to access unemployment insurance right now is virtually through an online system. You can call the agency, they do have a customer service line and you can make attempts, but as you can imagine, the lines are flooded right now.

That is the primary way to access assistance and to register. It did take some time to get it set up, and it's going to take a little while for all folks who've filed for PUA to begin receiving those benefits, but they have begun to administer those benefits in Georgia thankfully. Those weren't reported on in the last ETA weekly unemployment insurance claims update. Most states did not report on that, but our state, thankfully, in the previous slide you probably saw, is starting to include some data on Pandemic Unemployment Assistance there. That brings us to where we are moving forward and kind of some of the challenges that are bubbling up as a result of this unbelievable demand in our state for UI. As you can imagine, there's, a significant backlog in claims processing. The state's Department of Labor's capacity to serve the unbelievable high number of now jobless Georgians has been stretched to know end.

Prior to the coronavirus, or the pandemic, or what I've referred to as a pandemic recession, the State Department of Labor was operating with half the staff it had during the Great Recession. Very unfortunately in our state, this is likely to worsen as our state agency is required to cut its budget by 14 percent in the upcoming fiscal year. For the Department of Labor, really the only thing that they can cut is staff capacity, so we are really leaning on a lot of the relief measures included in the Families First Coronavirus Relief Act, which provided some administrative support to the state to beef up its staffing capacity as well as some potential relief, and the CARES Act and the state and local relief funds that our state lawmakers are still interpreting currently the best use of those funds.

However, Treasury has given much flexibility to states to actually inject some of that relief funding into unemployment insurance systems. States, obviously, as they are facing incredible budget shortfalls, have to prioritize very limited funding. I did want to lift up the kind of the staff capacity challenges. There are other pesky administrative challenges that are keeping people excluded from assistance unfortunately. For example, I mentioned that the phone lines tend to be a nonstarter and that the system is accessible online only, and self-help options aren't that accessible. Virtually, if you live in an area of the state that is not very broadband friendly, where there isn't much internet access. In Georgia like many Southern states, have huge swaths of communities that are definitely rural and under-resourced in terms of their broadband access.

Another challenge is that despite a rule change suggesting that the work search requirement is waived, new applicants are still told when they log in to participate in an activity or have their benefits denied or suspended. We have gotten confirmation from the agency that they are not suspending those benefits, and that it is indeed waived as was ordered in the emergency rule as of March 14th. However, a lot of folks who would see that on a landing page to apply for benefits, might be concerned and feel the pressure to participate in the work search when they are not clear that they will not be sanctioned for not doing so. There needs to be more clarity around that from our standpoint. Another issue is that unemployment insurance income may impact eligibility for other critical public assistance, such as SNAP, or what's formally known as food stamps as well as temporary assistance for needy families.

Again, UI is countable taxable income and has to be reported as income whenever applying for other public benefits. Lastly, as Georgia was one of the first states to begin reopening, which I'm sure many of you know, pressure is really mounting on jobless individuals to return if they are recalled. There's just so much uncertainty on whether or not refusing suitable work out of fear of contracting the virus is good cause. Good cause is highly debatable right now because people need to know, or want to know if an individual is simply fearful that their employer is a place where they will be exposed to the virus, whether or not that is considered good cause. Right now, some states—I believe North Carolina is really a good example on this—are actually providing very explicit guidelines with FAQs on their home pages listing out, these are the things that are considered good cause.

UI is very restrictive. It is a very reactive policy for situations like the one that we're in now, but it is very clear in terms of what eligibility means for folks who don't have suitable work history, who don't have the right income earnings, and whether or not you are eligible based off of your ability to accept suitable work, or if you're recalled back to work. We are, on our side of things, trying to our best interpret some of the guidance from the federal level around this as well as having to unfortunately send a lot of folks who are getting unemployment insurance to seek out legal help, who will likely need to endure an appeal's process if we feel that they were wrongfully denied a benefit because of the situation that we're in, but we expect to see a lot of different interpretations of good cause in the next few weeks as this issue, as more businesses are continuing to open, bubbles up.

Then lastly, I wanted to hit on kind of the retraining and reemployment piece of unemployment insurance. We mentioned earlier that almost two million people have been laid off of work and have filed claims for unemployment insurance. Of those that have actually been validated claims, which is less than half after right now, the majority of the claims are folks who still have an attachment to their employers. They are those claims that are considered partial. Their employers are filing on their behalf because they assume that their employee will still have attachments to them – that they will come back to work. That definitely adds some nuance to the numbers that we are only just now able to begin digging into, but I just wanted to highlight that the vast majority of claimants are considered still attached to their employer at least marginally. Then, the other 60 percent of those who have not been considered validated claims at this time, likely have other ineligibility challenges such as income restrictions, work history is not sufficient, etc.

There's that element. There's also some additional resources. Georgia was just awarded $12 million in Dislocated Worker Grants that were authorized in the CARES act, and the money has already beginning to be administered to the local workforce areas, so that they can begin retraining and retooling our workforce. We look forward to seeing folks access those resources, and they are actively promoting that as a reemployment and retraining opportunity. This is incredibly important because, despite the changing economic situation and employment situation, I think many states, Georgia certainly are singing a decline in WIOA funding and public federal funds over time. Unfortunately, our formula for determining how much money Georgia gets for public workforce dollars through the Workforce Innovation Opportunity Act, was determined before we were in the employment situation that we're in now. We are sadly going to see kind of some austerity in the areas of workforce development that I hope can be corrected in the future federal proposals that were mentioned earlier in this call. I know I've rambled on a lot, and I know we have some more open discussion, so I'll leave with that.

Miller: Thank you so much, Alex. That provides such a great insight as to what's been happening in a specific state example. I think a lot of the challenges that Georgia has been faced and is actively trying to overcome are felt by many. Thank you so much for all of that. We have a lot of questions that are in here. Let me just start off quickly with one that came in and we know is a big issue particularly here in the South as it relates to connectivity and access to broadband in many of these claims requiring online filing, even separating that from issues of people that don't have internet access or that just have internet access through a mobile device, and many sites not having mobile functionality.

Can you talk a little bit about other ways that people are coming into the system, I guess not just from Georgia's perspective, but also Stuart what you're seeing? I know that we did come across an app that was created for a number of different other kind of public sector filings called “Do Not Pay” that was effectively allowing people through their mobile devices to submit all of the information that they needed to file unemployment. Then that organization was then printing the forms and sending it in through snail mail to get the claims process because of the capacity constraints on the websites and folks inability through broadband. I don't know—Alex or Stu, if you have any comments on that, and I'll just respond to that question in the Q and A as well.

Andreason: I'll just say that I think that the connectivity and infrastructure questions exist on both sides. The systems that run the unemployment insurance system are relatively old. They were built in old software, which really does not interface well with mobile devices. In some states, you can't apply except for on a desktop, or by phone. A lot of this started in-person and then moved to phone and then move to online, so there are some real questions there that the administration of it is a challenge. That's probably the big one that I’d note there is that we need to also think about kind of the interface between what's happening with people's connectivity and the systems that are built on.

Camardelle: Yeah, and I would just concur. The online system the Department of Labor in our state has been working with is very outdated as most states are. I think that the bombardment of claims in addition to having to essentially design a new system to handle PUA claims, the Pandemic Unemployment Assistance claims has definitely stretched the capacity to be more innovative for our state leaders to develop things like apps, other call centers and things like that. Part of what the federal relief requires, namely the first or the second package see to the Families First Coronavirus Relief Act is that states do invest and make changes that will improve accessibility. Part of that also includes online accessibility for folks. What that means for people who live in areas that don't have much online accessibility at all, I think the jury's still out on that. Unfortunately, those folks are still probably waiting long hours and sometimes days to get through to a claims examiner on the phone, but I think it's a huge signal. I think that we're lifting up as we're entering into our budget season in the next couple weeks here in Georgia to talk about the need to invest in infrastructure for rural communities, especially who can't do things as necessary as apply for UI during this time.

Miller: Great, and quickly, Alex, because your partial claims response, I think, is really innovative in flipping that sort of the employer is providing that claim on behalf of the employees, so you're turning that into a one-to-one relationship as opposed to a one-of-many. There was a comment that came. In Tennessee, an employer can file a single mass wide claim on behalf of all its furlough employees, but this makes it incredibly easy and efficient for the state to process the claim. It seems like in Tennessee and Georgia, those are similar programs, but ultimately we're under the impression that most states do not offer this option for their employers and their employees. From your scan, either Stuart, what you've seen or Alex, what you're tracking nationally, what can you tell us about whether or not you think this experience is going to cause other states to adopt this mass claim procedure, or what are some lessons to consider in you're very limited hindsight from just the past couple of weeks in deploying that program?

Camardelle: I will say for us—I probably didn't mention this in my earlier talking points—but all the state policies changes that I mentioned, unfortunately only lasts the duration of the public health emergency, the state public health emergency. I don't think people will look to Georgia at least for a long term solution given that many of the things that we have been proud and happy to see change are likely to, what's the word, expire possibly soon. We don't know what our governor and the Department of Health are deciding on when that date will be, but I just wanted to add to the caveat that those changes only are set to expire once the public health emergency expires in our state. My advice to other states is that if these do help with the turnaround for people who are laid off suddenly at no fault of their own to be able to get benefits more quickly, then make it a permanent change. That's what we're asking for in the emergency reforms that took place, is that a lot of this makes sense to just keep in place through the direction of this downturn, which will likely not in December 31st, even federal provisions at the end of the year, so that's all.

Miller: Right. No, I think that, that's really solid comments and guidance that there is some lifeline on this as it relates to the state of emergency, but there is advocacy to continue. Another question came in as it relates specifically to the pandemic and employment assistance and whether or not this is something that we should consider advocating for beyond this current crisis, recognizing that many people that fall into the gig and 1099 category don't necessarily have that, or they have insufficient work experience in order to be able to claim. We are actively tracking what we can learn from the Pandemic Unemployment Assistance data, so that we can have a better insight, and an insight for the first time, into who is actually claiming unemployment that falls into this category. In terms of hoping that this is something that continues, this does fall into the bucket of what we're tracking to see what's going to be extended, not just as kind of a stop gap while we get through phase recovery, but longer term. I think that the ability that the PUA and assistance for those 1099 and gig workers is likely something that will continue and we know that it's being considered very significantly on the hill.

Andreason: Yeah. I would just add that the 1099 question, who is losing work in economic crisis has always been there. There's people that will argue that work persists a little bit longer, that it's some of the first to go in an economic downturn. We really for the first time, starting a few weeks ago, have some trackable data about who's claiming and getting certified for those programs. We really hope that the tool and the data that's collected on that can inform decisions going forward, so that we better understand who's losing work, who's persisting longer on that. I mean, these are real questions. Who's seeing work returned faster, are our contract and 1099 workers returning to work faster than traditional claimants or not. We plan to monitor that and see what happens, so that people can make informed decisions.

Miller: Great. We have just a couple minutes left. I want to ask just one question that always comes up in terms of the expanded compensation, and what we're seeing with that additional $600 potentially being a disincentive to return to work. Alex, I know you mentioned specifically to the Georgia case, the businesses are facing open, but what constitutes a reasonable cause not to go back because of concerns and things like that an ability to keep claiming that additional $600, but I know that we've also seen some research that shows at least at the topline for each state, how much more people are being made. The assumption is with that additional $600, that if you're making around $40,000, you are then receiving full wage replacement, but anybody that's below that income threshold is still net negative. Just any kind of quick parting comments on the extended benefits, and what you're seeing either locally or on a national trend level Stuart, whether or not that's become a hurdle to overcome for reemployment.

Andreason: Yeah. First I would argue that I think the $600 supplement in the CARES Act was probably one of the best moves that could have been made during a time where you have millions, tens of millions of people at this point who have lost a significant share of their income, or have lost it all together, being able to have an additional boost to actually go back and see their economies and circulate a dollar. In a period where we're in complete revenue and budgetary uncertainty, it is simply just economic relief, not just for individuals, but also from a consumer standpoint for their community. I really applauded that, and I do think that continuing that extra supplement is really helpful.

For Georgia, the average weekly benefit before the PUA, before the federal boost was $300 a week and you're often lucky if you just got that. I think it is not sufficient on its own. I think full right wage replacement is important during periods like this because you need spending power. Our sales taxes are being hit very hard right now, hence the reason why we're having to cut our budget or say budget significantly, and we'll likely end up having to cut the services and things like education and health care that is so necessary to keep people driving or at least somewhat above water during this time, so I think that was great. I would say that we keep it because there's the disincentive concepts, which for me just doesn't land as well.

The disincentive, I mean, for one, the $600 benefit you lose that if you don't accept your job back, so it would be considered fraud if you are not going back to work because you're too comfortable in the $600. That's one thing. The second thing is that it only lasts through July, so it's not going to be a permanent thing. My understanding is that there is strong opposition for that now at the federal level for that in Congress. It's very temporary boost, and then there are other more macro-economic challenges with expecting people to go back to a workplace where they were earning minimum wage likely and be expected to be happy with the fact that they're earning less than they were on unemployment insurance, if that makes sense. I think there's a bigger conversation you need to have about the dignity of work and livable wages, and I hope that this debate around the disincentive to work and other things will result in a much more robust policy response around wages and high road employers and other things in the next year or so.

Miller: I absolutely agree. I think this presents a lot of discussion on job quality and on the value of full wage replacement, especially in times like these and the ability to take the time to upskill, look for good jobs that offer longer term pathways. Alex, we can't thank you enough for joining us today. This has been so valuable to get a little bit of a perspective into what's happening in Georgia, in your policy advocacy platforms. I think it's given a lot for us to think about. Just quickly, there's a lot of resources that are going to be available for you. We'll send this link out to get to that support that's available through the Atlanta Fed in general, but also as well through the Center for Workforce and Economic Opportunity.

Again, please mark your calendars for this next session on June 17 at 2 p.m.[ET]. We're very excited to be joined by Jane Oates and Carl Van Horn. We fan girl—I fan girl over both of them, so we're looking very much forward to that discussion and the highlights from their lessons from the Great Recession paper. Please do register now. We'll send this out to you, Stuart’s, and my email is linked in here. If you have additional questions that we were not able to add in to the Q and A today, please do so. We will provide a full recording and Q and A digest readouts. If we were not able to get to your question today, and even if we did, we will reiterate that response and address those that we haven't already received. Then also again, please do register for that next session. We look forward to talking with you again in June and very much appreciate you taking some time with us today.